Gerald Celente of the Trends Research Institute has just gone on the record with a prediction that there will be a stock market crash by the end of this calendar year. If you are not familiar with Gerald Celente, he is one of the most highly respected trends forecasters in the entire world. He has been featured on CNN, The Oprah Winfrey Show, The Today Show, Good Morning America, CBS Morning News, NBC Nightly News and Coast to Coast AM. Personally, I have a lot of respect for him.

While it is true that not every single one of his forecasts about the future came to pass over the years, he does have a very solid track record that goes back for decades. He correctly predicted the 1987 stock market crash, the bursting of the dotcom bubble and the financial panic of 2008. Just a couple of days ago, he told Eric King the following: “I’m now predicting that we are going to see a global stock market crash before the end of the year.” Celente says that it won’t just be US stocks either. He believes that crashes are also coming to “the DAX, the FTSE, the CAC, Shanghai, and the Nikkei”. It other words, it is going to be a truly global financial crisis and he says that there is “going to be panic on the streets from Wall Street to Shanghai and from the UK down to Brazil”.

When you go out on a limb like this, you are putting your credibility on the line. This is something that Celente has only done a few times in the past, and normally he has been spot on…

"Rarely do I ever put a date on market crashes. I did it in 1987 when I forecast the 1987 stock market crash — that was in the Wall Street Journal. I also forecast the ‘Panic of 2008,’ and the ‘dot-com bust’ in October of 1999, when I said it (the dot-com mania) would fail in the second quarter of 2000…"

Of course Celente is far from alone. Many others have also been warning that a new financial crisis is imminent.

For instance, just check out what David Stockman recently told CNBC…

David Stockman has long warned that the stock market is on the verge of a massive collapse, and the recent price action has him even more convinced than ever that the bottom is about to fall out.

“I think it’s pretty obvious that the top is in,” the Reagan administration’s OMB director said Thursday on CNBC’s “Futures Now.” The S&P 500 has traded in a historically narrow range for the better part of 2015, having moved just 1 percent higher year to date. “It’s just waiting for the knee-jerk bulls, robo traders and dip buyers to finally capitulate.”

Stockman, whose past claims have yet to come to fruition, still believes that the excessive monetary policy from central banks around the world has created a “debt supernova,” and all the signs point to “the end of the central bank enabled bubble,” which could cause a worldwide recession.

There is a growing consensus that something really, really bad is about to happen in the very near future. You know that we are really late in the game when the mainstream media starts sounding exactly like The Economic Collapse Blog.

The mainstream media is starting to get it. The exact same patterns that we witnessed just prior to the last financial crisis are playing out once again right before our very eyes. Here is an excerpt from that Bloomberg article:

Attention commodities investors: Welcome back to 2008!

The meltdown has pushed as many commodities into bear markets as there were in the month after the collapse of Lehman Brothers Holdings Inc., which spurred the worst financial crisis seven years ago since the Great Depression.

Eighteen of the 22 components in the Bloomberg Commodity Index have dropped at least 20 percent from recent closing highs, meeting the common definition of a bear market. That’s the same number as at the end of October 2008, when deepening financial turmoil sent global markets into a swoon.

This is the kind of stuff that I have been hammering on for weeks.

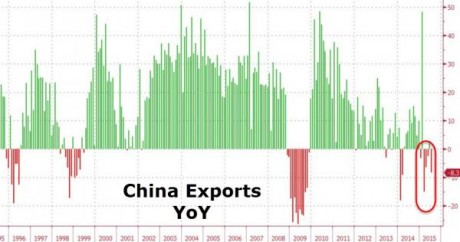

Another sign that we saw back in 2008 that is repeating once again is a substantial slowdown in global trade. Over the weekend, we got some more bad news on this front from China. The following comes from Zero Hedge:

Overnight we got another acute reminder of just who is lying hunched over, comatose in the driver’s seat of global commerce: the country whose July exports just crashed by 8.3% Y/Y (and down 3.6% from the month before) far greater than the consensus estimate of only a 1.5% drop, and the biggest drop in four months following the modest June rebound by 2.8%: China.

It wasn’t just exports, imports tumbled as well by 8.1%, fractionally worse than the -8.0% consensus, and down from the -6.1% in June as China’s commodity tolling operations are suddenly mothballed.

The crisis that so many have been waiting for is here.

As the coming weeks and months play out, there will be good days and there will be bad days. Remember, some of the biggest one day gains in US stock market history happened right in the middle of the financial crisis of 2008. So don’t get fooled by what happens on any one particular day.

Also, please do not think that this crisis will be “over” by the end of 2015. What we are moving into is just the start of the crisis. Things will continue to unravel as we move into 2016 and beyond. The recession that we experienced back in 2008 and 2009 will seem like a Sunday picnic compared to what is coming by the time that everything is all said and done.

So that is why I work so hard to encourage people to get prepared.

What we are facing is not going to last for weeks or for months.

The coming crisis is going to last for years, and it is going to be painful beyond what most people would dare to imagine.