Trump to impose 100% tariff on China starting November 1

EU stock indices traded quietly yesterday, Wall Street’s main indices slid, with the soft market sentiment rolling into the Asia today, perhaps as investors were reluctant to add to their risk exposures ahead of today’s FOMC meeting minutes. Apart from the Fed minutes, the other top-tier release on the agenda is Canada’s CPIs for April, which could point as to whether the BoC acted currently in scaling back its bond purchases at its prior gathering.

Equities Trade Pull Back As The FOMC Minutes Loom

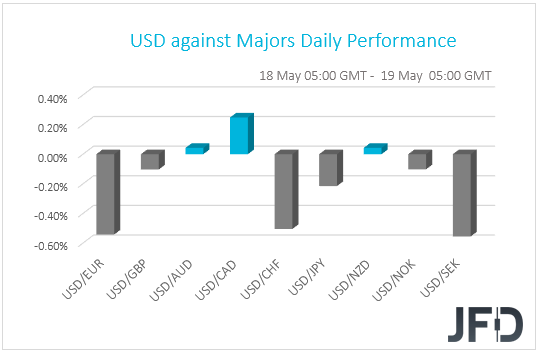

The US dollar continued trading lower against the majority of the other G10 currencies on Tuesday and during the Asian session Wednesday. It lost the most ground versus SEK, EUR and CHF in that order, while it gained only against CAD. The greenback was found virtually unchanged versus AUD and NZD.

The weakening of the US dollar suggests that markets may have continued trading in a risk-on manner yesterday and today in Asia. However, the strengthening of the Swiss franc and the weakening of the Loonie point otherwise. Thus, in order to get a clearer picture with regards to the broader market sentiment, we prefer to turn our gaze to the equity world.

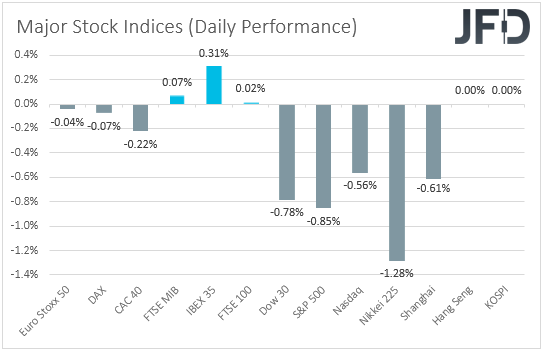

There, major EU indices traded quietly, staying in a narrow range of ±0.35%. However, Wall Street saw all three of its main indices finishing in the red, with the S&P 500 sliding the most. The downbeat morale rolled over into the Asian session today as well, with Japan’s Nikkei 225 and China’s Shanghai Composite sliding 1.28% and 0.61% respectively. Hong Kong’s Hang Seng and South Korea’s KOSPI stayed closed.

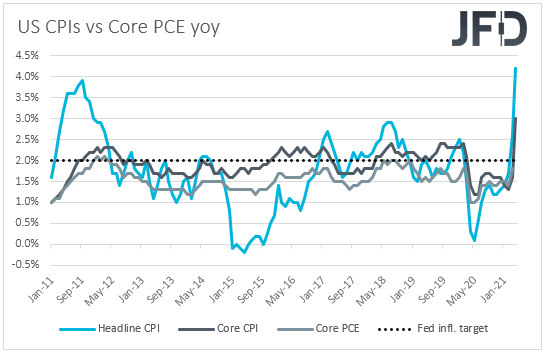

In our view, this suggests that market participants may have turned cautious ahead of today’s minutes from the latest FOMC gathering. At that gathering, officials kept policy untouched, maintaining their dovish stance. They reiterated the view that any short-term spikes in inflation this year are likely to prove to be temporary, while Fed Chief Powell stuck to his guns, saying that the economy is a “long way” from their goals and that it’s not time to start discussing QE tapering yet.

We will scan the minutes for more details on policymakers’ view, but bearing in mind that we got to hear from some of them after the more-than-expected surge in inflation last week, we will treat the minutes as outdated. Yes, the minutes may confirm the Committee’s dovish stance, but following the spike in both headline and core inflation last Wednesday, some members appeared slightly more skeptical with regards to that view, with Vice Chair Clarida saying that if inflation proves not to be transitory, they will use their tools to bring it under control. Atlanta Fed President Raphael Bostic noted that it’s too soon to judge whether the inflation trend is worrisome, avoiding to say confidently that the surge is due to transitory factors.

