Market Brief

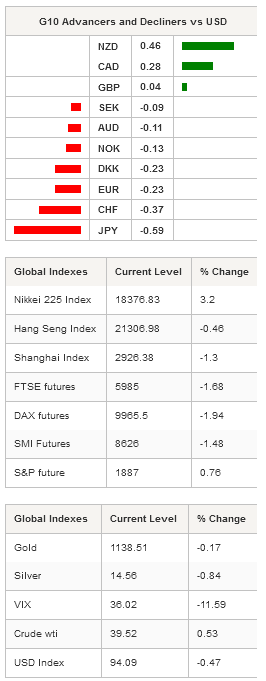

In a surprise move the PBoC lowered borrowing costs, by cutting the 1-year lending rate by 25bps to 4.60% and the 1-year deposit rate by 25bps to 1.75%, and trimmed the reserve requirement ratio by 50bps to 18%, effective September 6. Initially, the move didn’t prevent Chinese stock markets from sliding lower as the Shanghai Composite fell 3.80% in early Asian trading while the Shenzhen Composite dropped 4.40%. Optimism gradually returned, however, in the second part of the day with Japanese shares jumping 3.20%. In South Korea the KOSPI index surged 2.57% while in Hong Kong the Hang Seng edge down 0.46%. Overall, traders had a hard time determining whether Chinese shares had to stabilise or to keep sliding, it was a very volatile session with equity returns swinging from red to green. In the end, Shanghai Composite fell 1.30% and SZSE Composite 3.05%.

Yesterday in New York, US equities sacked the rebound in US dollar as all major indexes were trading in negative territory, with the S&P 500, Dow Jones and NASDAQ Composite down 1.35%, 1.29% and 0.44%, respectively. Nevertheless, futures on the S&P 500 are up 0.76% in Asia this morning. In Europe, futures are broadly lower this morning with Euro Stoxx 50 down 2.01%, DAX down 1.94%, FTSE 100 down 1.68%, CAC 40 down 1.70% and SMI down 1.48%.

In the FX market, the US dollar is slowly recovering from yesterday late session’s sell-off. The greenback is up 0.37% against the Swiss franc, 0.60% against the Japanese yen and 0.23% against the single currency. USD/CHF found a strong support at 0.9258 (Fib 50% on January-March rally) and is now heading toward the resistance standing at 0.9463 (Fib 38.2%). EUR/USD is stabilising around 1.15, slightly below the key 1.1514 level (Fib 50% on December- March debasement).

In New Zealand, the trade deficit widened to NZ$649mn in July versus NZ$600mn median forecast as import surged to NZ$4.85bn, well above market expectation of NZ$4.40bn. On the other hand, export increased to NZ$4.20bn compared to the downwardly revised figure of NZ$4.14bn the previous month. The news drew a muted response from NZD/USD a it has been trading in a narrow range between 0.6465 and 0.6560.

In Japan, services PPI surprised markets to the upside with a reading of 0.6%y/y versus 0.4% consensus. USD/JPY is edging higher this morning, after having found a strong support around 118.30 (low from March 26). The head of the New York Fed, Bill Dudley, will be speaking today on the regional and local economic situation, however the conference will be follow by a Q&A session and we may get some interesting question about the Fed monetary policy.

Today traders will be watching unemployment rate from Norway; MBA mortgage applications and durable goods orders from the US; total outstanding loans and weekly currency flow from Brazil.

Currency Tech

EUR/USD

R 2: 1.2252

R 1: 1.1871

CURRENT: 1.1504

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5684

S 1: 1.5425

S 2: 1.5330

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 119.44

S 1: 115.57

S 2: 113.86

USD/CHF

R 2: 0.9904

R 1: 0.9488

CURRENT: 0.9420

S 1: 0.9151

S 2: 0.9072