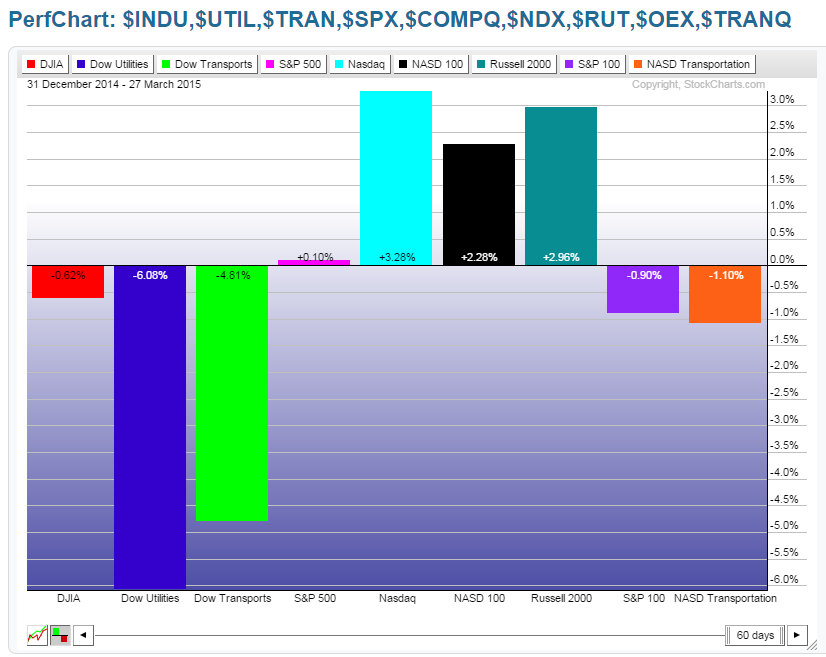

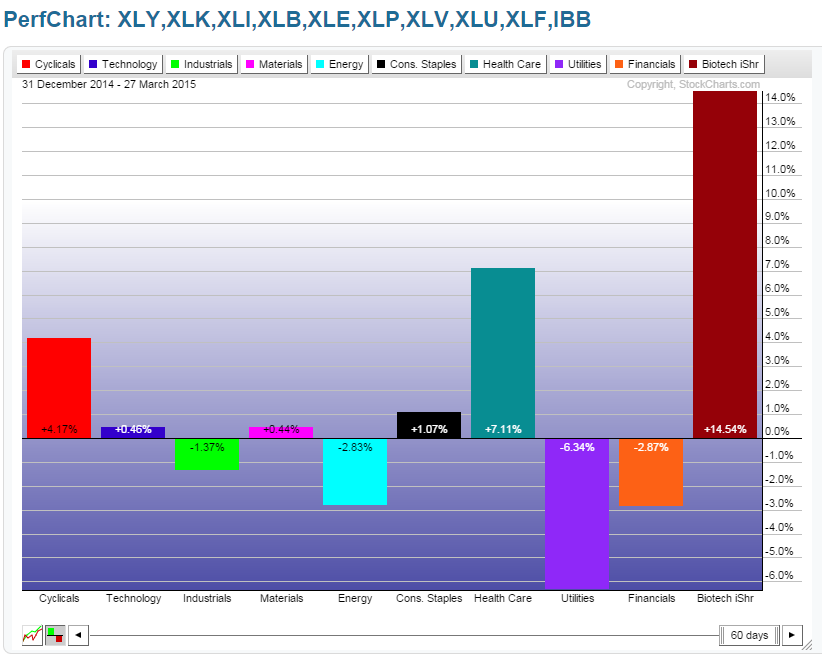

The following Year-to-Date Percentage Gained/Lost graphs are presented without individual comment to, simply, show where money has flowed in a variety of world markets since January of this year (until Friday's close).

