Wednesday May 24: Five things the markets are talking about

It’s been a busy overnight session for capital markets.

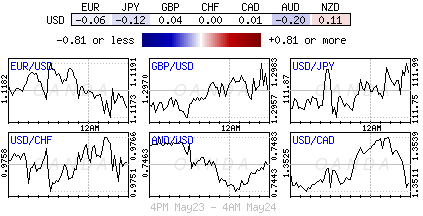

Global equities are mixed after China’s sovereign credit rating is downgraded by Moody’s (see below). The fallout has the AUD dollar being the worst performing G10 currency as the downgrade has spilled into a much weaker Dalian iron ore price, so the result is a softer Aussie (A$0.7456).

The ‘mighty’ USD and bond yields are steady, with fixed income dealers more confident that the Fed will raise U.S interest rates next month (June 13-14), while oil has rallied for a sixth consecutive day in anticipation of an OPEC-led output cut may be extended to the Q1 of 2018.

Note: OPEC officially meets in Vienna tomorrow, however, informal meeting are taking place today.

The markets focus is switching to today’s FOMC minutes, even though inflation has been softer and other U.S economic data on the weak side, the minutes of the Fed’s last meeting, will be released at 2 p.m. EST today, are expected to point to another rate hike in June.

Investors will also be looking for any new information about the Fed’s plans to shrink its balance sheet.

Expect the Fed to emphasize that the economy remains on pretty solid footing, highlighting continued improvement in the labor markets, solid consumer confidence data, mostly positive data on housing along with some signs of improvement in the manufacturing sector.

Offsetting the positives, the FOMC may point to continued uncertainty in Washington, and modest gains in wages.

1. Equities produce mixed results

In Japan, the Nikkei share average (+0.7%) rallied to a one-week closing high helped by exporters after the USD gained against the yen (¥111.93), while financials outperformed as U.S Treasury yields backed up. The broader Topix index increased +0.6%.

Down-under, despite China’s downgrade, Australia’s S&P/ASX 200 Index rose +0.2%, while South Korea’s KOSPI index advanced +0.2%.

In China, the Shanghai Composite rose +0.1%, reversing an earlier drop of -1.3%. The Hang Seng slipped less than -0.1%.

In Europe, indices are trading mostly lower across the board with the exception of the FTSE 100 helped by strength of some Q1 earnings reports.

U.S. stocks are set to open little changed (+0.1%).

Indices: Stoxx50 -0.1% at 3593, FTSE +0.2% at 7498, DAX -0.1% at 12643, CAC 40 flat at 5347, IBEX 35 flat at 10916, FTSE MIB -0.2% at 21363, SMI -0.1% at 9055, S&P 500 Futures +0.1%

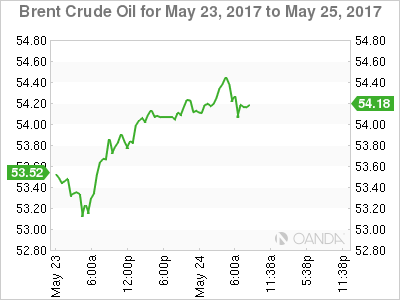

2. Oil prices rise as market awaits extended output cut

Oil prices have climbed in recent sessions on expectations that OPEC will extend their current production deal for a minimum of six months, to maybe nine months.

Ahead of the U.S open, Brent crude oil is up +40c a barrel at +$54.55, while U.S light crude (WTI) is up +35c at +$51.82.

Note: Both crude benchmarks have gained more than +10% from this months lows below +$50 a barrel, rebounding on a consensus that OPEC and other producers will maintain strict limits on oil production in an attempt to drain a global oversupply.

OPEC has promised to cut supplies by 1.8 million bpd until the end of June and is expected tomorrow to decide to prolong that cut to March 2018.

Crude bears are not expecting much of a price rally from current price levels. They point to U.S ‘frackers’ who are suddenly profitable again to increase production and there is an upside risk of U.S President Trump to take a fairly hard line on Iran by imposing sanctions.

