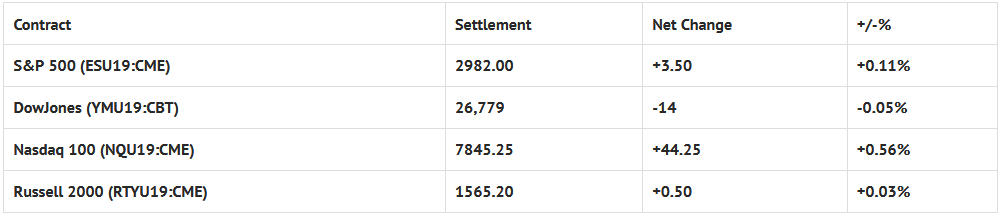

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp -0.44%, Hang Seng +0.31%, Nikkei -0.15%

- In Europe 7 out of 13 markets are trading lower: CAC +0.03%, DAX -0.43%, FTSE -0.07%

- Fair Value: S&P +3.68, NASDAQ +21.74, Dow -7.42

- Total Volume: 953k ESU & 409 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, Atlanta Fed Business Inflation Expectations 10:00 AM ET, Jerome Powell Speaks 10:00 AM ET, Wholesale Trade 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, James Bullard Speaks 1:30 PM ET, and the FOMC Minutes 2:00 PM ET.

S&P 500 Futures: Nasdaq Leads The Way

Chart courtesy of Scott Redler @RedDogT3 – As long as $spx holds 2952-2964 active market participants will stay in portfolio approach.

After trading down to 2963.50 during Monday nights Globex session, and opening Tuesday’s regular trading hours (RTH) at 2966.25, the S&P 500 futures immediately started to rally after the 8:30 CT bell.

By 10:30, the ESU had traded back up to the Globex high at 2979.50, then drifted sideways in a 5 handle range for the rest of the morning, and into the afternoon.

When the MiM reveal came out showing $608 million to buy MOC, the futures popped up to a new high at 2986.25, then eased back off a little, printing 2983.00 on the 3:00 cash close, and 2982.25 on the 3:15 futures close, up 4 handles on the day.