Taking all this into account, we stick to our guns that where financial markets may be headed next is likely to depend on what other Fed officials have to say moving forward, and not on today’s minutes. Yes, we may have a short-lived market reaction, but we don’t believe that this will prove to be the main catalyst of the market’s forthcoming direction.

If more Fed members appear a bit skeptical in the days to come, the stock market is likely to pull back again, while the US dollar is likely to stay supported. On the other hand, if the consensus among them is still that the inflation spike will prove to be temporary and that it is still too early to start discussing withdrawing policy support, risk appetite is likely to improve. Equities and other risk-linked assets are likely to rebound, while the US dollar and other safe-havens are likely to come under renewed selling interest.

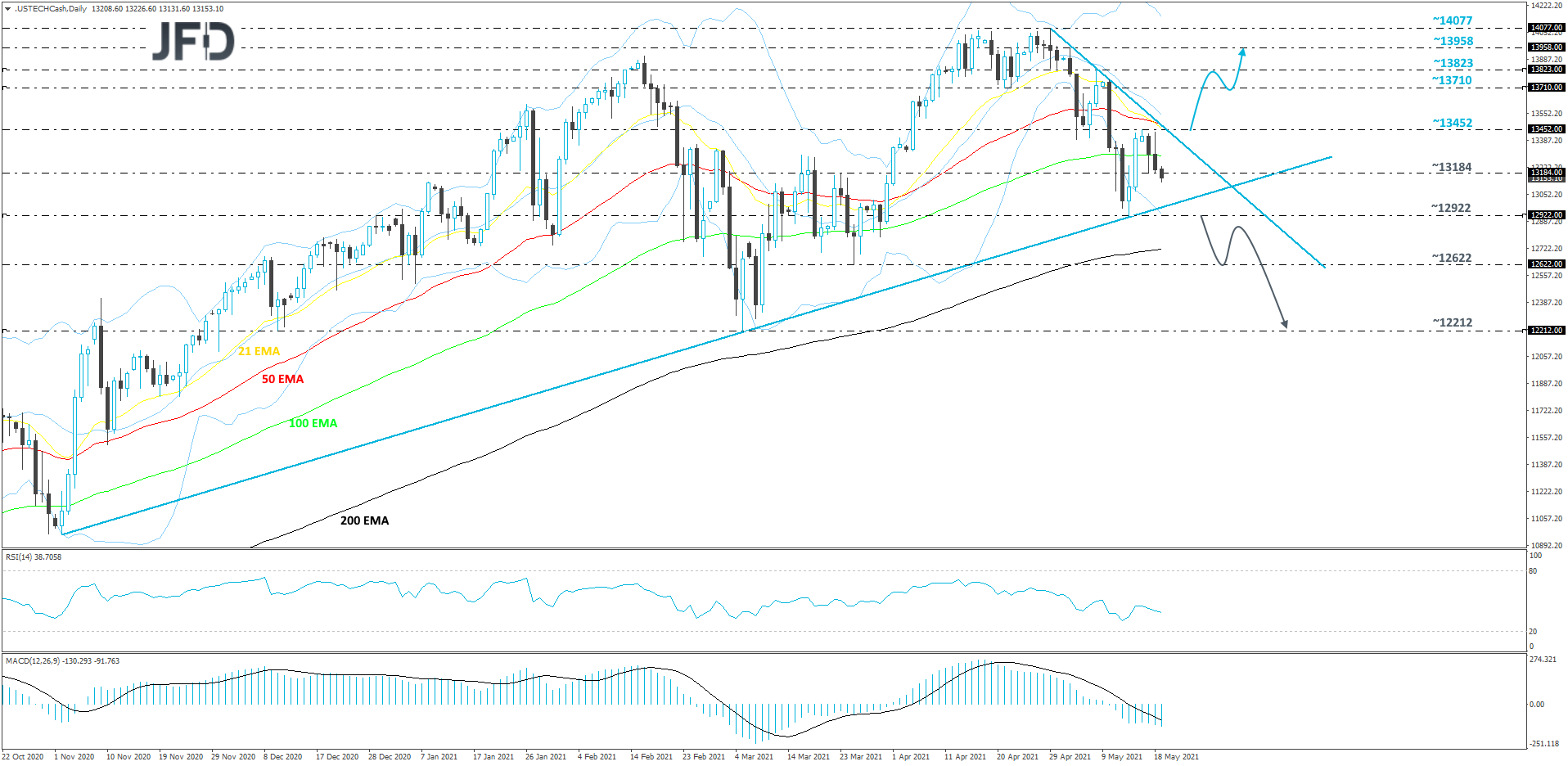

NASDAQ 100 Technical Outlook

After hitting the all-time high, at 14077, NASDAQ 100 started drifting south and is currently trading below a short-term tentative downside line taken from the high of Apr. 29. However, this move lower could be seen as a temporary correction, as, overall, the index is still balancing above a medium-term upside support line drawn from the low of Nov. 2. That said, in order to aim for the upside again, a break of that downside line would be needed. We will take a cautiously-bullish approach for now.

