Here are the latest developments in global markets:

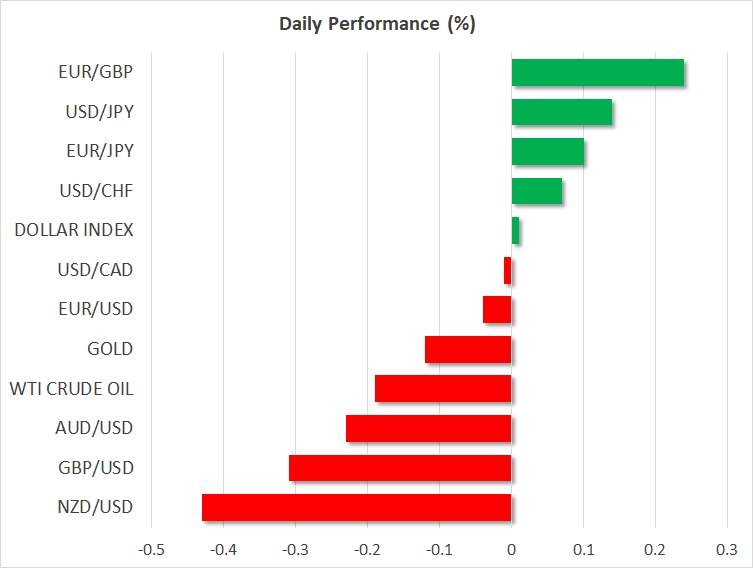

· FOREX: The US dollar index is practically unchanged on Friday, after it posted solid gains earlier on Thursday on the back of rising US Treasury yields. Sterling/dollar was 0.3% lower, with the British pound extending the losses it posted yesterday, after BoE Governor Mark Carney hinted that a rate hike in May is not actually a done-deal.

· STOCKS: US markets closed lower, pressured by a notable rise in longer-term US bond yields, something that usually curbs demand for stocks. The Nasdaq Composite led the way down on the back of concerns that the handset boom was taking a breather (Apple (NASDAQ:AAPL) was a notable decliner), falling by 0.78%, while the S&P 500 and the Dow Jones dropped by 0.57% and 0.34% respectively. The slide looks set to continue today, as futures tracking the Dow, S&P, and Nasdaq 100 are all currently pointing to a slightly lower open. Asian markets were lower on Friday as well, for the most part. In Hong Kong, the Hang Seng fell 0.68%, while Japan was mixed, with the Nikkei 225 falling by 0.13% but the Topix managing to close 0.05% higher. In Europe, futures tracking almost all the major indices were flashing green. The exceptions were the Euro STOXX 50, the German DAX and the Italian FTSE MIB.

· COMMODITIES: Oil prices are slightly lower on Friday, with both WTI and Brent down by 0.2%. That said, both benchmarks touched fresh highs last seen in 2014 yesterday, and despite the latest pullback, they remain elevated. Speculation that Saudi Arabia is aiming for prices closer to $100 was the key trigger for the recent surge, with surprising drawdowns in inventories enhancing the bullish sentiment. Today, the focus will turn to the Baker Hughes rig count, for a fresh indication on US production. In precious metals, gold is 0.1% lower, last seen near $1342 per ounce, extending losses from yesterday. The yellow metal’s underperformance is likely owed to the recovery in the greenback. Since gold is denominated in dollars, an appreciation in the currency makes the metal less attractive for investors using foreign currencies, weighing on its demand.

Major movers: Pound slammed as BoE’s Carney puts May hike into doubt; dollar climbs alongside US yields

It’s turning out to be a bad week for the British pound. While sterling/dollar touched fresh two-year highs earlier in the week, the pair has since collapsed following a flurry of disappointing UK economic data and some remarks from BoE Governor Carney yesterday that brought the prospect of a May rate hike into doubt.

The BoE chief noted that the precise timing of the next hike is not that important, and that what matters is the general path in rates. He also made reference to recent “mixed” data, Brexit uncertainties weighing on investment, and stagnant productivity. Overall, his tone was cautious, not resembling a central banker that is about to raise interest rates, thus disappointing sterling-bulls looking for signals that a hike is imminent. The implied probability for a May hike fell to 44% from 67% prior to Carney’s speech, according to UK OIS.

