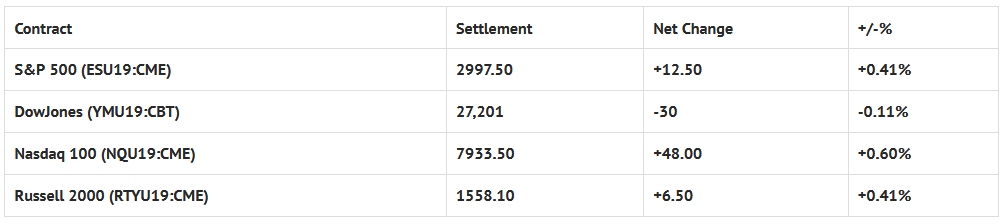

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 11 out of 11 markets closed higher: Shanghai Comp +0.79%, Hang Seng +1.07%, Nikkei +2.00%

- In Europe 9 out of 13 markets are trading higher: CAC +0.09%, DAX +0.09%, FTSE +0.12%

- Fair Value: S&P +2.55, NASDAQ +17.73, Dow -11.62

- Total Volume: +1.34 million ESU & 45 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes Consumer Sentiment 10:00 AM ET, James Bullard Speaks 11:05 AM ET, the Baker-Hughes Rig Count 1:00 PM ET, and Eric Rosengren Speaks 4:30 PM ET.

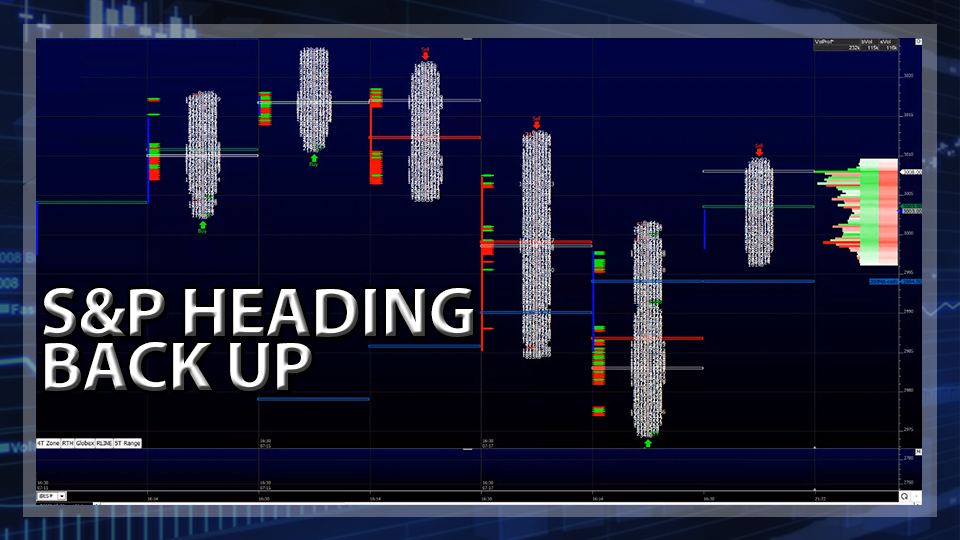

S&P 500 Futures: Sell Programs In The Morning, Buy Programs In The Afternoon

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +3 after reclaiming 2984 to try and prove it can stay elevated. Manage the trade with more care.

The S&P 500 futures (ESU19:CME) sold off down to 2974.50 on Wednesday nights Globex session, then printed 2980.75 yesterday’s 8:30 CT futures open.

After a quick down tick, the ES rallied up to 2090.00. The futures then sold back off down to a new daily low at 2975.75, 1.25 handles above the Globex low at 2974.50 going into the European close.

I have to admit, the markets looked weak, but I told the PitBull that I thought the ES was going finish higher on the day, then not long after a Federal Reserve official came out and said central banks “must lower interest rates swiftly on signs of economic weakening,” and the ES traded up to 3001.50, up +16.50 handles on the day.

After the new high the ES traded back down below the vwap to 2992.50 at 2:30, then rallied back up to 2994.00 as the MiM reveal showed close to $1 billion to buy MOC. The futures then went on to trade 2997.50 on the 3:00 cash close, and settled at 2997.75 on the 3:15 futures close, up +12.75 handles on the day.

In the end, it was all about sell programs in the beginning of the day, and buy programs later in the day. In terms of the markets overall tone, like I have been saying, you can get one down day, or even two down days, but getting three in a row doesn’t happen very often.

In terms of the days overall trade, volume was high for this time of year, with 1.3 million ESU contracts traded.