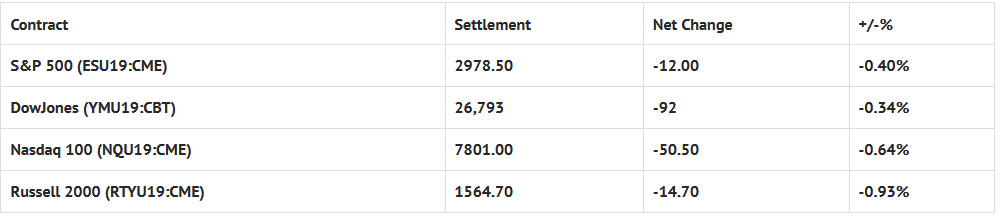

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -0.18%, Hang Seng -0.76%, Nikkei +0.14%

- In Europe 12 out of 13 markets are trading lower: CAC -0.37%, DAX -0.99%, FTSE -0.06%

- Fair Value: S&P +4.06, NASDAQ +22.63, Dow -3.47

- Total Volume: 1.0 ESU & 216 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, NFIB Small Business Optimism Index 6:00 AM ET, Jerome Powell Speaks 8:45 AM ET, Redbook 8:55 AM ET, James Bullard Speaks 10:00 AM ET, JOLTS 10:00 AM ET, Raphael Bostic Speaks 1:00 PM ET, and Randal Quarles Speaks 2:00 PM.

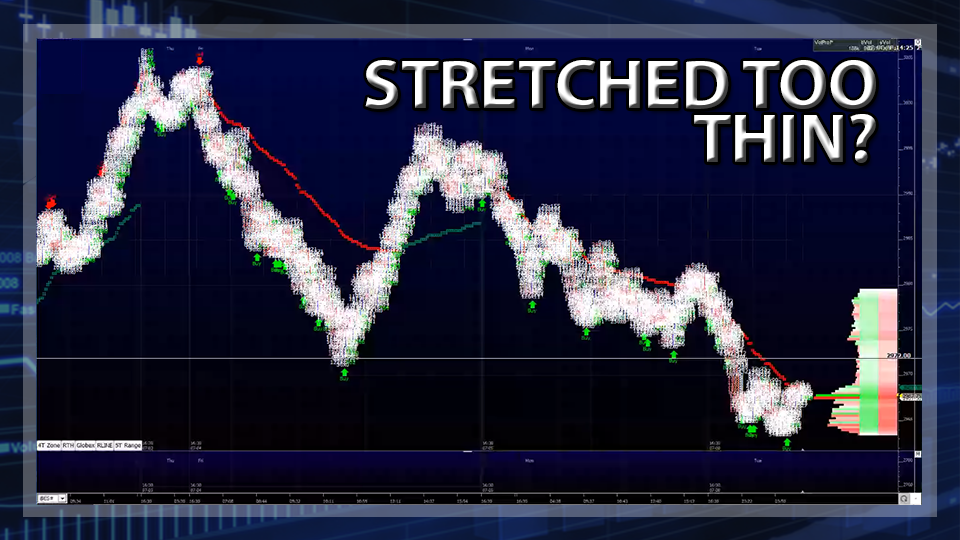

S&P 500 Futures: Monday, Repeat Of Friday

Chart courtesy of Scott Redler @RedDogT3 – $spx futures -12 as the Oscillator went from +40 to Neutral.. Holding the 2952 area is important. Powell is tomorrow.

After making a high at 2994.75 during Sunday nights Globex session, the S&P 500 futures broke down to 2978.75 just before 1:00 am CST, and opened Monday’s regular trading hours (RTH) at 2981.50.

Volume was low, the action was weak, and the range was tight for most of the day. It was a good day to play both sides if you’re a scalper.

The daily trend was definitely to the down side, but the final MOC reveal was a strong $654 million to buy. The futures went on to close out the day at 2978.25, which was right in the middle of the RTH opening range, and just 2 ticks lower than the Globex low.