Monday November 20: Five things the markets are talking about

The collapse of the German coalition talks over the weekend would suggest that Germany is no longer the role model of ‘political’ stability. Europe’s strongest economy has the possibility of three options ahead, a minority government, a continuation of the current grand coalition or new elections.

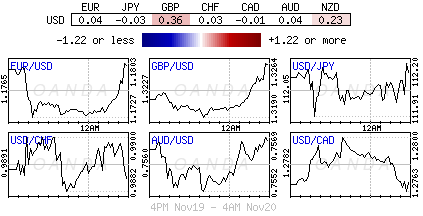

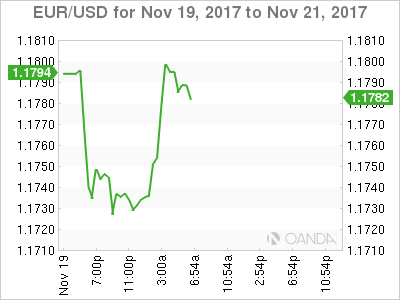

The EUR (€1.1795) has recovered to last trade up +0.68% outright having earlier dropped to its lowest in nearly a week at €1.1723 as the market reassessed how bad it is that Chancellor Merkel failed to form a coalition.

The majority expected a coalition to happen and the most probable scenario now is for Merkel to form a minority government with the FDP.

Note: Trading volumes are expected to be lower than average this week due to the Thanksgiving holiday in the U.S.

The week ahead, key data are the flash November PMI’s in Europe (November 23), Japan and the U.S. Germany posts updated Q3 GDP and the important November Ifo survey (Nov. 24). From Japan, key October merchandise trade data (November 24) will also be reported.

Minutes from the Reserve Bank of Australia’s (RBA) November meeting are due Tuesday (November 21), while those from the ECB’s October meeting due out on Thursday (November 23) could show dissent in the discussion about tapering.

The U.K. announces its budget Wednesday (November 23); that could see a significant economic downgrade amid a continued impasse in its negotiations with the E.U on Brexit.

Also on Wednesday, the Fed will publish the minute’s form its November meeting (2:00 pm EST). There will be more clues on where certain policy makers stand regarding inflation, but the market is still pricing in a +99% probability of a U.S. rate hike next month.

1. Stocks mixed results

In Japan, the Nikkei share average fell overnight amid losses stateside and a stronger yen (¥112.00), while semiconductor equipment manufacturers and financial stocks underperformed. The Nikkei ended -0.6%, while the broader Topix slipped -0.2%. Turnover also dropped to a one-month low.

Down-under, Australia’s stock benchmark was pressured overnight by a pullback in the country’s major banks after late-week gains. After rising the last two sessions, the S&P/ASX 200 settled down -0.2%.

In Hong Kong, stocks rose slightly overnight. The Hang Seng index rose +0.2%, and the China Enterprises Index lost -0.6%.

In China, stocks reversed early losses to end higher on Monday, aided by a rebound in banking shares even after Beijing set new guidelines to regulate asset management products. The blue-chip CSI300 index dropped as much as -1.5% in early trade but closed up +0.6%, while the Shanghai Composite Index ended -0.3% higher.

In Europe, regional equities opened lower, but turned around after digesting situation in Germany. Energy stocks are supported by oil prices, but commodity prices are underperforming, but not enough to significantly impact material stocks.

U.S stocks are set to open in the ‘red’ (-0.2%).

Indices: Stoxx50 -0.1% at 3,545, FTSE -0.2% at 7,366, DAX -02% at 12,970, CAC 40 flat at 5,320, IBEX 35 +0.1% at 10,019, FTSE MIB flat at 22,086, SMI +0.6% at 9,236, S&P 500 Futures -0.2%

2. Oil markets tepid ahead of Nov. 30 OPEC meeting, gold prices steady

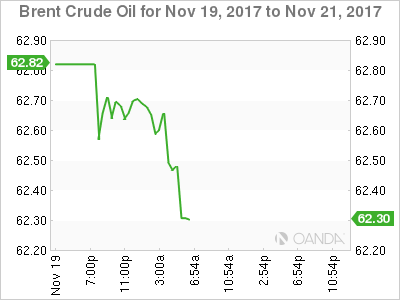

Oil markets are little changed as investors seem reluctant to take on big new positions ahead of an OPEC meeting at the end of the month, when producers are expected to decide whether to continue output cuts aimed at supporting prices.

