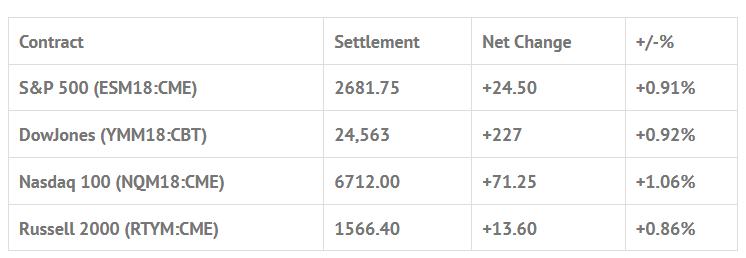

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -1.39%, Hang Seng -0.83%, Nikkei +0.06%

- In Europe 11 out of 12 markets are trading higher: CAC +0.42%, DAX +0.79%, FTSE +0.08%

- Fair Value: S&P +0.21, NASDAQ +8.98, Dow -31.74

- Total Volume: 1.2mil ESM, and 780 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Housing Starts 8:30 AM ET, Redbook 8:55 AM ET, Industrial Production 9:15 AM ET, John Williams Speaks 9:15 AM ET, Randal Quarles Speaks 10:00 AM ET, Patrick Harker Speaks 11:00 AM ET, and Charles Evans Speaks at 1:40 PM ET.

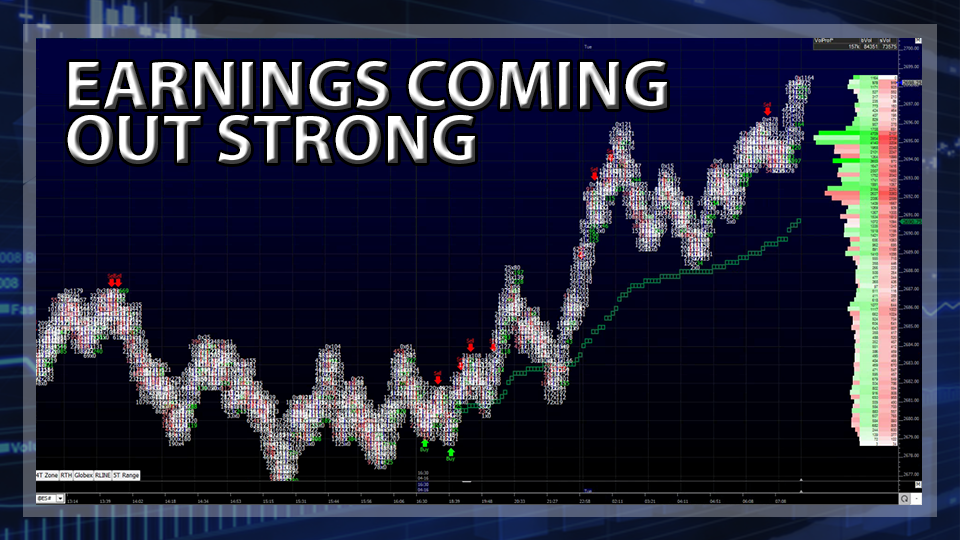

S&P 500 Futures: Big Time #ES Upside Stop Run

Sunday night’s S&P 500 futures Globex trading range was 2662.25 – 2678.25. The first print off Mondays 8:30 CT was 2675.25 up +17.00 handles. After the open, the ES sold off down to 2666.00, and then traded up to 2675.50 at 9:10. From there, the futures ‘back and filled’ between 2677.00 and 2669.00 for the next two hours before breaking out to the upside, initially making a new daily high at 2679.25, and then up to 2687.00 at 12:17 CT.

After the high was in, the ES pulled back a few handles and then ‘double topped’ at the high before selling off down to 2678.75. The break was followed by a rally back up to 2684.50, then a pullback down to 2676.25, as the MiM started showing over $700 million to sell. At 1:03 CT I put this out:

Dboy 1:03:30 Beware the afternoon flunk.

Soon after, the ES bounced back up to 2683.50 as the MiM dropped to $205 million to sell. At 2:45 the futures traded down to 2680.00 as the MiM shot back to $747 million to sell, and then went to $969 million to sell. On the 3:00 cash close the ES traded 2678.00 and what on to settle at 2681.75, up +24.50 handle or +0.91% on the 3:15 futures close.

In the end all the market concern over the US, France and Britain bombing Syria was a big fade job. The ES has been trying to go higher, but all the negative headlines have kneecapped the rallies. We met our 2685.00 objective, and now we think the ES is on a path above 2700, and up to the 2720 level. As long as the headline algos don’t blow up again, we think that could happen this week.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.