Market Brief

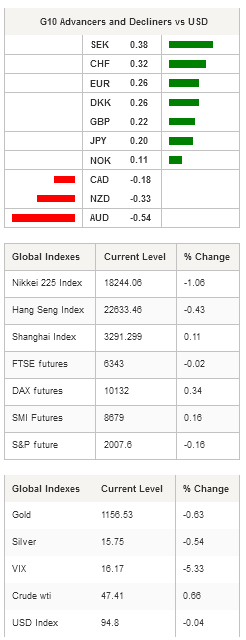

After rallying for the last two weeks, global equity markets falter as doubt rises. Most of Asian equity indices are now back to their pre-NFPs levels and investors are now wondering whether there is still some upside potential as China’s trade data showed the world’s second biggest economy is not the global growth driver it was used to be. Imports continue to fall dramatically with a contraction of 17.7%y/y in yuan term versus 16.5% expected and 14.3% in August. However, exports came in slightly better-than-expected, printing at -1.1%y/y versus -7.4% median forecast and -6.1% in the previous month. In the rest of the world, equity returns were already mixed yesterday with half of European indices trading in negative ground. In Wall Street, stocks were trading slightly higher in thin liquidity conditions but energy and materials stocks felt the heat from the collapse in commodity prices. This morning, metals are pairing losses: gold is down -0.68%, silver -0.60%, palladium -0.05% and platinum -1.13. Copper slides -0.90%, aluminium -0.95% while iron ore is down -1.83%.

Asian regional equity markets are mostly trading in negative territory on Chinese data. Japanese Nikkei fell 1.06% while the broader Topix index slid -0.79%. In mainland China, stocks are holding ground on encouraging Chinese exports figures with the Shanghai Composite up 0.11%, while the Shenzhen Composite rose 0.91%. In Australia, the S&P/ASX fell -0.57%, in New Zealand stocks are up 0.23% while in South Korea the Kospi index edged down -0.13%.

Commodity currencies erased partially previous gains - AUD/USD down 0.56%, NZD/USD down 0.48%, while the Canadian dollar fell 0.34% against the dollar - driven by lower crude oil prices. AUD/USD has been unable to break the strong resistance standing at around $0.74. On the downside, the pair will find support at 0.7165 (low from October 8th), then 0.6937 (low from September 29th).

In Europe, equity futures are trading without direction, swinging back and forth between positive and negative gains. The Footsie edges down -0.02; the DAX is up 0.34%, while the SMI edges up 0.16%. In France, the CAC 40 falls -0.21%. Overall in Europe, equities edge down -0.19%.

EUR/USD is holding ground between 1.13 and 1.14 as investors await the US inflation report due on Wednesday. A support can be found at 1.1327 (Fib 38.2% on August-September debasement) while on the upside the 1.14 threshold is the closest resistance. A stronger one can be found at 1.15 (psychological threshold).

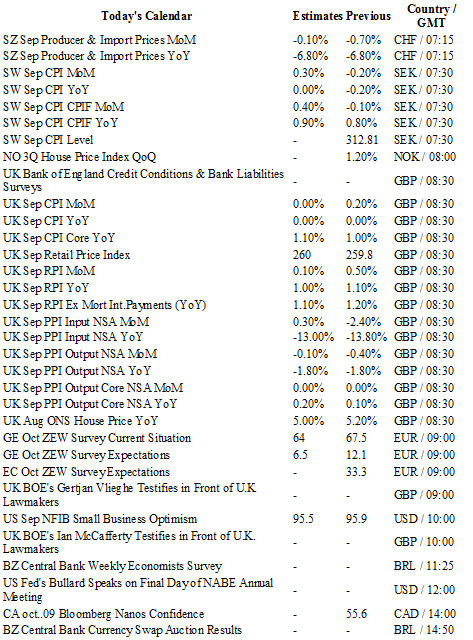

Today traders will be watching inflation figures from Sweden and the UK; German ZEW expectations; central banker speech: Bullard from the Fed, Haldane from the BoE and Wheeler from RBNZ.

Currency Tech

EUR/USD

R 2: 1.1561

R 1: 1.1460

CURRENT: 1.1392

S 1: 1.1106

S 2: 1.1017

GBP/USD

R 2: 1.5659

R 1: 1.5383

CURRENT: 1.5371

S 1: 1.5089

S 2: 1.4960

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.77

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9601

S 1: 0.9513

S 2: 0.9259