Brent crude futures are at +$62.47 per barrel, down -25c or -0.4% from Friday’s close, while U.S West Texas Intermediate (WTI) crude futures are at +$56.57 a barrel, up just +2c.

OPEC, along with a group of non-OPEC producers led by Russia, have been restraining output since the start of this year in a bid to end a global supply overhang and prop up prices. The deal expires in March 2018.

OPEC is expected to agree an extension, although there are doubts about the willingness of some participants to continue to restrain output.

Note: In the U.S., the number of rigs drilling for new oil production remained unchanged in the week to Nov. 17 at 738 (Baker Hughes).

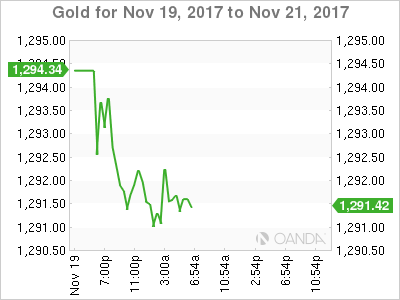

Gold has dipped on a firmer dollar, but it’s staying close to its one-month peak on uncertainty over progress on a potential overhaul of the U.S tax code. Spot gold is down -0.2% at +$1,291.44 per ounce.

3. Sovereign yields fall

Germany’s 10-year Bund yield fell to its lowest level in two-weeks in the early euro session, after weekend talks to form a coalition government failed and raised the risk of fresh elections.

The political crisis in Europe’s biggest economy has pushed Germany’s 10-year Bund yield down -1.5 bps to +0.35%, its lowest level since Nov. 9.

Elsewhere, the yield on U.S. 10-year Treasuries fell -1 bps to +2.34%. In the U.K, 10-year Gilt yield has climbed +1 bps to +1.309%. In Japan, the 10-year JGB yield has increased less than +1 bps to +0.038%.

4. Dollar continues to struggle

Naturally, the focus in FX is on Germany with the current German coalition talks collapsing.

The EUR/USD tested €1.1722 during the Asians session. However, EUR ‘bulls’ noted that despite the political uncertainty in Germany, the domestic economic engine remained robust and thus would not need the help of near-term reform efforts to continue to boom. The ‘single unit’ (€1.1795) has reversed back the majority of its overnight losses on reports that FDP would support forming a minority government run by Merkel rather than new elections.

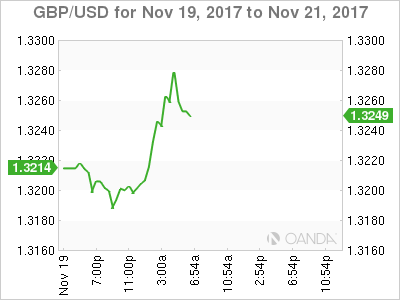

GBP (£1.3254) is higher on market optimism that the U.K would soon increase its offer for the Brexit financial settlement. The U.K. budget Wednesday will greatly influence the pounds short-term direction.

5. German producer prices in October 2017

In October, the index of producer prices for German industrial products rose by +2.7% compared with the corresponding month of 2016. Compared with the preceding month September, the overall index rose by +0.3%.

Note: In September, the annual rate of change all over had been +3.1%.

Digging deeper, the price indices of all main industrial groups increased y/y – prices of intermediate goods rose by +4.1%, energy prices were up +2.8%. Prices of non-durable consumer goods rose by +2.8%, while prices of durable consumer goods increased by +1.2%, whereas prices of capital goods increased by +1.1%.