Although EU indices closed their Thursday session in the red, most US and Asian ones traded in green waters as Fed Chair Powell announced that the Fed will now target a 2% average inflation, which means ultra-loose policy for longer. As for today, the main item on the calendar is Canada’s GDP for June and Q2 as a whole. What’s more, at the time of writing, reports hit the wires that Japanese PM Shinzo Abe is set to resign due to health reasons.

Equities Gain, USD And JPY Slide, As Fed Shifts Inflation Approach

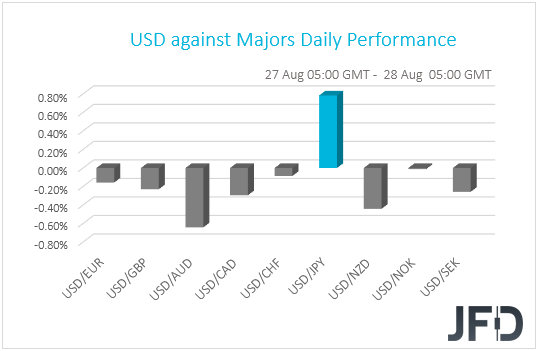

The dollar traded lower against the majority of the other G10 currencies on Thursday and during the Asian morning Friday. It gained only against JPY while it was found virtually unchanged against NOK. The greenback lost the most ground against AUD and NZD.

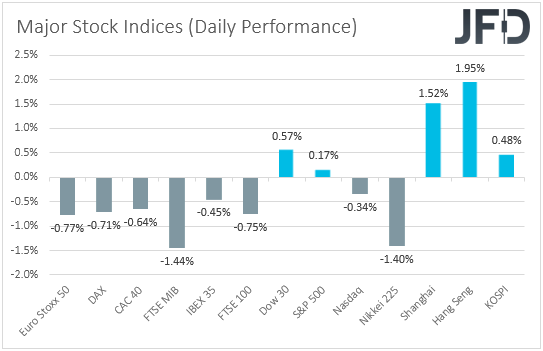

The weakening of the US dollar and the yen, combined with the strengthening of the risk-linked currencies Aussie and Kiwi, suggests that markets traded in a risk-on fashion once again. Although major EU indices closed the Thursday session in negative waters, in the US, both the S&P 500 and the DJIA gained 0.17% and 0.57% respectively, with the former hitting a fresh record. The exception was NASDAQ, which slid 0.34%. The positive investor morale rolled over into the Asian session today as well. Although Japan’s Nikkei fell 1.40% due to Abe’s resignation reports (see below), China’s Shanghai Composite, Hong Kong’s Hang Seng, and South Korea’s KOSPI are all up.

The risk-averse trading during the EU session shows that market participants remained cautious ahead of Fed Chief Powell’s speech at the Jackson Hole economic symposium. However, in the aftermath of the event, they felt comfortable to re-increase their risk exposure. Powell said that the Fed will now target a 2% average inflation and put emphasis on “broad and inclusive” employment, with the shift motivated by underlying changes to the economy, including lower potential growth, persistently lower interest rates and low inflation. He noted:

“Following periods when inflation has been running persistently below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time”.

Although he added that the Committee is not tying itself to any particular method to define “average” inflation, this means that the Fed is willing to tolerate above-2% inflation for a while before raising interest rates, which implies extra-loose monetary policy for longer.

In our view, this confirms the Fed’s willingness to do whatever it takes to support an economy hit by the fast spreading of the coronavirus pandemic, despite Powell not commenting on whether (or not) additional stimulus could be introduced soon. We believe that the Fed’s commitment to keep interest rates low for longer is likely to keep equity markets supported, and allow investors to divert more flows away from safe-haven assets, like the US dollar and the Japanese yen. However, we also believe that a lot will depend on whether Fed officials will hint extra action ahead of the September meeting. Anything suggesting that they could do so in the months to come could fuel further the broader risk appetite, while a decent correction may be possible in case they signal that they are done for now, something that we see as the least likely scenario. Remember that last week, in the minutes of the latest FOMC meeting, it was revealed that additional accommodation could be required. Thus, as long as data point to an economy struggling to recover, we expect policymakers to stay ready to do more if deemed necessary.

