Sentiment will be heavily influenced by today’s US inflation data, which is expected to be affected by the recent hurricanes which devastated the US coastline.

Meanwhile, oil is pushed higher thanks to robust Chinese economic data.

US Markets

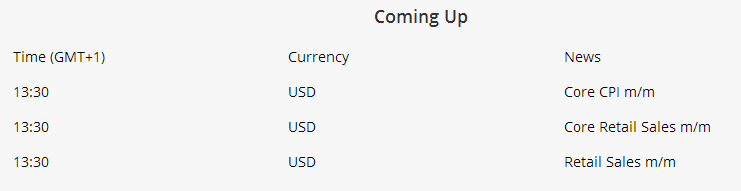

Ahead of today’s key US consumer price data, the dollar is dwindling. Core CPI is expected to remain at 0.2%. The inflation data will be closely watched by investors as the Federal Reserve’s latest meeting minutes showed some members were concerned about the persistently low inflation readings. The Fed’s target mark is 2% inflation, while it is likely that price stimulation will trend horizontally over the coming months.

Without an uptick in asset prices the Fed will perhaps reduce the pace of rate hikes. While the probability of a December rate hike is still high, investors are reducing their exposure on the dollar thanks to the lacklustre inflation reports.

It is important to note that this month’s report will be slightly skewed by the recent hurricanes.

Meanwhile, the prospect of lower-for-longer US interest rates are helping to support US equities. The S&P 500 ended 0.2% higher yesterday and is expected to hold steady throughout the day.

European Markets

The euro is slightly weaker against the dollar this morning losing the gains it made in yesterday’s trading session.

European Central Bank officials are deciding whether to cut its monthly bond-buying programme in January. This would reduce purchases from 60 billion to 30 billion euro as policymakers become more confident in the economic outlook for the eurozone.

European bourses are taking ques from US stocks, trading mostly upwards this morning.

The CAC 40 is 0.1% higher, while the eurozone’s proxy, the DAX 30, is 0.12% stronger. Amsterdam’s AEX has added 0.6% while Italy’s FTSE MIB is 0% higher.

Spain’s index, the IBEX 35, is still struggling under the weight of political uncertainty, down 0.23%.

Sterling sold-off yesterday as Brexit talks came to a ‘’deadlock’’. The pound has since rallied against both the dollar and euro as European Union Brexit negotiator Michel Barnier, indicated negotiations will turn to trade by December if progress is made on the rights of EU citizens.

The UK has been lamped with a €50 billion fine for leaving the trading bloc, a sum that would drastically bruise the UK economy.

The FTSE 100 is ignoring the stronger pound, trading 0.14% upwards.

Asia-Pacific Markets

China continues to be supported by global demand, showing exports grew 9% in September, while imports increased by a whopping 19.5%.

Japan’s Nikkei 225 climbed 1%, ending the week at the highest point since 1996.

The Japanese yen is 0.1% higher against the dollar as bubbling tensions in North Korea continue to support safe-haven assets.

North Korea suffered a modest earthquake close to the site where its nuclear tests occur.

Commodity Markets

Oil is on track for a weekly advance after rekindling its rally overnight. The commodity fell 1.2% on Thursday thanks to an increase in natural gas storages, while crude oil inventories fell by more than expected. Strong Chinese imports helped to push oil higher.

Crude oil is 1.7% higher, trading at $51.60. The international benchmark, Brent oil is 2% stronger at $57.54.

Gold is losing some momentum; however, the precious metal is still 0.09% higher. The commodity has added 1.5% to its value this week, after five weeks of declines. Gold has been supported by the heightened tensions in North Korea as well as the weaker dollar.