Tuesday August 22: Five things the markets are talking about

Uneven U.S economic data and political uncertainty have eaten away at investor confidence in recent weeks. Expectations that the Fed will raise rates at a “gradual” pace have been weighing on the dollar. Fed fund futures odds yesterday showed a roughly +40% chance of a rate-increase by December, down from +43% a month ago.

To date, the USD sell-off has already moved quite far, quite fast. The dollar ‘bulls’ are starting to view the greenback’s decline as becoming somewhat overdone at current levels, which leaves the dollar ripe for a recovery in the event of positive economic surprises.

With little in the way of top-tier economic data out this week stateside, markets are set to focus next on the annual conference of global central bankers hosted by the Kansas City Fed at Jackson Hole, Wyoming.

In particular, investors are awaiting comments from Fed Chairwoman Yellen and ECB President Draghi on Friday for clues on how policy makers view the U.S and the eurozone economies.

1. Stocks mixed results

European stocks joined a rally across most Asian equities following three-days of losses, though trading volumes were once again depressed.

In Japan, the Nikkei (-0.5%) inched down overnight to cap its fifth consecutive day in the ‘red’ amid lingering tensions on the Korean peninsula, though a strong rally in metals-linked shares helped steady the broader market. The TOPIX added +0.06%.

In South Korea, the KOSPI index gained +0.4%, as did Australia’s S&P/ASX 200. In Hong Kong, the Hang Seng Index rose +1.1%, outperforming all other equity markets in the region, on strong earning results.

In China, stocks ended higher as a unit of China Unicom surged by the daily limit for a second day, and as financial and materials firms also experienced strong gains. The blue-chip CSI300 index rose +0.3%, while the Shanghai Composite Index gained +0.1%.

In Europe, indices trade higher across the board, rebounding from the weakness seen in the past few sessions. Indexes are been led by mining names following a continued increase in commodity prices (copper trades at a three year-high, while zinc trades atop of its 10-year high).

U.S stocks are set to open in the ‘black’ (+0.2%).

Indices: STOXX 600 +0.5% at 374.6, FTSE +0.7% at 7368, DAX +0.6% at 12139, CAC 40 +0.4% at 5108, IBEX 35 +0.3% at 10386, FTSE MIB +0.1% at 21775, SMI +0.6% at 8936, S&P 500 Futures +0.2%

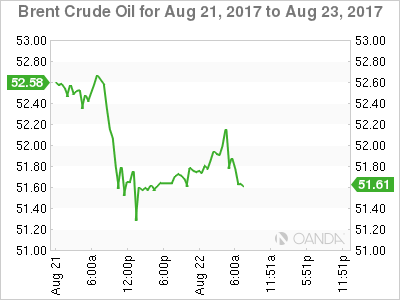

2. Oil prices rise on signs of tightening market, gold lower

Oil prices are better bid ahead of the U.S. open, lifted by indications that supply is gradually tightening stateside.

Brent crude oil is up +40c at +$52.06 a barrel, while U.S. light crude +35c higher at +$47.72.

U.S. crude oil inventories have been falling consistently in recent weeks and if the downtrend in oil inventories is maintained this week supports the bullish case for higher crude prices.

Note: U.S commercial crude inventories have fallen by -13% from its March peaks, to +466.5m barrels.

U.S. crude production has broken through +9.5m bpd, it’s highest since July 2015, but it’s expected to slowdown as U.S energy firms cut the number of rigs drilling for new oil.

The weekly rollout of U.S inventory numbers starts later today. This will give investors a chance to see if the recent downward trend in U.S stocks is continuing.

Note: American Petroleum Institute (API) will publish statistics on crude inventories and refinery operations for last week at 4:30 pm EDT. Tomorrow, it’s the turn of the U.S government’s EIA at 10:30 am EDT.

U.S crude inventories are expected to have fallen for an eighth consecutive week and drop by -3.4m barrels.

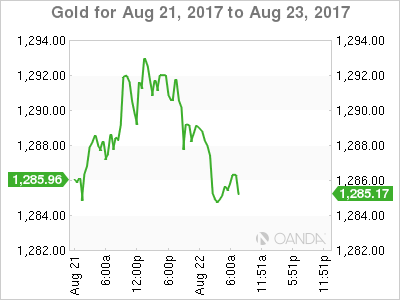

Gold prices have slipped overnight (down -0.4% at +$1,285.48 an ounce), pressured by a stronger dollar. Investors continue to focus on North Korea tensions and remain cautious ahead of Jackson Hole later this week. The ‘yellow’ metal ended yesterday’s session up +0.5%.

