Wednesday June 29: Five things the markets are talking about

The Brexit “bad” seems to be temporarily put on hold as market participants question whether a new financial crisis is about to take a firm global grip.

Former Fed chair Ben Bernanke seems to think that is quite “unlikely at this point,” but believes that the biggest current risks to financial stability appear to be political, not economic – specifically other countries pressing for more autonomy from the 28-nation bloc (Scotland and Northern Ireland).

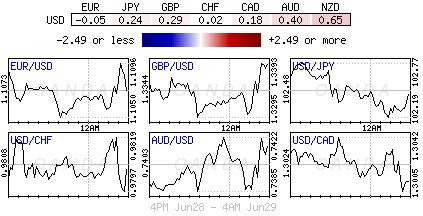

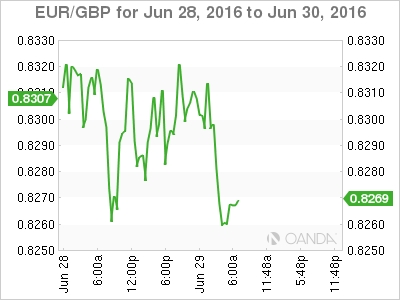

Capital markets again overnight showed signs of stabilizing following sharp declines to sterling (£1.3400) and global equities after the U.K. voted to leave the EU last Thursday. The optimist would have us believe that we may have seen the worst of it in the course of the last couple of days in terms of global assets, but we may not have seen the worst of it in terms of the U.K.

Nevertheless, risk aversion has subsided for the time being as signs of policymaker responses to Brexit fallout is supporting an improved sentiment.

1. Global indices dive takes a breather

Stocks in Asia and Europe are on the upswing, tracking the solid gains made yesterday in U.S indices, as post-Brexit concerns continue to subside.

The skeptics will be concerned about the duration of this rebound, especially with quarter-end window-dressing and short covering purchases being mentioned as the catalyst for this turnabout. Outside of the improved U.S consumer confidence and an uptick in Q1 GDP data prints yesterday, there is nothing in terms of positive fundamental stimuli behind the gains.

The current EU gathering in Brussels highlights the uncertainty over Brexit proceedings. Europe is standing tough and is positioning itself that there is “no turning back” for the U.K. and wants a quickie divorce. PM Cameron prefers to proceed more slowly, reiterating invoking Article 50 is the matter for the next U.K leader in September. U.K ‘s summer of discontent seems to be in full swing.

The Stoxx Europe 600 Index rose for a second day and U.S. equity index futures advanced. The MSCI AC Asia Pacific Index gained the most in a week and has now recovered about half of the loss seen on Friday.

Indices: Stoxx50 +2.3% at 2,817, FTSE +2.0% at 6,260, DAX +1.5% at 9,587, CAC 40 +2.0% at 4,171, IBEX 35+2.2% at 8,005, FTSE MIB +2.2% at 15,950, SMI+1.6% at 7,897, S&P 500 Futures +0.5%

2. Odds for a near-term rate cut by Fed has pulled back

When it comes to the U.S yield curve, its short-dated Treasury’s that seem to be bearing the brunt of profit taking from dealers and investors over the past two days. This is making the odds of a near-term rate cut by the Fed to drop.

Since the shock Brexit vote outcome, there is a raging debate in fixed income whether the Fed is about to reverse policy. Nevertheless, the collective action by central bankers of standing tall in this crisis is providing some investor confidence. Currently, fed-funds futures are pricing in a +4% probability of a rate cut by the Fed’s at next month’s meeting, down from +7% on Monday. The rate-cut odds by September have been cut in half, falling to +9% from +18%. For December, the odds are down to +8% from +16%.

For many, U.S policy makers are expected to stand pat in the coming months – the Fed’s policy outlook depends on whether U.S growth would withstand the impact from Brexit. The lack of fundamental data is not making dealers jobs any easier. In next weeks shortened trading week the markets focus will be on June non-farm payroll (NFP) data for guidance.

The yield on the 10-Year Treasury is +1.469% as we head stateside, a slight uptick from yesterday’s close of +1.463%.

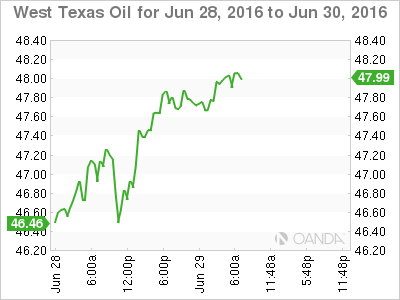

3. Crude prices been driven by Brexit

Since the Brexit vote oil prices have remained volatile. The surprise outcome is having a negative impact on energy producers. The crude bulls would have investors believe that the long-term prospects look bright if lower crude prices bring demand back on line. However for now, global demand remains questionable if there is a genuine threat of another global recession given the outcome of last week’s U.K/EU referendum.

West Texas Intermediate crude has climbed +1% to $48.35 a barrel, building on yesterday’s +3.3% rally, while U.K’s Brent is up +1% to $49.09. Providing some supports is yesterday’s U.S. API oil inventories falling by -3.86m barrels for the second consecutive week. This morning’s EIA inventory numbers will be released at 10:30 EDT. It’s expected to report a drawdown of -2.3m barrels vs. -0.9m.

4. BoJ hanging tough

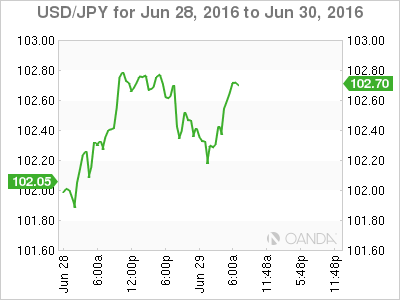

When it comes to central banks, the Bank of Japan (BoJ) remains the markets favored ‘outlier.’ Overnight, the Japanese government and the BoJ held another joint meeting to help reverse sentiment behind the recent rally in JPY (¥98.98 Friday).

PM Abe has called for Finance Minister Aso and BoJ’s Governor Kuroda to continue watching markets and to make sure that there is sufficient liquidity to support their economy. The rapid appreciation in yen after the Brexit vote (from ¥105.00 to ¥98.98) had many dealers concerned about direct forex intervention to stem the yen’s gain – JPY continues to be the markets go to risk aversion currency of choice.

Many dealers are looking for JPY to test ¥95.00 before they see the Bank of Japan (BoJ).

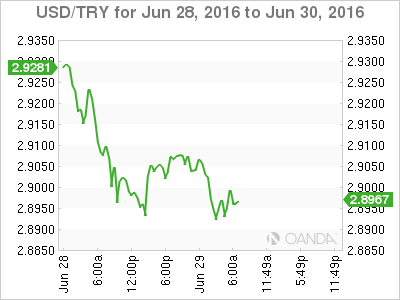

5. Turkish Lira remains resilient after terror attacks

The Turkish lira ($2.9000) seems to be maintaining a positive tone outright this morning despite yesterday’s terror attack at Istanbul main airport that left 41 people dead and 147 wounded. It is the fourth deadliest attack this year and again highlights the country’s security risk concerns.

These risks are likely to continue to weigh on the country’s tourism performance, which has already taken a massive dent this year. To analysts, one of the main reasons why Turkish assets are not underperforming much more has to do with the risk premium that is already been priced into such incidents actually occurring.