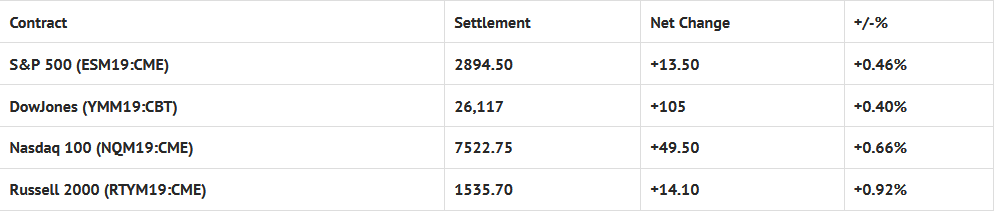

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -0.99%, Hang Seng -0.65%, Nikkei +0.40%

- In Europe 13 out of 13 markets are trading lower: CAC -0.51%, DAX -0.88%, FTSE -0.56%

- Fair Value: S&P +5.24, NASDAQ +30.77, Dow +18.95

- Total Volume: 1.4 million ESM & 4,221 SPM traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes Retail Sales 8:30 AM ET, Industrial Production 9:15 AM ET, Business Inventories 10:00 AM ET, Consumer Sentiment 10:00 AM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: Markets Roll Over For The Roll

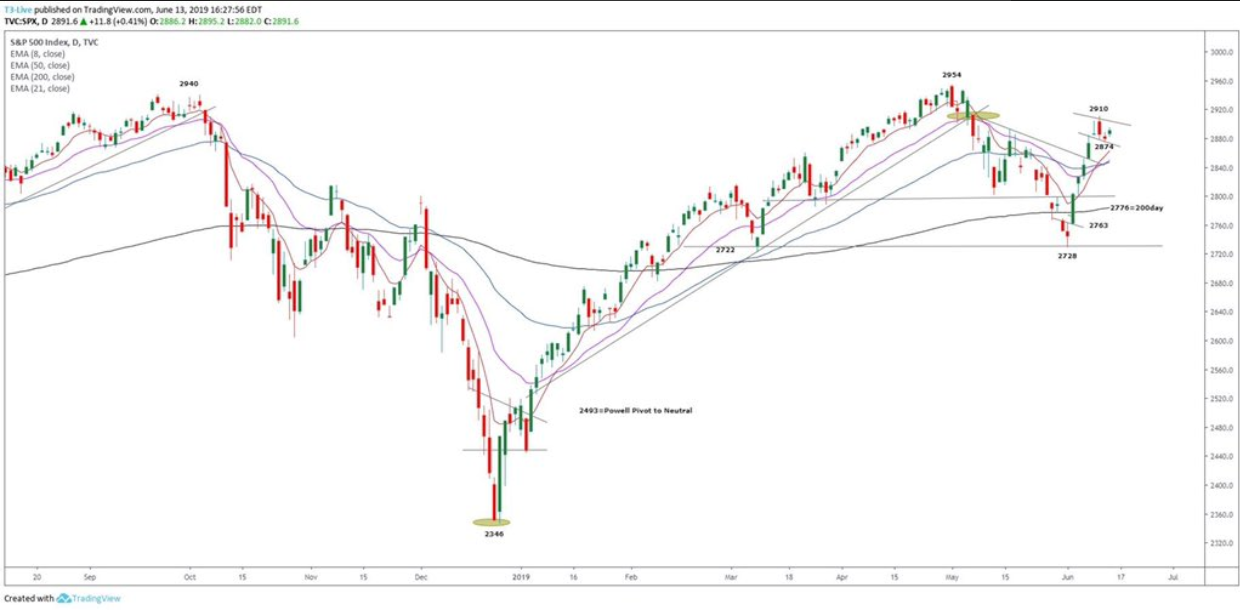

Chart courtesy of Scott Redler @RedDogT3 – Good morning. Mixed/mostly red arrows around the World as AVGO creates weakness in the Semi’s. Iran/Tanker, US/China trade are the focus. $spx futures -11. We’ll see if 2874 holds or does the upper flag break lower (2855 is support under).

After trading down to 2867.25 during Wednesday nights Globex session, the S&P 500 futures rallied to open Thursday’s regular trading hours at 2890.00. The first move after the 8:30 Ct bell was to trade through the Globex high at 2894.50, and print a new high at 2896.50.

Once the high was in, the futures settled into a cozy sideways 12 handle range for the rest of the day.

Going into the close, when the MiM came out showing $173M to sell, the ES was trading at 2886.75. It would then go on to print 2893.25 on the 3:00 cash close, and 2894.50 on the 3:15 futures close.

It was a quiet day, to say the least, especially with the roll getting started. Markets were thin, volume was low, and we expect to see more of the same today.