The US dollar climbed yesterday, boosted by a surge in longer-term US Treasury yields. The 10-year yield currently hovers near 2.91%, just below its February high of 2.95%. While the greenback initially remained unfazed by the surge in yields, it eventually caught up and enjoyed some demand, with the dollar index reaching a 10-day high. Meanwhile, US stocks underperformed. Rising bond yields are typically considered harmful for stocks, which become less attractive to hold in an environment where bonds begin to offer a higher and “safer” return.

The yen was on the back foot today, declining by 0.15% and 0.1% against the dollar and euro respectively. Overnight, data showed that Japanese inflation slowed in March, as expected, confirming once again that there is no pressure on the BoJ to begin considering a stimulus-exit.

Elsewhere, the antipodean currencies underperformed, with aussie/dollar and kiwi/dollar falling by 0.2% and 0.4% correspondingly, both extending the significant losses they posted yesterday as the dollar regained its footing.

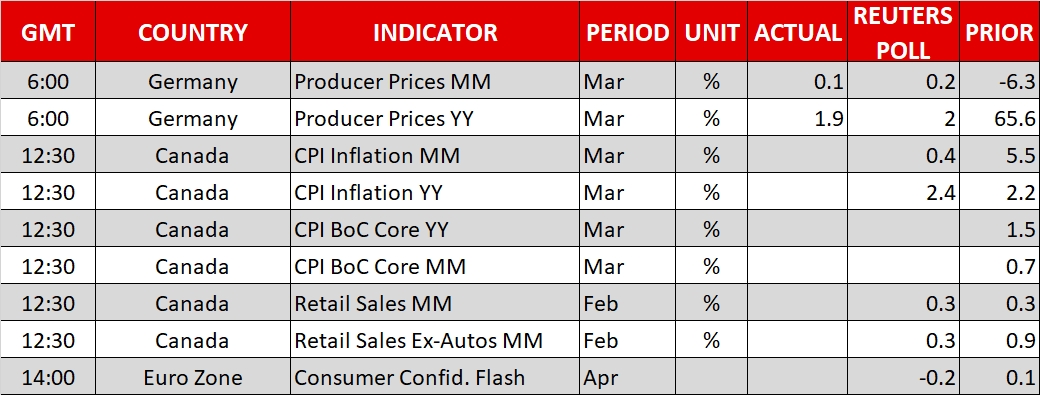

Day ahead: Canadian CPI and retail sales figures in focus; eurozone consumer confidence also due

In a relatively light day in terms of releases, most attention will be falling on Canadian inflation and retail sales figures, with data on eurozone consumer confidence also attracting some interest.

Canadian CPI figures for the month of March will be made public at 1230 GMT. Headline inflation is expected to accelerate to 2.4% y/y from February’s 2.2%. An upside surprise in likely to help the Canadian dollar, though maybe not as much as would have otherwise been the case. This is owed to the Bank of Canada downplaying the significance of rising inflation, attributing it to transitory factors, in its latest meeting earlier this week. Month-on-month, headline CPI is anticipated to rise by 0.4%, a slower pace compared to February’s 0.6%. Core CPI, as well as the measures of inflation utilized by the BoC in its policy-making, will also be watched by market participants.

Retail sales for February out of Canada will also be made public at 1230 GMT. Those are expected to grow at the same 0.3% rate as in January. Core retail sales, the measure that excludes automobiles, are projected to slow down to 0.3% from January’s 0.9%.

The European Commission’s Directorate General for Economic and Financial Affairs will release its flash estimate of eurozone consumer confidence for the month of April at 1400 GMT. Further deterioration in consumer morale is expected, with the measure expected to return to negative territory at -0.20, recording its lowest reading since October.

General Electric (NYSE:GE) and Honeywell International (NYSE:HON) are among companies releasing quarterly results on Friday; they will both be reporting before the US market open.

In energy markets, the US Baker Hughes oil rig count due out at 1700 GMT will be generating attention, especially in light of the recent surge in oil prices.

