Here are the latest developments in global markets:

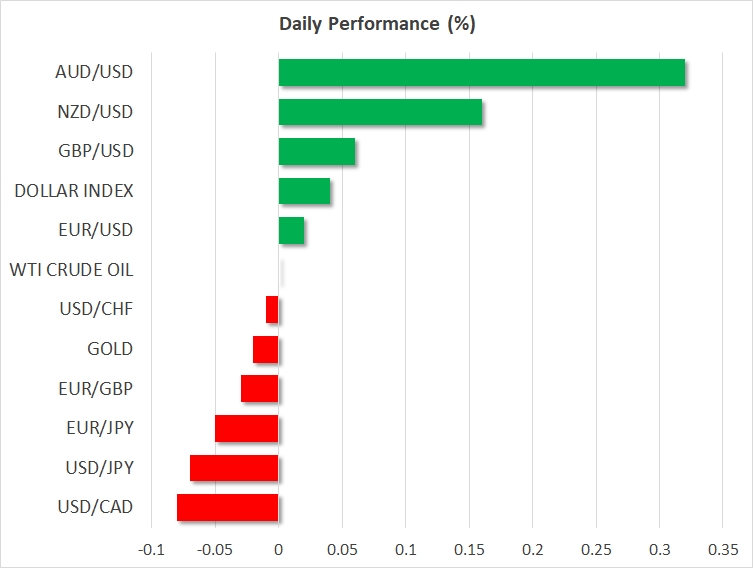

· FOREX: The dollar was little changed versus a basket of currencies on Wednesday after retreating following the departure of Rex Tillerson from the position of US Secretary of State on Tuesday.

· STOCKS: US markets closed lower yesterday, as news that US Secretary of State Rex Tillerson had been fired increased political uncertainty, and reports that the US is preparing new tariffs against China curbed risk appetite. The NASDAQ Composite led the way lower, declining by 1.0%, while the Dow Jones and the S&P 500 fell by 0.7% and 0.6% respectively. Futures tracking the S&P, Dow, and NASDAQ 100 are currently not much changed. Asian markets were a sea of red today as well. In Japan, the Nikkei 225 and the Topix tumbled by 0.9% and 0.5% correspondingly, while in Hong Kong, the Hang Seng was 1.0% lower. In Europe, futures tracking most of the major benchmarks were flashing red, pointing to a lower open.

· COMMODITIES: Oil prices were more or less flat on Wednesday, after posting significant losses during Tuesday’s trading session. While there was no clear fundamental catalyst behind yesterday’s slide, it is worth noting that it occurred a few minutes after news hit the wires that Rex Tillerson had been fired, and thus may be owed to the diminished risk appetite in markets. Today, oil traders will turn their sights to the weekly EIA crude inventory data at 1430 GMT for a fresh indication of whether US production continues to soar. In precious metals, gold prices traded marginally lower today, last seen near the $1325/ounce mark. The yellow metal gained notably yesterday, on the back of increased political uncertainty in the US, and a lower dollar.

Major movers: Dollar loses ground on Tillerson departure; upbeat Chinese data boost antipodeans

US President Donald Trump’s decision to fire Rex Tillerson from the position of Secretary of State on Tuesday led to weakness in the greenback, with investors’ confidence in the administration’s ability to deliver potentially being hampered, especially if viewed in light of the fact that this is one of many departures from Trump’s inner circle. Mike Pompeo, who served as CIA Director, will replace Tillerson.

The dollar index was roughly flat after previously touching a six-day low of 89.56. Euro/dollar and pound/dollar were little changed after reaching a six-day high of 1.2412 and a two-week peak of 1.3996 respectively. Both the euro and sterling benefitted on the back of yesterday’s weakness in the dollar.

Japan’s currency might not have managed to finish Tuesday higher versus the greenback amid a political scandal that unfolded in the world’s third largest economy implicating PM Shinzo Abe and Finance Minister Taro Aso, but it still managed to recover a significant part of its losses that saw dollar/yen rise to a two-week high of 107.29. At 0730 GMT, the pair was not much changed at 106.51.

February’s inflation data out of the US came in line with projections and were in a way interpreted as dollar-positive in the sense that they continued to support the case for gradual rate hikes by the Federal Reserve. Still, developments on the political front dominated attention, not allowing the US currency to advance on the release. The US central bank convenes next week and is widely expected to deliver a quarter percentage point rate hike.

US long-term Treasury yields declining also led the dollar to lose part of its allure relative to other currencies.

The aussie and the kiwi traded higher by 0.3% and 0.15% respectively versus their US counterpart, with the latter revisiting a three-week high of 0.7354 earlier in the day. The commodity-linked currencies were likely supported by stronger-than-expected data on fixed asset investment and industrial output out of China for the month of February. The yuan was also on a positive footing, with dollar/yuan posting a one-week low of 6.3076 and the pair last trading not far above this level. Reports suggest that the US administration is currently considering the imposition of tariffs on a broad range of Chinese imports amounting to tens of billions of dollars worth of goods per year.