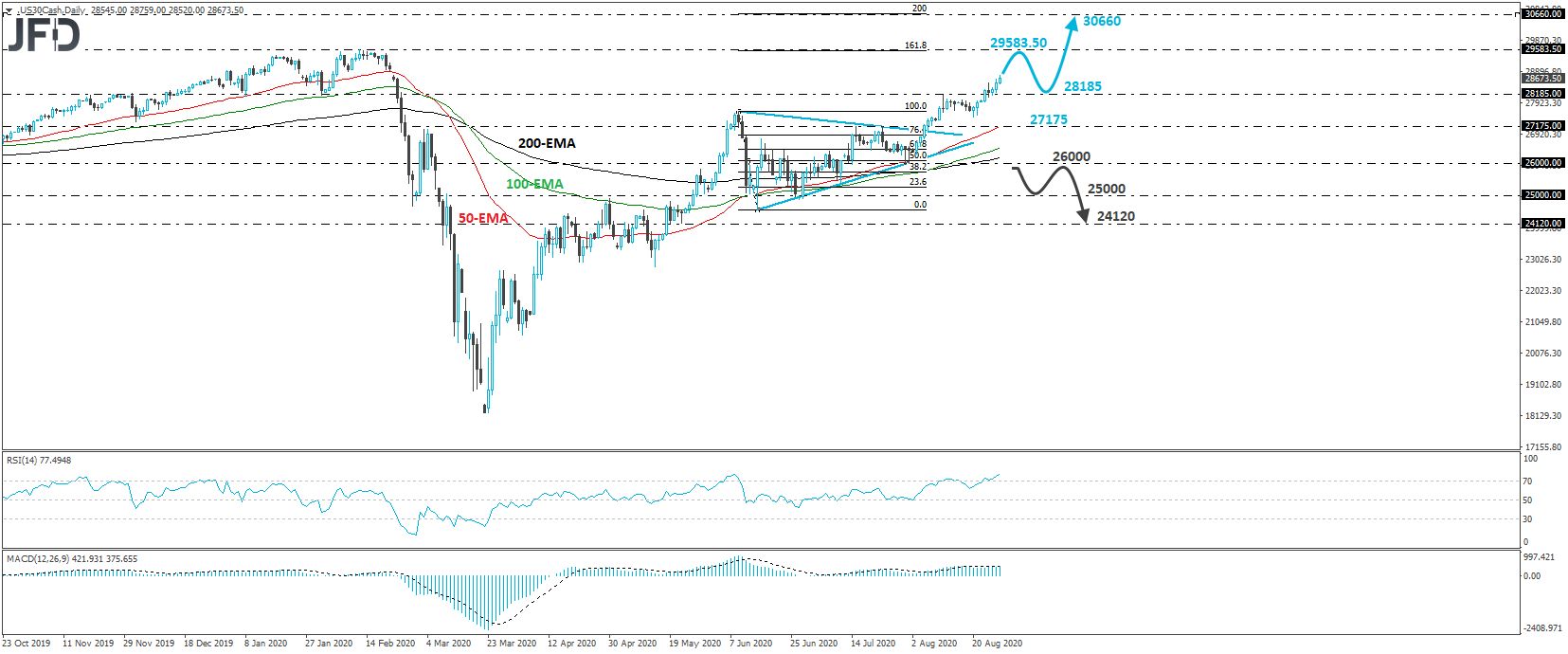

Dow Technical Outlook

After breaking above the upper bound of a symmetrical triangle on August 5th, the Dow Jones Industrial Average kept drifting north. What’s more, on Monday, it emerged above the peak of August 11th, thereby confirming a forthcoming higher high. With all that technical signs in mind, we would consider the near-term outlook of this index to be positive.

