Investors look to add to Monday’s gains as the earnings parade continues ahead of Friday’s jobs report. As of Monday morning, the Nasdaq Composite was on track to have its worst January ever, but was able to rally off those lows and dodged the record. This morning Exxon Mobil (NYSE:XOM), United Parcel Service (NYSE:UPS) and UBS Group (NYSE:UBS) were a few of the companies to announce earnings.

XOM topped earnings and met revenue estimate according to FactSet. The report prompted the stock to move 1.49% higher in premarket trading. The company’s revenue nearly doubled compared to a year ago thanks to rising oil prices and increased oil production aided by capital investments the company made a few years ago. XOM is also looking to cut costs by restructuring and closing its Houston headquarters and moving to its Dallas facility. XOM also plans to continue its $10-billion stock buyback program.

Shipping and transportation company UPS rallied 7% in premarket trading on better than expected profits and revenue. The street was forecasting earnings of $3.10 per share, but the company delivered $3.59 per share. The increase in earnings allowed UPS to jack up its dividend from $1.02 per share to $1.52 per share. While many companies have reiterated stock buyback programs, there has been a growing trend of rising dividends this earnings season. It’s likely that this trend is in response to rising yields. Many companies are raising dividends to keep competitive with the higher bond yields.

The Switzerland-based bank UBS also rose more than 7% in premarket trading on rising earnings. The bank raised some of its financial targets offering a rosier outlook for 2022 because of its success with managing money for the wealthy. It also plans to buy back $5 billion in shares this year.

While raising dividends is becoming the rage, AT&T (NYSE:T) fell more than 6% in premarket trading after it announced it’s bucking the trend and cutting its dividend. T cut its dividend from $2.08 per share to $1.11 per share. The company had about an 8% yield that many investors enjoyed but the higher yield has kept the stock from appreciating. The company’s stock price has slowly declined over 20 years. In addition to its dividend, T also reiterated its plans to spin off its stake in WarnerMedia to Discovery (NASDAQ:DISCA).

It’s nice to wake up and not see the market has made a big swing overnight, and equity index futures are pointing slightly higher before the close. The Cboe Market Volatility Index (VIX) dropped 1.77% in premarket trading and below the 25 level. Investors will look to ride the earnings parade as they wait for Friday’s Employment Situation Report. The United States 10-Year dropped nearly 1% in premarket trading but bounced from its lows. The TNX has been bouncing around 1.8% looking to consolidate after making gains the last two months.

Breadth And Butter

Monday’s trading appeared to be all about breadth. Stocks were able to break out of last week’s range and rallied higher. The S&P 500 (SPX) closed 1.89% after extending its gains by rallying into the close. The rally was fairly broad with advancers outpacing decliners by about 4-to-1 on the New York Stock Exchange (NYSE). The Russell 2000 also rallied 3.05%, adding to the breadth of the rally. The Nasdaq Composite closed 3.41% higher, and the advancers topped decliners about 5-to-1 on the Nasdaq exchange. The narrowest index, the Dow Jones Industrial Average, was up the least, closing 1.17% higher on the day.

The rally appeared to help ease investor fears because the VIX fell more than 10% on the day and closed just below 25. Stocks appeared unaffected by the rise in oil prices. Crude oil futures rose 1.77% to open the week. Natural gas futures outpaced oil, rising more than 4.87% on Monday and keeping a seven-day win streak alive. In that time frame, natural gas prices have risen 27%. Market watchers are unsure of what caused the rally, but some think it may have been short sellers getting squeezed ahead of the February expiration.

The Walgreens Boots Alliance (NASDAQ:WBA) is disbanding its alliance as Walgreens looks to sell the United Kingdom’s Boots division. Boots has 2,200 stores and about 55,000 employees in the United Kingdom. The company is expected to be valued at £7billion. WBA fell about 2% on the news.

Growth stocks struck back on Monday, with the S&P 500 Pure Growth Index climbing 3.53%. Stocks like Tesla (NASDAQ:TSLA), Netflix (NASDAQ:NFLX), Spotify (NYSE:SPOT), and Beyond Meat (NASDAQ:BYND) aided in the recovery, rallying 10.68%, 11.13%, 13.46%, and 15.19% respectively. The S&P 500 Pure Value Index rose just 0.80%.

Despite focusing on growth over value, investors appeared to be looking for bargains in the consumer discretionary sector. The Consumer Discretionary Select Sector Index rose 3.91% and is trying to recover some of the 16% it lost last week. Technology and utilities rounded out the top three sectors on Monday. Every sector ended the day in the green.

Monday was particularly light on news despite a busy week of earnings and economic announcements. However, it was reported that vaccine maker Moderna (NASDAQ:MRNA) received the full FDA approval for SPIKEMAD. The news prompted the stock to rally more than 5%. Also, Boeing (NYSE:BA) rallied 4.42% on Monday on the news that the company signed a deal with Qatar Airways for up to 50 aircrafts.