Day ahead: US retail sales in focus as tariff concerns lurk in the background

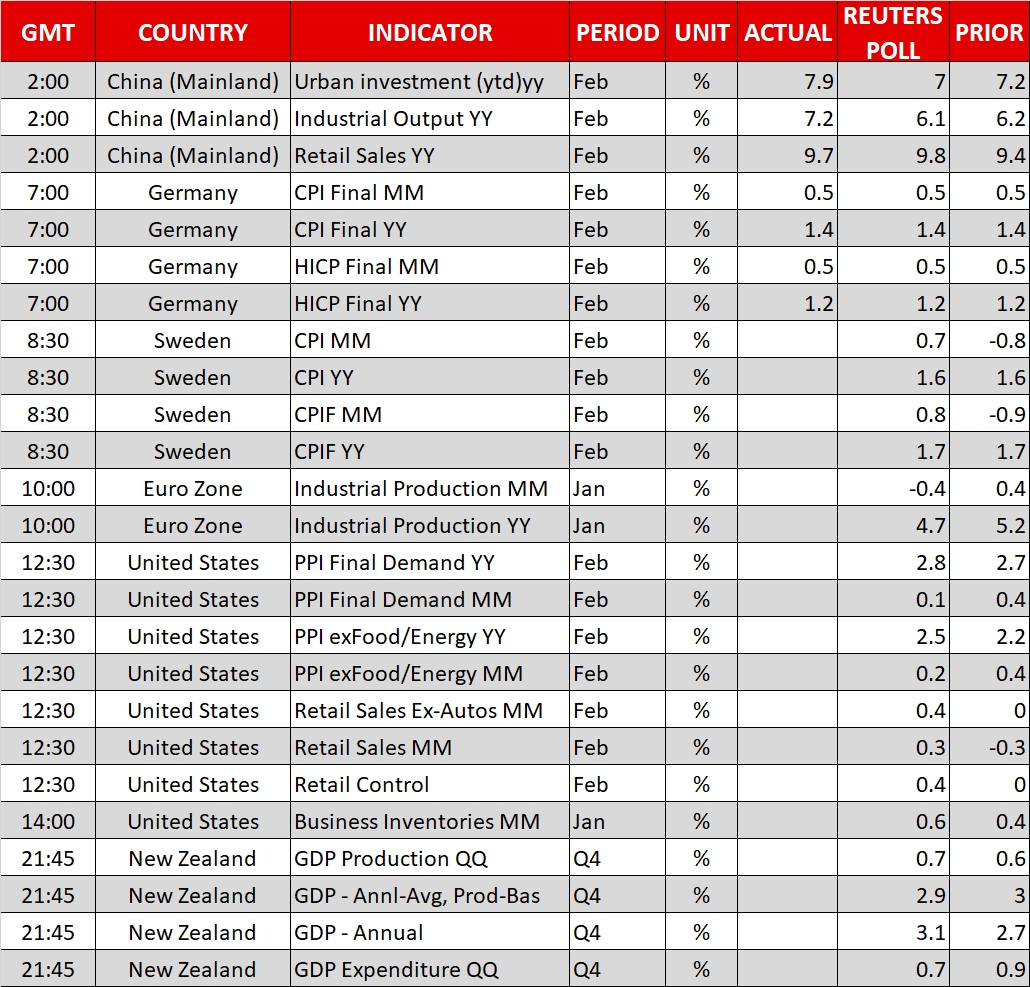

In terms of economic data, the key release will be the US retail sales figures for February, at 1230 GMT. After a 0.3% monthly drop in January, retail sales are projected to have bounced back by the same amount in February. The core print is also expected to have risen by 0.4%, after stagnating previously. Indeed, consumer sentiment indicators like the Conference Board and the University of Michigan indices surged during the month, supporting the case for a rebound in spending. The US will also release its PPI data for February, and the forecast is for producer prices to have accelerated slightly in yearly terms.

In case these data come in stronger than expected – particularly on the retail sales front – the dollar could regain some of its poise on the news, on speculation that the Fed may upgrade its “dot plot” at next week’s meeting to signal four rate hikes this year. That said though, even in case of a positive knee-jerk reaction in the greenback, it remains to be seen whether it can hold onto gains, amid elevated political uncertainties and the risk of increased protectionism clouding the currency’s outlook. On the flip side, weaker-than-anticipated data today could diminish speculation for a more hawkish Fed, and thus bring the dollar under renewed selling interest.

In Sweden, the headline and the underlying CPI rates for February are due out at 0830 GMT, and both are anticipated to have remained unchanged at 1.6% and 1.7% respectively in yearly terms. In the Eurozone, industrial production data for January will be in focus at 1000 GMT.