In our view, the bulls may now be headed towards the all-time high of 29583.50, hit on February 12th. That level is also near the 161.8% extension level of the aforementioned triangle’s base. They may decide to take a break after hitting that record, thereby allowing a small retreat, but if the bulls are strong enough to recharge from above 28185, we would expect the next positive leg to drive the price into uncharted territory. With no prior peaks or troughs to determine the next resistance level, we will consider as a potential obstacle the 200% extension level of the triangle’s base, which is at around 30660.

In order to abandon the bullish case, we would like to see a decisive dip below 26000, a support marked by the lows of July 30th and 31st. Such a move may also take the index below all three of our moving averages on the daily chart and could initially target the low of July 10th, at around 25000. Another dip, below 25000, could extend the slide towards the 24120 area, marked by the low of May 22nd.

Trader's Await Canada's GDP Data

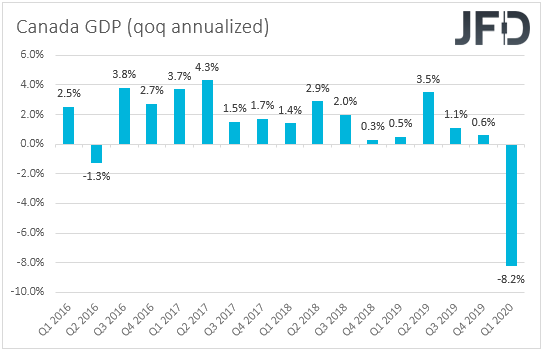

Apart from headlines and developments surrounding the broader investor morale, CAD-traders are also likely to place emphasis on Canada’s GDP data for June and Q2 as a whole. The monthly rate for June is forecast to have increased further, to 5.3% from 4.5%, after tumbling to -11.7% in April. That said, no forecast is available for the qoq annualized rate.

At its last meeting, the BoC decided to keep interest rates unchanged at +0.25%, and noted that they will stay there until the 2% inflation target is sustainably achieved. Officials also added that they will continue with their QE program until the economic recovery is well underway, and that they stand ready to adjust their programs if market conditions change. With all that in mind, we believe that further improvement in economic activity during the month of June may allow policymakers to stand pat for a while more. On top of that, with oil prices staying in an uptrend mode and the broader market sentiment staying supported, the Loonie may stay relatively strong for more. If risk appetite continues to improve, we would expect it to perform better against the safe havens, like the US dollar, the Japanese yen, and maybe the Swiss franc.

Japan's PM Abe To Resign

At the time of writing, headlines hit the wires that Japan’s PM Shinzo Abe is set to resign due to health reasons. He wants to avoid disruptions to the government due to his illness, the reports suggested. Abe has pledged to revive growth with his “Abenomics”, policies that included extra-loose monetary easing, as well as fiscal spending and reforms. As a result, the immediate market reaction on the reports was a stronger USD/JPY and a tumble in Nikkei.

That said, with monetary and fiscal policies worldwide staying ultra-loose, we doubt that Abe’s resignation could result in a long-lasting uptrend in the yen and a more severe slide in the Nikkei. If investors around the globe continue to trade in a risk-on manner, the safe-haven yen is likely to come back under renewed selling interest, and Japanese equities are likely to rebound.