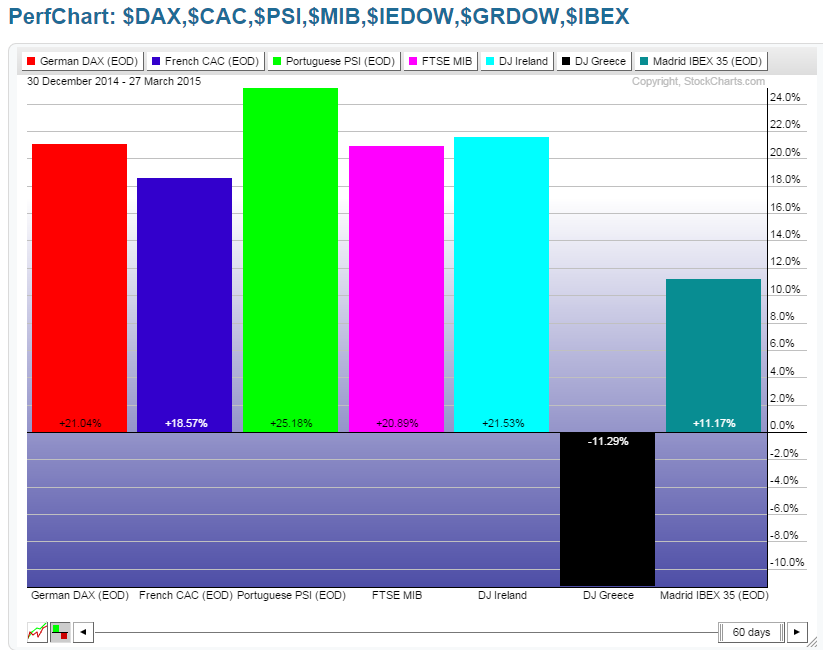

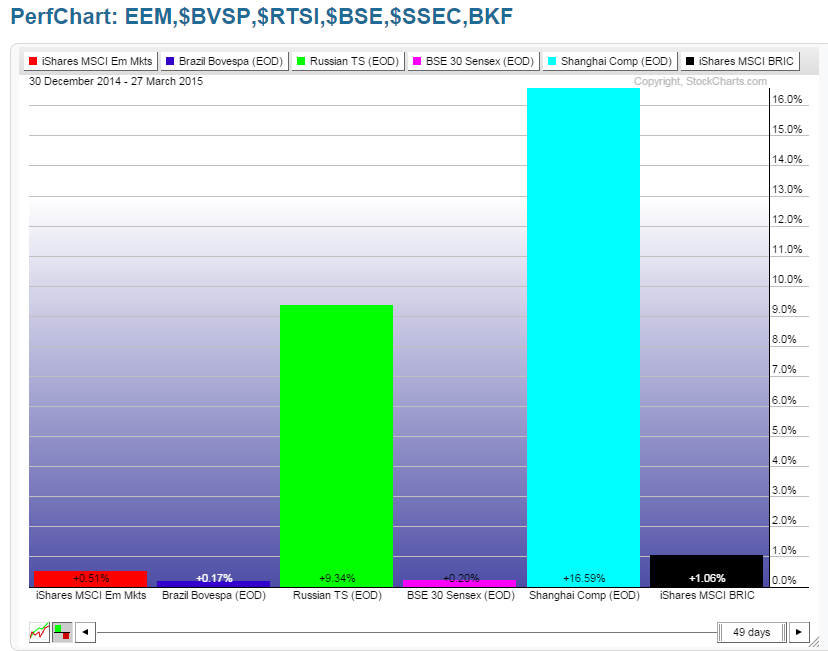

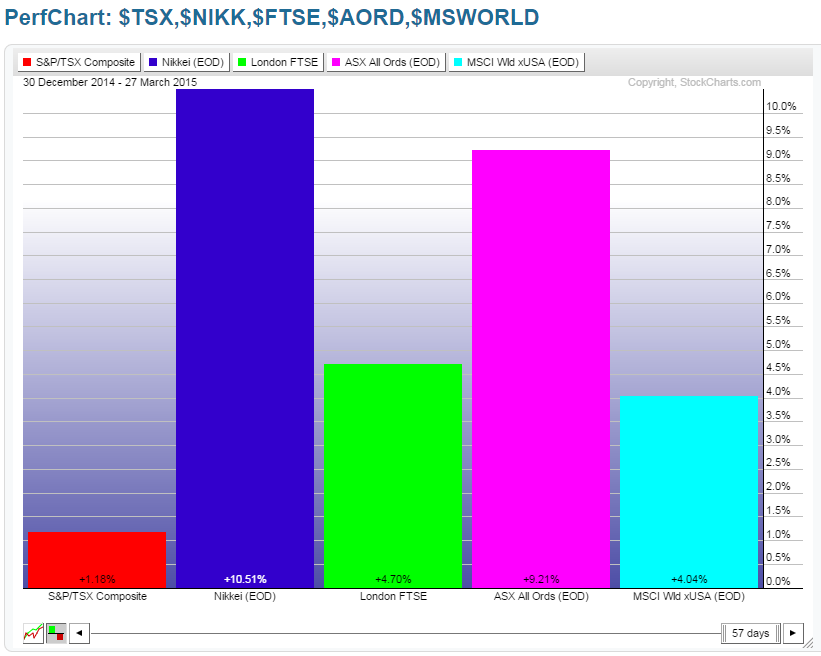

This year, the majority of the money has flowed into the NASDAQ, Biotech), Homebuilders, Healthcare, the U.S. Dollar, U.S. Bonds, Silver, Russia, China, Japn, Australia, Germany, France, Portugal, Italy, Ireland, and Spain. The Dow 30, S&P 100, and S&P 500 Indices have remained basically flat, while Dow Utilities, Dow Transports, and Nasdaq Transports are down on the year, and Small Caps have made some minor gains.

