Industrials lead stock market pullback

US stocks retreated Tuesday as trade war concerns weighed on market. The S&P 500 ended 0.3% lower at 2724.44 led by industrial stocks down 1.3%. Dow Jones industrial average lost 0.7% to 24834.41. The NASDAQ Composite fell 0.2% to 7378.46. The dollar strengthening resumed: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% and is gaining currently. Stock indices futures point to lower openings today.

Traders were weighing US President Donald Trump’s assessment of the ongoing US-China trade talks he was “Not really” happy with the progress of negotiations which “have a long way to go”. Bond yields remained elevated ahead of the release of the Federal Reserve meeting minutes due today at 20:00 CET. No major economic reports were revealed yesterday.

DAX outperforms European indices

European stock indices extended gains Tuesday as Italy’s anti-establishment coalition named its prime minister candidate. The British Poundended higher against the dollar while euro accelerated its slide with both currencies receding currently. The Stoxx Europe 600 added 0.3%. The German DAX 30 outperformed rising 0.7% to 13169.92. France’s CAC 40 added 0.1% and UK’s FTSE 100 gained 0.2% to 7877.45. Markets opened 0.2% - 0.4% lower today.

In Italy President Sergio Matarella is considering the 5 Star Movement and League coalition’s prime minister candidate professor Giuseppe Conte. The president is expected to announce his decision later this week.

Chinese stocks lead Asian indices tumble

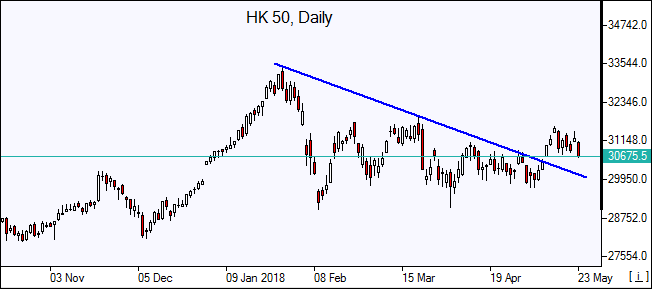

Asian stock indices are mostly lower today as investor optimism was undermined by President Trump’s comment he was not happy with US-China trade talks even after China announced import tariffs for automobiles and car parts will be cut.Nikkei dropped 1.2% to 22690 as yen rose sharply against the dollar. Chinese stocks are lower despite President Trump’s plan to fine the ZTE (HK:0763) corporation instead of more severe penalties: the Shanghai Composite Index is down 1.4% and Hong Kong’s Hang Seng Index is 1.4% lower. Australia’s ASX All Ordinaries is down 0.2% despite Australian dollar’s extended losses against the greenback.

Brent slips

Brent futures prices are lower today on possibility the Organization of the Petroleum Exporting Countries may raise oil output in June because of concerns about Venezuela output and Iran oil supply shortage. Prices are falling despite the American Petroleum Institute late Tuesday report indicating US crude inventories fell by 1.3 million barrels last week. Prices ended higher yesterday: July Brent gained 0.4% to $79.57 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.