Monday January 22: Five things the markets are talking about

Despite the distraction of a U.S government shutdown, the focus of capital markets this week will return to the more upbeat message of the global growth upswing and a couple of G7 central banks monetary communications.

The Bank of Japan (Tuesday) and the European Central Bank (Thursday) both hold policy meetings and both are expected to leave their respective policies unchanged. Nevertheless, the market will be listening to governor Kuroda and president Draghi for hints of possible policy changes going forward as growth picks up.

In North America, Canada release retail sales Thursday and inflation numbers Friday, while stateside, the U.S will release its initial Q1 estimates of GDP Friday.

Overnight, global equities traded mixed, while sovereign bonds halted a recent selloff as investors assessed the impact of the U.S federal government’s partial shutdown.

Note: The Senate is to vote on later today to try to reopen government and fund it through Feb 8.

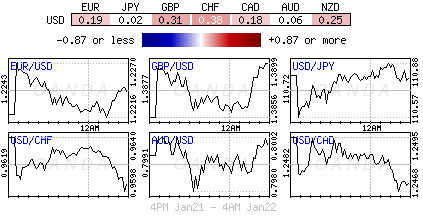

The U.S dollar is steady as we enter the third day after Senate leaders failed to end the impasse on the weekend. The EUR has gained on optimism that Germany’s Merkel has made a breakthrough towards her fourth term after the Social Democrats backed formal coalition talks with the Chancellor after their divisive party convention Sunday.

Note: The SPD voted to support the opening of formal coalition talks with Chancellor Merkel’s conservative bloc with vote by 362 to 279.

1. Stocks mixed results

In Japan, stocks produced small gains on Monday, with strength in securities and insurers offsetting falls in resources-related sectors. The Nikkei index was flat, while the broader Topix added +0.1%.

Down-under, afternoon selling took Aussie shares to a fifth consecutive loss and the benchmark to a seven-week low. Settling at the session low, the S&P/ASX 200 dropped -0.2% as the major banks in particular weighed. In S. Korea, the Kospi was down -1.05%, pressured by worries over the U.S government shutdown.

In Hong Kong, equities traded close to flat in the overnight session. Chinese H-shares listed in Hong Kong eased -0.02%, while the Hang Seng Index was down -0.04%.

In China, stocks rose overnight to new two-year highs, helped by gains in the defensive consumer and healthcare firms. The Shanghai Composite index was up +0.22%, while China’s blue-chip CSI 300 index was up +0.75%.

In Europe, regional indices trade mixed this morning, with outperformance in the Spanish Ibex ahead of a busy earnings week.

Futures on the S&P 500 Index have dipped -0.1%.

Indices: STOXX 600 flat at 400.7, FTSE +0.1% at 7735, DAX -0.1% at 13423, CAC 40 -0.1% at 5520, IBEX 35 +0.4% at 10519, FTSE MIB +0.1% at 237773, SMI -0.2% at 9494, S&P 500 Futures -0.1%

2. Oil rises as Saudi Arabia says producers will cooperate beyond 2018

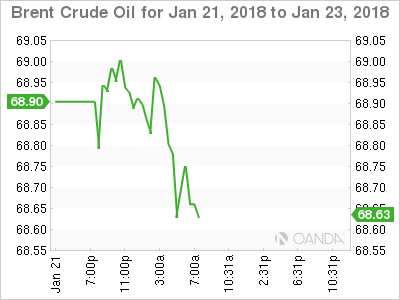

Oil prices start the week better bid, pushed higher by comments from Saudi Arabia that cooperation between oil producers who are withholding supplies would continue beyond this year.

Strong global economic growth, coupled with a drop in U.S drilling activity is also supporting crude prices.

Brent crude futures are at +$68.84 a barrel, up +23c or +0.34% from Friday’s close. Brent on Jan. 15 rose to +$70.37, its highest print in three-years. U.S West Texas Intermediate (WTI) crude futures are at +$63.53 a barrel, up +16c, or +0.25% from their last settlement. WTI climbed to +$64.89 on Jan. 16, also its highest since December 2014.

Data stateside from Baker Hughes Friday showed that U.S drillers cut five oil rigs in the week to Jan. 19, bringing the count down to 747.

Note: Despite this, the rig count in 2017 and early this year remains much higher than in 2016, resulting in a +16% rise in U.S production since mid-2016, to +9.75m bpd.