3. Yield little changed ahead of Symposium

In the absence of major economic data, bonds have been strongly influenced by market sentiment in recent sessions, a pattern that is expected to hold for much of this week until the Jackson Hole conference on Friday, which kicks off with a speech from Fed Chairwoman Janet Yellen on financial stability. A key question is whether Yellen will suggest the need for tighter monetary policy to address high asset prices.

Treasuries continue their recent close correlation with stocks, edging a tad lower overnight as global stocks rally. The 10-year yield was recently at +2.185%.

Yields on German Bunds (+0.41%) and U.K Gilts (+1.085%) have been on a downtrend since July and are not expected to move much this week, at least until ECB’s Draghi’s appearance at the Fed’s symposium.

Note: Bund yields fell from their 18-month high in July (+0.60%) after comments from ECB’s Draghi were seen paving the way for a scaling back of the ECB’s massive monetary stimulus in the months ahead.

While a trimming of expectations for a tighter ECB policy have helped push down yields across the euro zone, investors are now seem reluctant to go any further without fresh policy cues. With market speculation mounting about when the ECB will signal an exit from its ultra-loose monetary policy, Draghi’s speech Friday remains a key focus for markets.

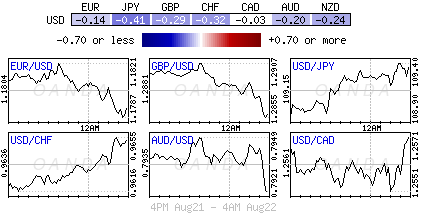

4. Dollar gets the green light for now

In a light volume session overnight the ‘mighty’ USD is a tad firmer ahead of the U.S open with the markets focus looking ahead to the Fed’s Janet Yellen speech at the end of the week. Investors are looking for insights into the outlook for U.S. monetary policy.

Note: Fed Chair Yellen’s speech could increase market expectations that the Fed would raise interest rates in December.

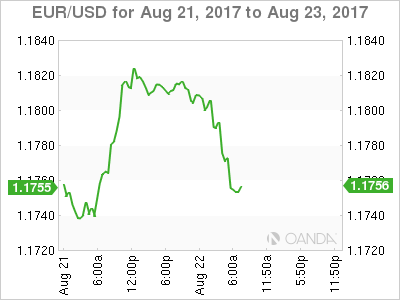

Europe’s ‘single’ unit, the EUR (€1.1754), remains within striking distance of this years high print of €1.1870. Last week’s ECB minutes noted that concerns were expressed about the risk of the EUR “overshooting” in the future. Expect investors to keep their positions relatively tight ahead of Draghi’s speech Friday.

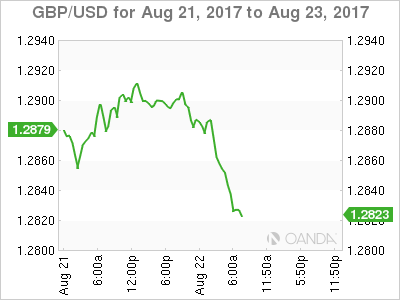

GBP/USD (£1.2835) is a tad softer as dealers assess uncertainties about how long it will take for the UK to forge post-Brexit trade agreements with the E.U. USD/JPY (¥109.29) is little changed.

5. German ZEW survey mixed

Data this morning showed that German economic sentiment fell markedly this month, but the general outlook for Europe’s largest economy remains “stable” and relatively solid, according to the ZEW think tank.

The ZEW Indicator of Economic Sentiment for Germany fell by -7.5 points in August 2017 and now stands at 10.0.

Note: The indicator remains significantly below the long-term average of 23.8. The assessment of the current economic situation in Germany increased slightly by +0.3 m/m to 86.7 points.

Many expect the German economy to maintain its solid performance in H2. The Bundesbank said Monday that “the strong economic upturn in the German economy is expected to continue in the third quarter, with industrial output probably continuing to play an important role, thanks to a substantial expansion in exports.”

Note: Official data last week showed that the German economy grew by +0.6% in quarterly terms, or +2.5% in annualized terms, in Q2, following an annualized growth of +2.9% in Q1.