If the price, eventually, breaks the aforementioned downside line and climbs above the 13452 barrier, marked by the high of May 16, that may invite more bulls back into the field, resulting in a possible further upmove. NASDAQ 100 may travel to the 13710 obstacle, or to the 13823 zone again, marked by the high of May 7, where the upmove could get halted for a bit. That said, if the buying continues, the price might get lifted to the 13958 level, marked by the current highest point of May.

On the other hand, if the previously discussed upside line breaks and the price also falls below the 12922 hurdle, marked by the current lowest point of May, that may invite more bears into the field, this way confirming a forthcoming lower low. NASDAQ100 could then drift to the low of Mar. 25, at 12622, a break of which might set the stage for a move to the 12212 level, marked by the lowest point of March.

Loonie Traders Eye Canada's Inflation Numbers

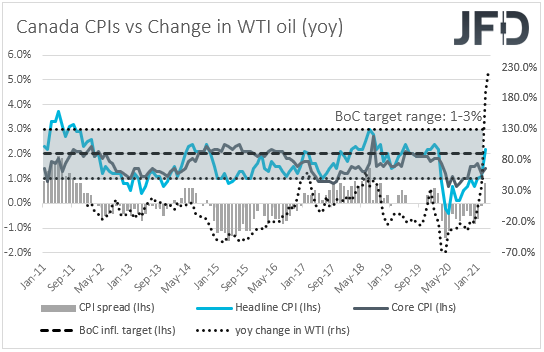

Apart from the Fed minutes, another item on today’s agenda that could attract special attention may be the Canadian CPIs for April. The headline rate is expected to have surged to +3.1% yoy from +2.2%, while no forecast is available for the core rate, neither for the Trimmed mean one. The employment report for the month disappointed, while most policymakers around the globe support that any spikes in inflation this year are likely to prove to be temporary. What’s more, the BoC Governor said last week that the Loonie has strengthened beyond their expectations and that if this continues, it could impact their policy decisions.

Therefore, with all that in mind, we believe that investors may have already started questioning whether the BoC acted correctly at its last gathering, when it scaled back its QE purchases. Thus, we don’t expect a jump in the headline CPI to boost the Loonie much. For that to happen, we may have to see the core and Trimmed mean rates jumping as well, which could mean that the inflation surge is not due to transitory factors after all.

