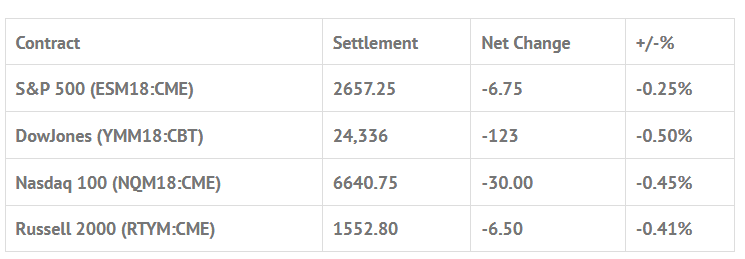

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp -1.53%, Hang Seng -1.60%, Nikkei +0.26%

- In Europe 9 out of 12 markets are trading lower: CAC -0.16%, DAX -0.11%, FTSE -0.51%

- Fair Value: S&P -0.11, NASDAQ +8.24, Dow -34.68

- Total Volume: 1.6mil ESM, and 691 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Retail Sales 8:30 AM ET, Empire State Mfg Survey 8:30 AM ET, Business Inventories 10:00 AM ET, Housing Market Index 10:00 AM ET, Raphael Bostic Speaks 1:15 PM ET, and Treasury International Capital at 4:00 PM ET.

S&P 500 Futures: #ES Sell The Bank Earnings

Friday, Asian markets closed mixed, and European markets were up across the board. After the banks beat expectations, the S&P 500 futures, which made a Globex low at 2652.00 before trading up to 2680.00, traded 2679.50 on the 8:30 CT futures open. Just after the bell, the ES up ticked to 2680.50 and then sold off down to 2661.25. Once the initial selloff was over, the futures bounced up to 2669.00, and then went on to make a new low at 2655.00. After some back and fill, the ES traded up to 2663.00, and then sold off down to new lows at 2651.00, -29.50 handles off the high.

After making the low just after 10:00 AM CT, the ES rallied up to 2665.75 through the Euro close, printing the midday high 60 minutes after the morning low, a +15.75 handle rally. From there, the futures went sideways to lower, trading down to 2657.50, before beginning to rally in the mid afternoon, up to a new high of 2668.00.

As the ES traded into the final two hours of the day, the futures began to break down, pushing down to 2660.50, then rallying up to 2666.00 before selling off down to 2644.75 at 2:20 PM CT. Going into the close, the ES rallied up to 2659.00 before going on to settle the day at 2657.25, down -6.75 handles, or -0.26%, with the MOC at $325 million to sell.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.