Breadth Basket

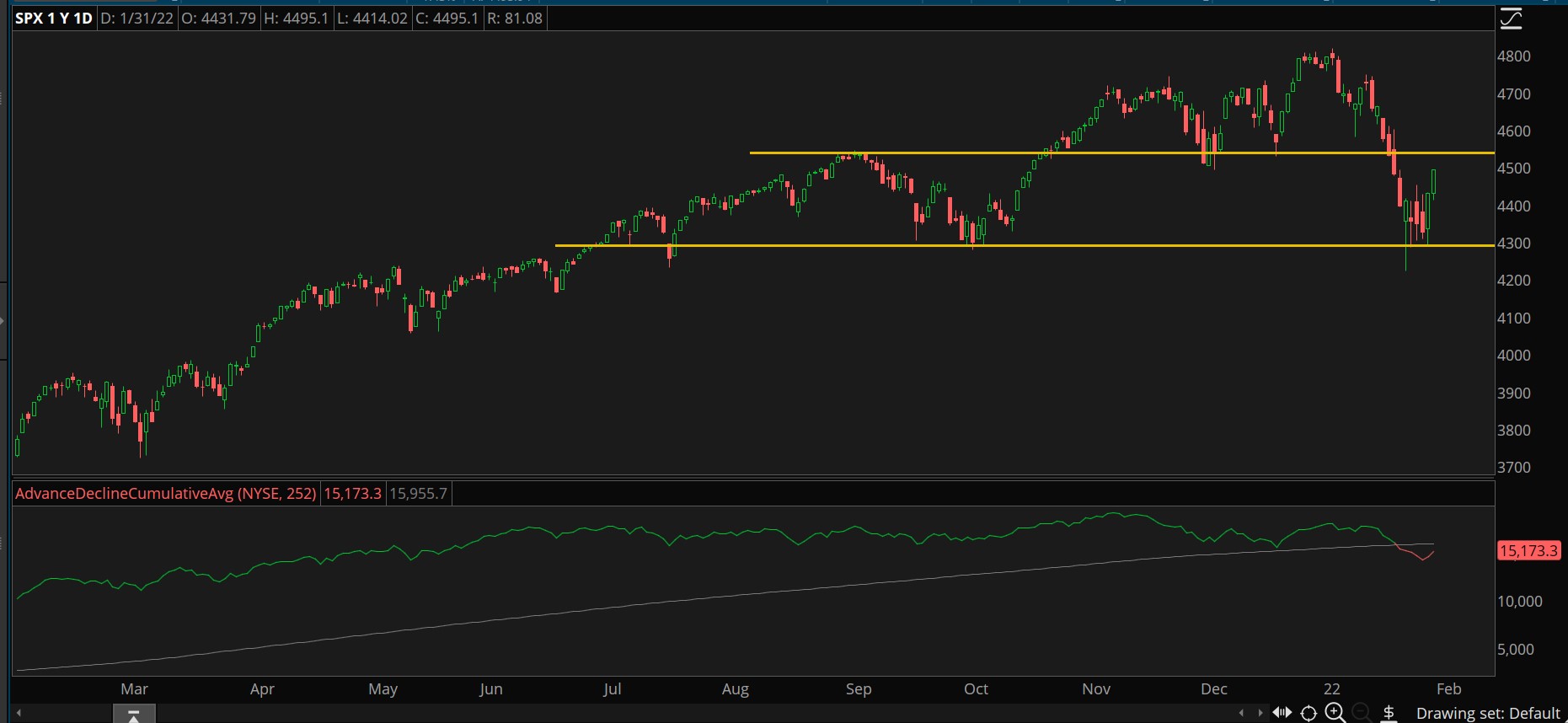

The NYSE advance-decline line turned higher recently, but the breadth indicator has been trending lower since November of last year. Investors started selling stocks as they became increasingly concerned about the quickening pace of inflation and how the Fed might react to it. The Russell 2000 reflected the lack of breadth and topped out about the same time in November. It has since fallen about 17%. Before Monday’s rally, the index was in bear market territory because it was down about 20%.

Breadth must remain strong over an extended period of time before many investors will considered the market to be “out of the woods.” The S&P 500 is already nearing its previous level of resistance, which could cause problems for the bulls if the bears start selling again.

CHART OF THE DAY: DAILY BREADTH. The recent pullback in the S&P 500 (SPX—candlesticks) was preceded by falling breadth as measured by the pullback in the NYSE advance-decline line (lower green-red). Data Sources: ICE, S&P Dow Jones Indices. Chart source: The thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

Bottom Dollars: The U.S. Dollar Index hit a new 52-week high against a basket of currencies on Thursday and Friday but sold off on Monday to give back much of its gains from the previous two trading days. It could be that the dollar is just testing old resistance as new support before it moves higher once again. If that’s the case, the stronger dollar may continue to be a drag on stocks because the rising dollar makes American products more expensive overseas. With the United States looking to raise rates and nearly everyone else maintaining or lowering rates, the U.S. dollar is likely to keep getting stronger.

Going Abroad: With the dollar strengthening against most all other currencies, it could be that foreign stocks are at a value relative to U.S. stocks. In fact, the French CAC 40, the German DAX and the British FTSE all started exhibiting greater relative strength as the year turned over. While some of the gains in strength come from so much weakness in the U.S. markets, the FTSE and CAC have been rising overall.

Some of the growth in Europe may be localized, but the STOXX 600 has fallen throughout January. However, its drop of 3.88% is less than the 6% seen in the S&P 500, which gives it greater relative strength as well. Each day there appears to be more and more European countries rolling back pandemic restrictions, which could allow these countries to reopen and start growing again.

Gold Bugs: Gold futures have risen nearly 7.5% from its March 2021 lows. The precious metal has had to scrape and claw for each gain. Nearly every rally has been met with a comparable sell-off. With inflation hitting 7% in December, according the Consumer Price Index, many analysts expected gold to perform better because it has historically been seen as a hedge against inflation. However, the rising dollar may be keeping gold down. If and when other countries start looking to battle inflation by raising their rates, the dollar could weaken, and gold may start living up to its reputation as an inflation hedge.