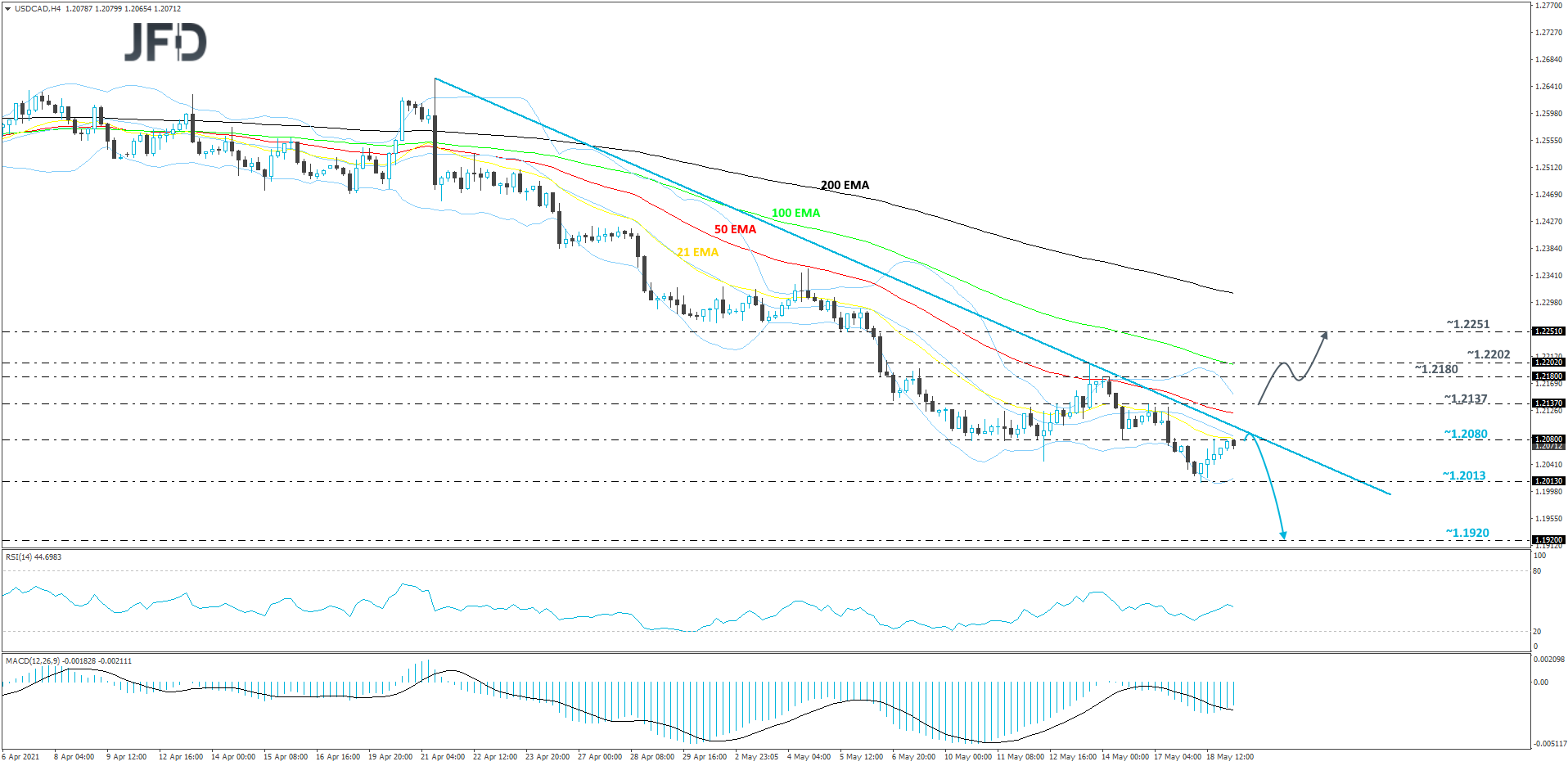

USD/CAD Technical Outlook

Although the bulls are trying hard to raise USD/CAD higher, they keep losing the battle to the bears. Also, the rate continues to respect the short-term tentative downside resistance line drawn from the high of Apr. 21, which remains intact. If that stays as it is right now, another slide could be possible in the near term.

As mentioned above, if the aforementioned downside line continues to hold, USD/CAD might end up dropping again and making its way towards yesterday’s low, at 1.2013, where the pair may stall for a bit. However, if the buyers are still nowhere in sight, the rate could fall further, possibly aiming for the 1.1920 area, which is the lowest point of May 2015.

Alternatively, if the previously mentioned downside line breaks and the pair climbs above the 1.2137 barrier, marked by the high of May 17, that could increase the pair’s chances of pushing higher again. USD/CAD may then drift to the 1.2180 obstacle, or to the 1.2202 zone, marked by the highest point of last week. If the buying does not stop there, the next potential target could be the 1.2251 level, marked by the low of May 5.

As For The Rest Of Today's Events

During the early EU morning, we got the UK CPIs for April. The headline rate rallied to +1.5% yoy from +0.7%, while the core one rose to +1.3% yoy from +1.1%. Although the modest rise in the core rate suggests that the jump in headline inflation may be due to transitory factors, last week’s better than expected GDP, IP and MP data, combined with the decent vaccination rollout pace in the UK, may keep the pound relatively supported.

Later in the day, apart from the Fed minutes and Canada’s inflation data, we also get Eurozone’s final CPIs for April, but, as it is always the case, they are expected to confirm their preliminary estimates. The EIA (Energy Information Administration) report on crude oil inventories for last week is also coming out and expectations are for a 1.623mn barrels increase, after a 0.427mn slide the week before.

Tonight, during the Asian session Thursday, we have Australia’s employment report for April. The unemployment rate is expected to have held steady at 5.6%, but the employment change is forecast to have slowed to 15k from 70.7k.

As for the speakers, we have several on today’s agenda, including Atlanta Fed President Raphael Bostic, Fed Board Governor Randal Quarles, ECB Supervisory Board Chair Andrea Enria, and ECB Executive Board members Fabio Panetta and Philip Lane. We will pay more attention to the Fed members for up-to-date views on whether they continue to see the spike in inflation as being transitory, or not.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 3 out of 4 global portfolios are beating their benchmark indexes, with 98% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?