Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp -1.17%, Hang Seng +0.26%, Nikkei +0.53%

- In Europe 13 out of 13 markets are trading higher: CAC +1.44%, DAX +0.67%, FTSE +0.79%

- Fair Value: S&P +0.84, NASDAQ +4.19, Dow +10.39

- Total Volume: 1.56 million ESM & 208 SPM traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the Employment Situation 8:30 AM ET, Wholesale Trade 10:00 AM ET, the Baker-Hughes Rig Count 1:00 PM ET, and Consumer Credit 3:00 PM ET.

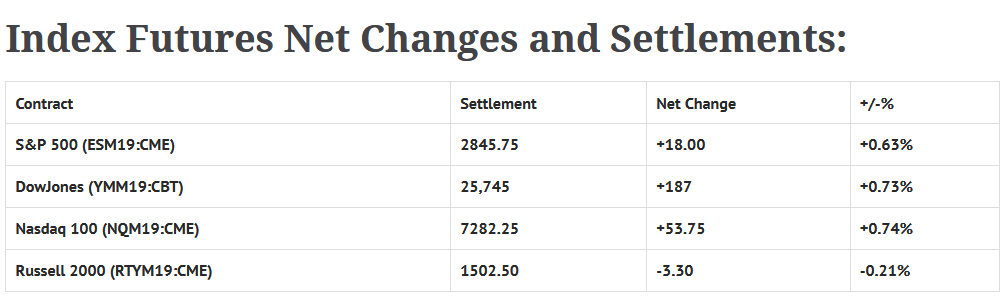

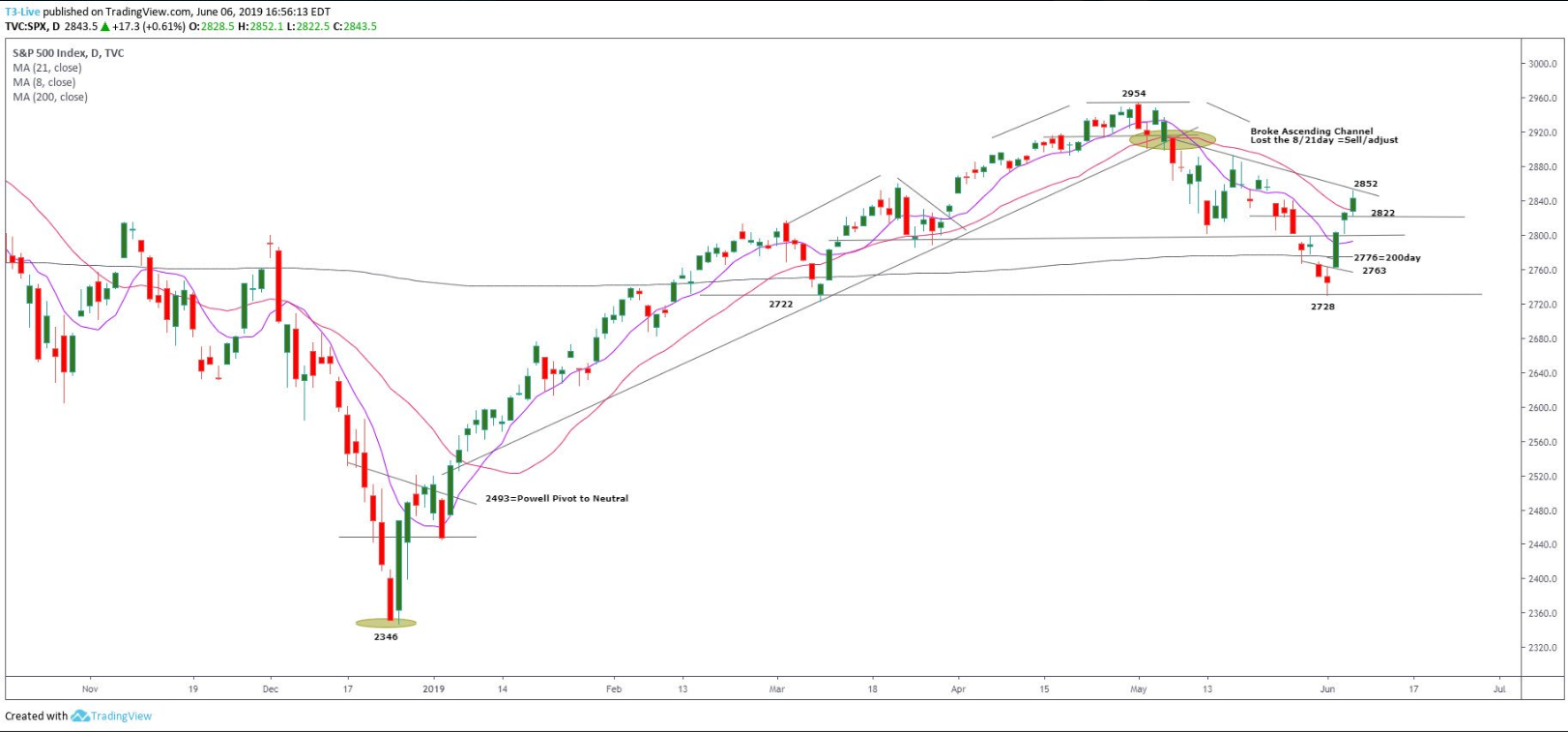

S&P 500 Futures: ES Up 125 Handles In 3 Sessions

Chart courtesy of Scott Redler @RedDogT3 – Good morning. Mostly green arrows around the World ahead of Jobs Friday. $spx futures +8. See if it holds above 2852 (or not) next resistance 2864-2875 area. If you didn’t buy earlier this week. Take care with your first buy into this gap up (probably a better sell).

After gapping lower to open yesterday’s Globex session at 2820.50, then printing a low of 2812.75, the S&P 500 futures (ESM19:CME) firmed up and traded higher for the rest of the night, filling the gap and trading up to 2838.00.

The ES opened regular trading hours at 2830.75, and was a little weak out of the gate, breaking down to 2823.25 at 9:30. From there, headlines triggered some buy programs, and by 10:30, it had made it back up to 2836.50.

After the early high was in, a trade headline activated some sell programs that quickly smacked the futures down to 2827.25. Once the dust had settled, the ES began a slow choppy grind higher.

Heading into the final hour, the ES continued to trade higher, topping out at 2853.00. When the cash imbalance reveal came out showing $371 million to sell, the futures started to back off a little, and went on to print 2845.00 on the 3:00 cash close, and 2845.50 on the 3:15 futures close, up 27 handles on the day.