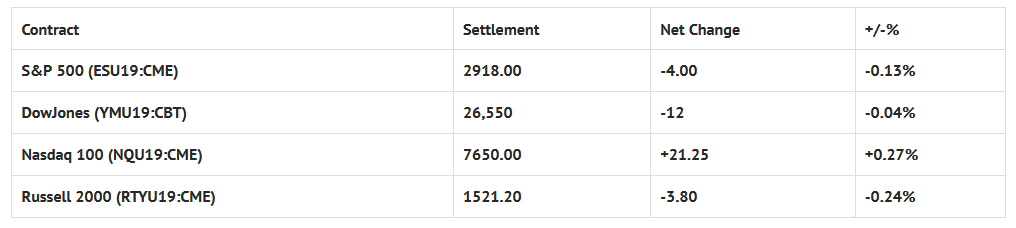

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +0.69%, Hang Seng +1.42%, Nikkei +1.19%

- In Europe 7 out of 13 markets are trading lower: CAC -0.26%, DAX +0.11%, FTSE -0.35%

- Fair Value: S&P +4.22, NASDAQ +27.46, Dow +2.09

- Total Volume: 1.23 million ESU & 80 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes GDP 8:30 AM ET, Jobless Claims 8:30 AM ET, Corporate Profits 8:30 AM ET, Pending Home Sales Index 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Kansas City Fed Manufacturing Index 11:00 AM ET, Farm Prices 3:00 PM ET, Fed Balance Sheet & Money Supply 4:30 PM ET.

S&P 500 Futures: New Lows On The Close

Chart courtesy of Scott Redler @RedDogT3 – $spx quick micro and bigger look as we try and figure out what’s next.

Strength during Tuesday nights Globex session bled through into Wednesday’s regular trading hours, but it couldn’t hold on. After the 8:30 CT bell, the S&P 500 futures rallied to test the Globex high at 2939.00, only making it as high as 2936.75, and then turned south for the rest of the day.

The first stop on the way down was at 2924.25, followed by a sideways range trade that lasted until 12:30, then another move lower to 2921.50. From there, the futures did a little back and fill up to 2925.25, before taking out the Globex low at 2917.50 by 2 ticks.

Going into the close, when the MiM reveal came out showing $400 million to buy, the ES continued to trade lower. The futures would then go on to make another new low, printing 2916.75 on the 3:00 cash close, and 2918.00 on the 3:15 futures close.