Technical Outlook

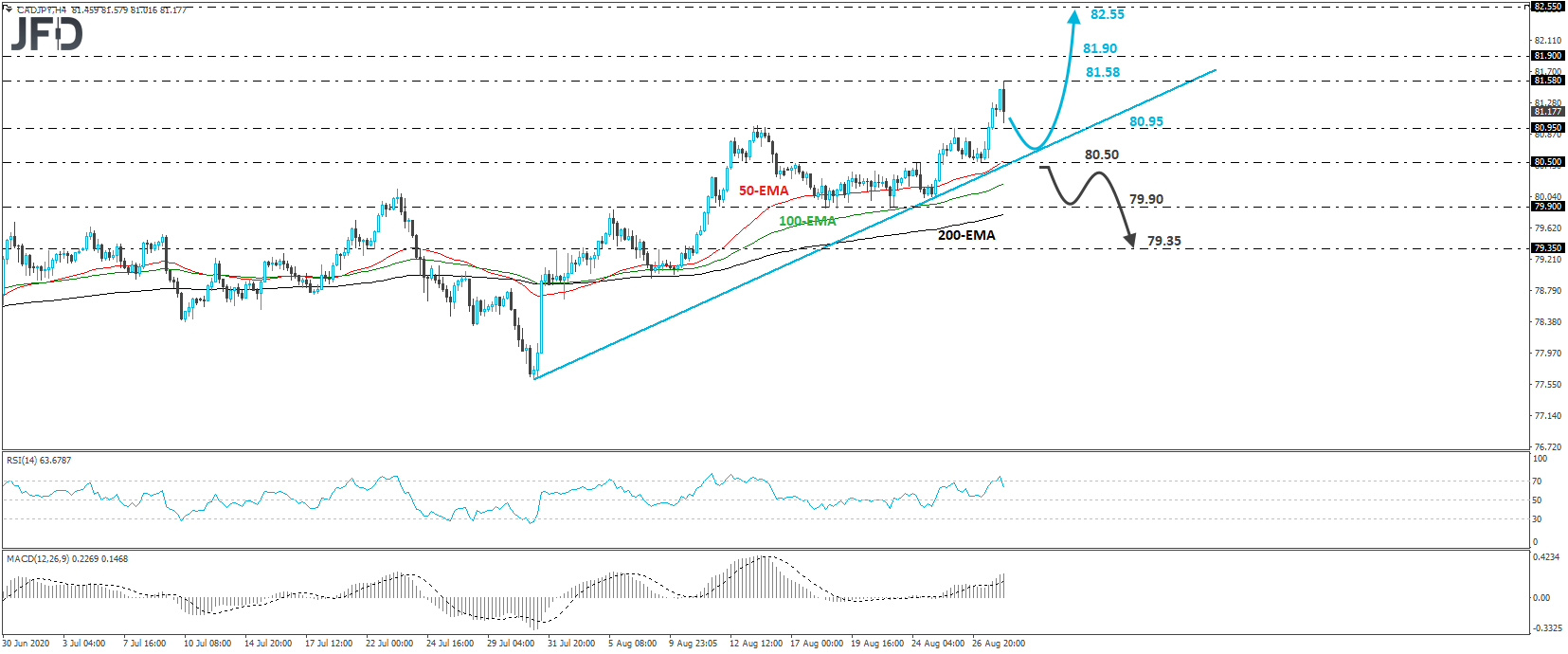

CAD/JPY hit resistance at 81.58 and slid, after the reports that Abe is set to resign. However, the pair continues to trade above the tentative upside support line drawn from the low of July 31st, and thus, we would consider the short-term outlook to still be positive.

The retreat may continue for a while more, even below Wednesday’s peak of 80.95, but we see decent chances for the bulls to take the reins again from near the aforementioned upside line. If so, they may target once again the 81.58 level, the break of which may initially aim for the 81.90 area, defined as a resistance by the highs of June 5th and 8th. If that zone is not able to stop the advance, a break higher may see scope for larger extensions, perhaps towards the 82.55 territory, near the inside swing low of February 26th.

On the downside, we would like to see a strong fall below 80.50 before we start examining whether the bears have stolen the bulls’ swords. Such a move would not only take the rate below the pre-discussed upside line, but would also confirm a forthcoming lower low. The next stop may be near the 79.90 zone, which provided decent support between August 18th and 21st, the break of which may encourage the bears to put the 79.35 barrier on their radars. That level is marked by the inside swing high of August 7th.

As For The Rest of Today's Events

During the US session, we get personal income and spending data for July, alongside the core PCE index for the month. Personal income is expected to have declined 0.2% mom after falling 1.1% in June, while spending is forecast to have slowed to +1.5% mom from +5.6%. The core PCE index, the Fed’s favorite inflation metric, is expected to have increased to +1.2% yoy from +0.9%, something supported by the rise in the core CPI rate for the month. The final UoM consumer sentiment index for August is also coming out and is expected to be revised fractionally up, to 72.8 from 72.5.

We also have one speaker on today’s agenda, and this is BoE Governor Andrew Bailey.