In energy markets, the weekly EIA oil inventory data will be released at 1430 GMT. Expectations are for crude stockpiles to have risen again, but by less than the previous week. These data will likely serve as a gauge of whether US production continues to soar higher. The latest US rig data showed a decline in the number of active rigs, signaling that US output may have peaked for now. If the EIA data confirm this narrative, oil prices may rebound today. That said though, in the bigger picture, oil prices are still faced with significant risks, and it may take more than an optimistic inventory report to change that.

In equity markets, trade considerations will likely remain at the forefront of attention, after a report from Politico yesterday suggested that the US is preparing steep new tariffs against China, which may be rolled out as early as next week. Any confirmation of this would likely revive concerns of a potential US-China trade war and thereby, trigger similar market reactions to what we saw last week. Namely, stock indices and trade-sensitive currencies like the Aussie and the loonie could come under renewed pressure, while safe havens like the yen may gain.

We have a slew of ECB speakers on the agenda today. President Mario Draghi has already spoken, and among other points he noted that further strength in the euro could weigh on inflation, a comment that triggered a small negative reaction in the common currency. Next in line is the Bank’s chief economist Peter Praet, who will speak at 0845 GMT, while Vice President Vitor Constancio will step up to the rostrum at 1045 GMT. Finally, Executive Board member Benoit Coeure will deliver remarks at 1615 GMT.

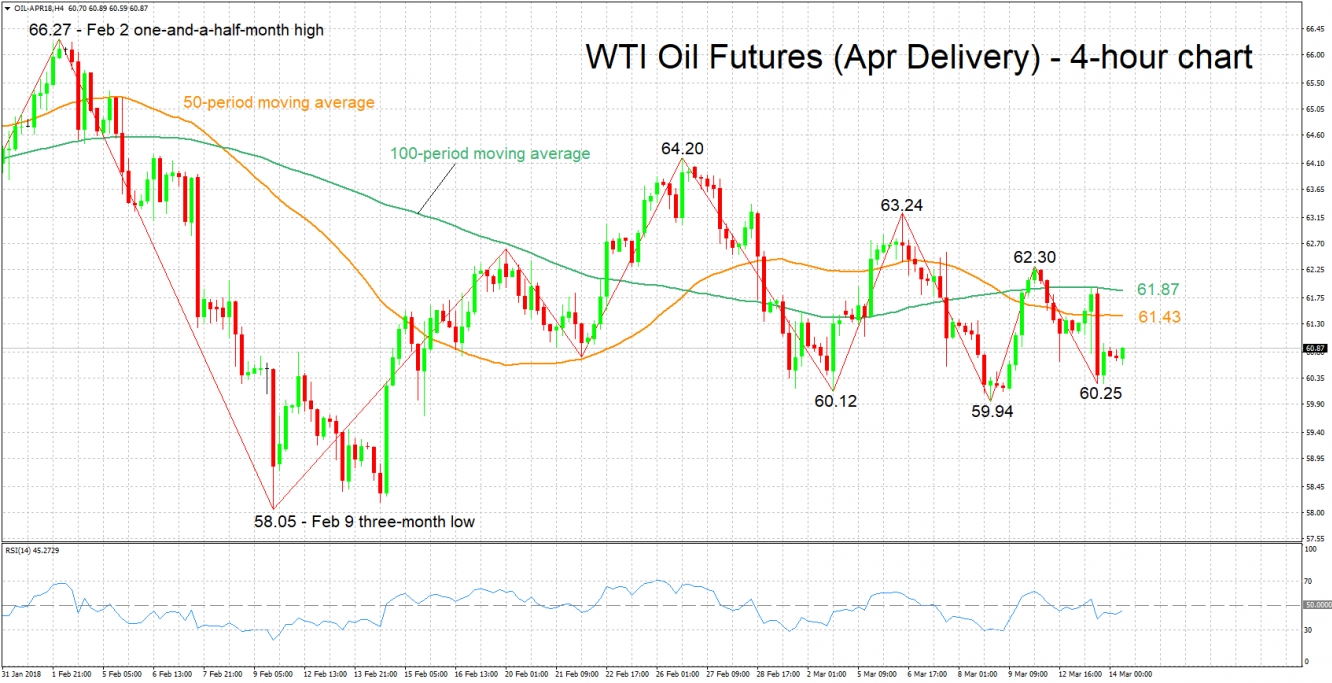

Technical Analysis: WTI oil futures looking neutral in the short-term

WTI oil futures for April delivery are currently moving sideways above a five-day low of 60.25 hit during Tuesday’s trading. The RSI is also largely moving sideways, projecting a mostly neutral short-term picture.

If the Energy Information Administration’s weekly report shows a smaller-than-anticipated increase in US crude oil inventories, prices could rise. In this scenario, resistance could come around the current level of the 50-period moving average at 61.43. Notice that the 100-period MA lies not far above at 61.87.

If on the other hand crude inventories increase by more than projected, then prices could post losses. In this case, the area around yesterday’s low of 60.25 might provide support. Note that the range around this level encapsulates numerous bottoms from the recent past as well as the 60 handle that may hold psychological significance.