Regional Fed Presidents Charles Evans (non-voting FOMC member in 2018) and John Williams (voter) are among policymakers sharing remarks today. They will be speaking at 1340 GMT and 1515 GMT respectively. Meanwhile, the IMF and World Bank Spring Summit is underway, with finance ministers and central bank heads from around the world, including ECB and BoE chiefs Mario Draghi and Mark Carney attending the event.

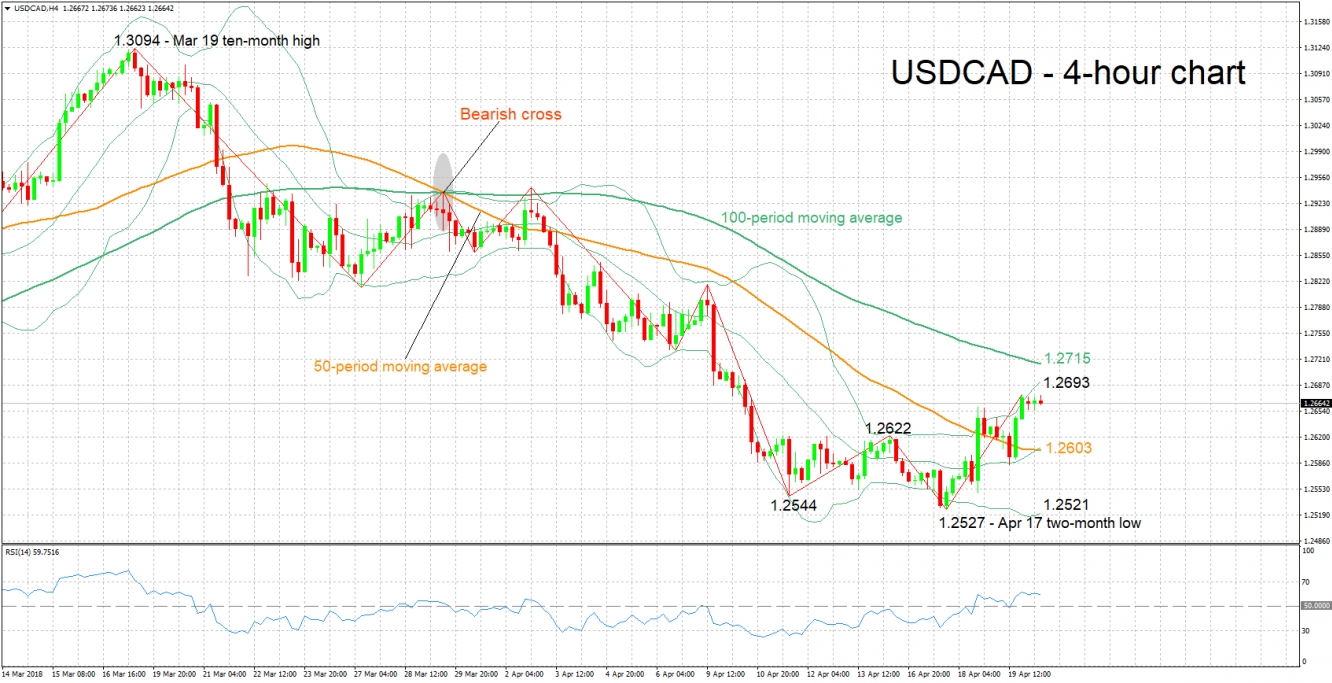

Technical Analysis: USD/CAD records 10-day high; bullish momentum may be fading

USDCAD posted a 10-day high of 1.2675 on Thursday, while it is trading only a few pips below the aforementioned peak at the moment. The RSI has been rising overall in recent days, though it is currently moving sideways. This could be an early sign of easing positive momentum and a more neutral picture in the near-term.

Upbeat Canadian data later in the day are likely to support the loonie, pushing USD/CAD lower. Support to declines could come around 1.2622 – a previous peak – and the current level of the 50-period moving average at 1.2603 (this is where the middle Bollinger line roughly lies as well).

Disappointing data on the other hand could push the pair higher. Resistance to advances might be met around the upper Bollinger band at 1.2693 and the 100-period MA at 1.2715.