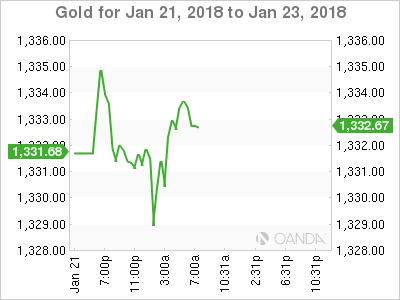

Ahead of the U.S open, gold prices have inched as the dollar regained some of its strength after slipping earlier on a U.S government shutdown, with investors on wait-and-see mode. Spot gold has fallen -0.1% to +$1,329.75 an ounce.

Note: Spot gold fell -0.5% last week, it’s first weekly decline in six-weeks.

3. Yields changes on central banks message

Fixed income traders need a push from central bankers to plot the next directional phase for global yields. Currently, global sovereign yields have backed up their to their three year highs. The Bank of Japan and the European Central Bank both have policy decisions this week, before an announcement from the Federal Reserve on Jan. 31.

While no action is expected from any of the three this month, investors will be on alert for the latest signals on withdrawal of policy accommodation after years of unprecedented stimulus. Any ‘dovish’ hints from officials could pull the benchmark U.S 10-year Treasury note yield back – it touched +2.66% on Friday, the highest print since July 2014.

Note: Current technical indicators signal weak support for the U.S 10s if the yield breaks even higher. However, if policy makers signal they’re hesitant to remove QE – if global rates are going to stay low, at least for this year – sovereign yield should pare back some of their recent gains.

Overnight, the yield on 10-year Treasuries decreased -1 bps to +2.65%, the biggest dip in more than a week. While in Germany, the 10-year Bund yield has advanced less than +1 bps to +0.57%.

4. Dollar’s undoing

The ‘mighty’ USD is only modestly softer despite the shutdown of the U.S government.

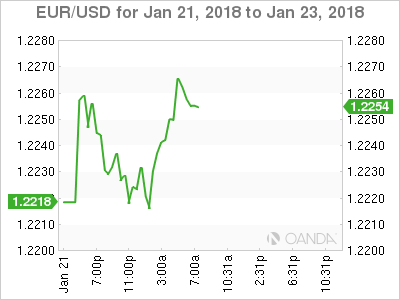

The EUR/USD (€1.2248) remains within striking distance from its three month high of €1.2323 despite the bullish news that Germany’s SDP are willing to enter coalition talks with Chancellor Markel. Market focus now shifts to the ECB rate announcement and in particular the following press conference with President Draghi.

Has USD/JPY (¥110.70) broken its historical correlation with U.S bond yields? Forex dealers have noted that U.S bond yields are not supporting the USD/JPY pair. The Bank of Japan (BoJ) meets later this evening with no change expected in policy, but the market will focus on its forward communication especially on the inflation front.

Note: Japan will release its Dec CPI data on Friday – will an overshoot in the core raise the possibility of the BoJ moving to a normalize policy?

Elsewhere, TRY has weakened outright after Turkey launched a ground operation against Syrian Kurdish militia. From a market perspective, although the operation seemed to be well advertised, the news flow is unnerving for some investors. USD/TRY trades up +0.1% at $3.8100.

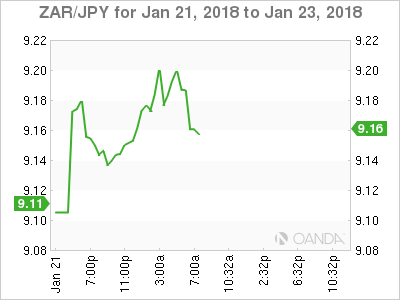

South Africa’s rand ($12.0438) has rallied to its strongest level in nearly three-years on speculation over how much longer President Zuma will remain in power.

5. Davos and World Economic Forum

Barring any last minute changes in Washington, President Donald Trump will join world leaders and senior executives in Davos, Switzerland, for the annual World Economic Forum, which will take place from this Tuesday to Friday.

Note: Trump is due to deliver a keynote address on the final day.

There is a possibility that the U.S President could use this platform to up the “protectionist ante.” Also, expect U.K PM Theresa May to try and “clear the air” with the President, who remains still furious with the way he has been treated by the British government and warned his deteriorating relationship with May is likely to kill any prospect of a swift post-Brexit bilateral trade deal.