Wednesday July 6: Five things the markets are talking about

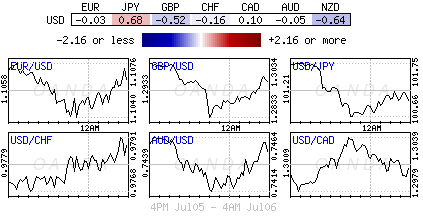

The theme thus far, in this holiday shortened trading week, has been all about risk aversion. Investors it seems prefer to proceed with caution, egged on by the Bank of England’s (BoE) negative indictment of the U.K economy after the historic Brexit vote. Risk assets have been taking a beating whether its stocks or currencies, while sovereign yields continue to seek new lows, reflecting a lack of confidence over the global economy.

After today’s FOMC minutes (02:00pm EDT) the market will quickly turn its attention to Friday’s non-farm payroll (NFP) report, where a bounce back is expected after May’s disappointing headline (+38k). The current consensus is for a return to a healthy payroll growth of +180k, and an unemployment rate to tick back up to +4.8%. If we get these numbers it will make it an interesting trading day to shut out the week, especially now that the various asset classes seem so tightly wound.

Expect today’s minutes to give more clues about how worried Fed official’s were/are about a persistent slowdown in the broader economy and about the so-called Brexit vote.

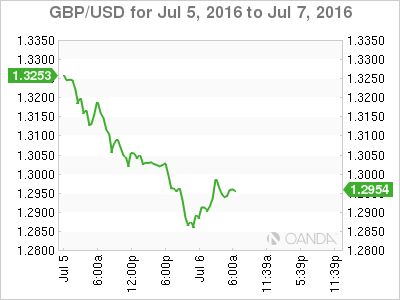

1. Cable crashes below £1.28 for new 31-year lows after BoE warning

The pound receives no respite, tumbling again overnight across the board as investors flee to the safety of bonds and gold.

Brexit fears are again “front and center” after the latest BoE financial stability report released yesterday emphasized that the risks from Brexit are beginning to materialize, with worries over deterioration in demand for UK assets becoming more acute.

The overnight plunge in particular has come after three U.K. real estate investment funds suspended redemptions, questioning the health of the housing market and the economy as a whole, and raising concern about investors pulling out of U.K. assets.

The pound has lost -15% since the historic June 23 vote and the next line of support for this battle-scarred currency now that the psychological £1.30 has been breached is £1.25 outright.

2. How low can government yields go?

Sovereign bond yields in the U.S and Europe remain in uncharted waters. Investor anxiety over a Brexit’s fallout and a persistent worry regarding Italy’s banking system is now adding to this week’s risk-off sentiment. U.S. 10-Year Treasuries have fallen -38bps in three-weeks to yield +1.33%. German Bunds trade in deeper negative territory (-0.21%); while U.K gilts yield have plummeted to +0.78%. As investors seek safety, the yield on Japan’s 20-Year government bond fell below zero for the first time ever in overnight trading.

The market is now trading atop levels where bond bulls may need to tread with extreme caution. Friday’s jobs report could be the outlier that may require investors and dealers to be quick footed. A strong report may hit the bond market via an excuse to take profits. It would also be a blow to fixed income odds on a near-term rate cut from the Fed.

The BoE’s Carney said last week that growth will slow in coming months and that further interest-rate cuts and other measures will be needed. Fixed income dealers now expect the BoJ to ease monetary policy further at this months meeting (July 27/28) and for the ECB to extend its bond-buying program later this year.

3. Global stocks are mostly lower

The downward spiral for stocks has extended into a third-day, the longest run of losses in more than two-weeks.

Global stocks were mostly lower in overnight trading as investors continued to question last week’s post-Brexit recovery in risky assets.

The Stoxx Europe 600 has fallen -0.2% in early trade, with concerns about Italian banks and U.K. property fund suspensions exacerbating uncertainty following the U.K. referendum on EU membership.

The U.K.’s FTSE 100 Index has advanced +0.1%, as commodity producers gained.

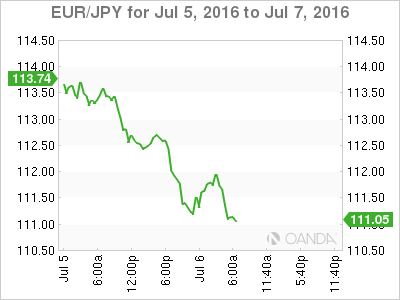

The yen (¥100.50), which tends to gain in times of market stress, continues to rally and is again encroaching on levels that the BoJ will be concerned about. The stronger yen is dragging down stocks in Japan.

Indices: Stoxx50 -1.5% at 2,770, FTSE -0.4% at 6,517, DAX -1.8% at 9,358, CAC 40 -1.5% at 4,100, IBEX 35 -1.8% at 7,923, FTSE MIB -1.8% at 15,499, SMI -1.0% at 7,861, S&P 500 Futures -0.6%

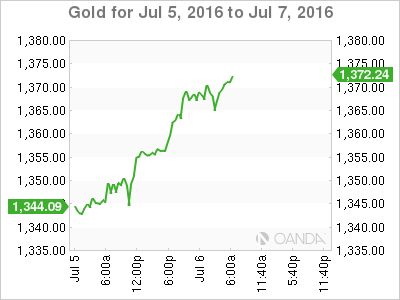

4. Gold climbs to a 2-year high

Investors fear is helping to push gold to new heights. The ‘yellow metal’ has climbed to a two-year high of $1,371 a ounce ahead of the open stateside.

With the market firmly focused on the wider European risk is expected to continue to support the strong appetite for gold. Open interest in the futures has risen to new multi-year highs.

Oil futures continue to struggle to rebound from Tuesday’s big losses as Brexit worries, combined with output reports by OPEC hitting a record high in June, continues to weigh on prices.

Brent crude is steady at $47.97 a barrel after losing -4.3% on Tuesday, while WTI is flat at $46.61, having slid -5% overnight.

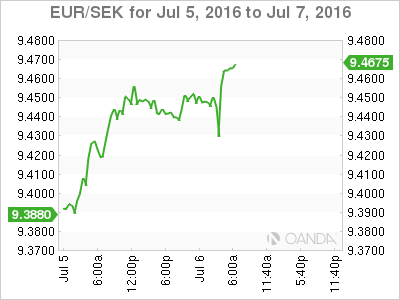

5. No surprises from Riksbank

Sweden’s central bank (Riksbank) indicated earlier this morning that the turbulence created by the U.K’s plan to quit the EU had knocked its “confidence in the economic outlook and it didn’t now expect to raise interest rates as soon as it had previously thought.”

Swedish policy makers have left their main interest rate at -0.5% (as expected) and now expect to increase borrowing costs in late H2, 2017, instead of the middle of next year. The statement indicated that a “highly expansionary monetary policy is needed to provide support to the Swedish economy and rising inflation.”

The SEK has strengthened a tad on the news (€9.42 vs. € 9.44).