Gold (+$1,250.52 per ounce) is holding steady ahead of the U.S open, after slipping in Tuesday’s session. Investors await cues on the U.S Fed’s rate hike stance from today’s minutes. Higher interest rates tend to boost the dollar and push bond yields up, putting pressure on gold prices.

Nickel has slumped -1.7% and copper -0.6% after Moody’s Investors Service cut China’s sovereign credit rating for the first time since 1989.

3. Yields under pressure to back up from supply and data

In Europe, government bond yields are higher as improving consumer sentiment in Germany is viewed as the latest evidence that a brightening economy may encourage the ECB to wind back ultra-easy monetary policy. German 10-year Bund yields have climbed +2 bps to +0.43%. Also, a sale of 10-year Bunds is also adding upward pressure to yields.

Note: Euro data shows that German consumer morale is the highest in nearly 16 years.

In the U.S, despite there being a +$34B five-year note sale today and +$28B sale of seven-year notes tomorrow, the shape of the yield curve will take its cues from today’s FOMC minutes. The market will focus on clues about the pace of interest-rate increases as well as discussions about how to wind down the Fed’s balance sheet.

Currently, fed funds show a +79% chance that the Fed would raise short-term interest rates at its June 13-14 meeting – the odds was at +74% on Friday and +51% a month ago.

The yield on U.S 10’s is holding at +2.28%, while Aussie 10-year yields have backed up +4 bps to +2.48%.

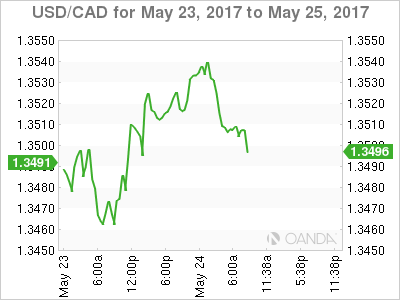

Note: The Bank of Canada (BoC) releases its monetary policy decision at 10 am EST – no change (+0.5%) is expected (C$1.3502).

4. Dollar contained until Fed minutes

The USD is steady in quiet trading as investors/dealers wait for the Fed minutes to see if the language could help to support the greenback.

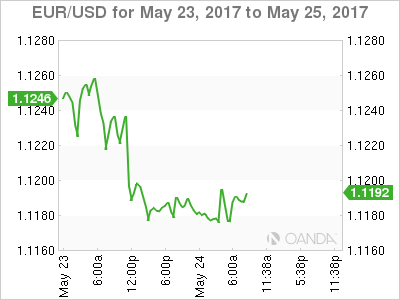

The EUR/USD (€1.1179) continues to hover just under the psychological €1.12 handle. Many expect the ‘single’ unit pullbacks to be brief and shallow. The ‘bulls’ believe the EUR is in the process of going higher – the prospect of the ECB announcing a path to more tapering of its asset-purchase program at the June ECB meeting, improving eurozone economic activity, and rising eurozone capital inflows is expected to support the currency towards €1.1275.

The pound (£1.2972) is still within striking distance of testing the alleged option barriers at £1.3050. To many, £1.3000 is considered the key pivot and with any momentum through theses levels expect the structural shorts out there post-Brexit will be looking to wind back. Short-term sterling bulls are now targeting £1.3350/1.3400.

USD/JPY (¥111.79) probed the ¥112 area overnight, supported mostly by U.S Treasury yield backing up. JPY is also under pressure after Japan’s Upper House approved government’s two nominees for the BoJ board. The nominees would replace current dissenters of Kuroda’s QQE policy.

5. Moody’s cuts China sovereign rating for the first time in 28-years

Overnight, Moody’s Investor Service cuts China’s sovereign rating from AA3 to A1 (one notch) and revised its outlook from negative to stable.

The rating agency noted that “China’s financial strength will erode over the coming years, with economy-wide debt continuing to rise as potential growth slows”, though the “stable outlook reflects our assessment that, at the A1 rating level, risks are balanced.”

Moody’s also forecast leverage across the China economy to increase in coming years and reform to slow, as sustained policy stimulus will lead to higher debt.

Note: China Finance Ministry responded that the assessment overestimated economic difficulties and underestimates ability to deepen supply side reform, maintaining that debt levels will be reasonable and government reform will help curb local debt risks.