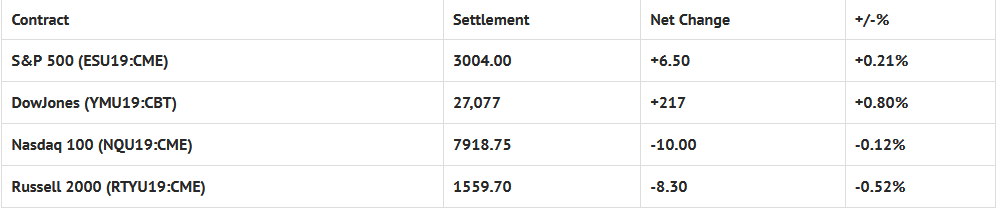

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.44%, Hang Seng +0.14%, Nikkei +0.20%

- In Europe 9 out of 13 markets are trading higher: CAC +0.45%, DAX -0.01%, FTSE +0.16%

- Fair Value: S&P +3.68, NASDAQ +22.10, Dow -9.40

- Total Volume: 1.17 million ESU & 404 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes PPI-FD 8:30 AM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: Close And Getting Closer

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +7 as yesterday we held 2984 and look to clear 3003 this morning. Such a methodical trend above the 8day as a portfolio approach paid traders.

During Wednesday nights Globex session, the S&P 500 futures (ESU19:CME) printed a high of 3006.75, a low of 2995.25, and opened Thursday’s regular trading hours (RTH) at 3003.50.

It was a choppy day, to say the least, and money could be made trading both sides of the market. Our call in yesterday’s Opening Print to sell the early strength and buy the late morning weakness was close, just a little off, but if you were able to time it right and hold on, you would have been in good shape.

The ESU failed to take out the Globex range, on both sides, until just before 1:30, when it finally broke through and printed a new low at 2992.50. Then, when the MiM reveal showed more than $1.1 billion to buy MOC, I thought we might make a new high on the close, but the futures fell just short, and went on to print 3003.50 on the 3:00 cash close, and 3004.25 on the 3:15 futures close.