U.S. MAJOR INDICES

U.S. MAJOR SECTORS + Biotech

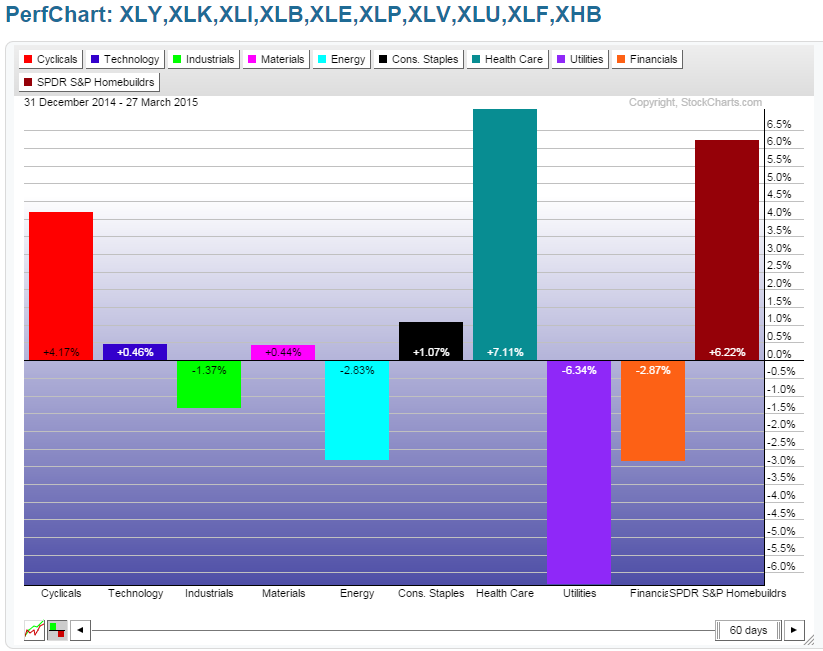

U.S. MAJOR SECTORS + Homebuilders

MAJOR EU COUNTRIES

EMERGING MARKETS + BRICs

CANADA, JAPAN, BRITAIN, AUSTRALIA + MAJOR WORLD MARKET INDEX

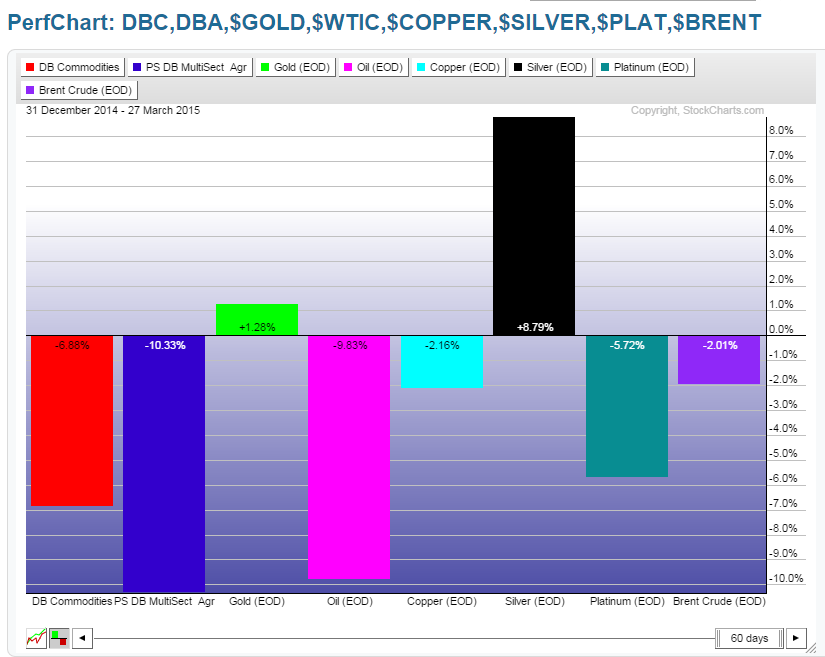

COMMODITIES

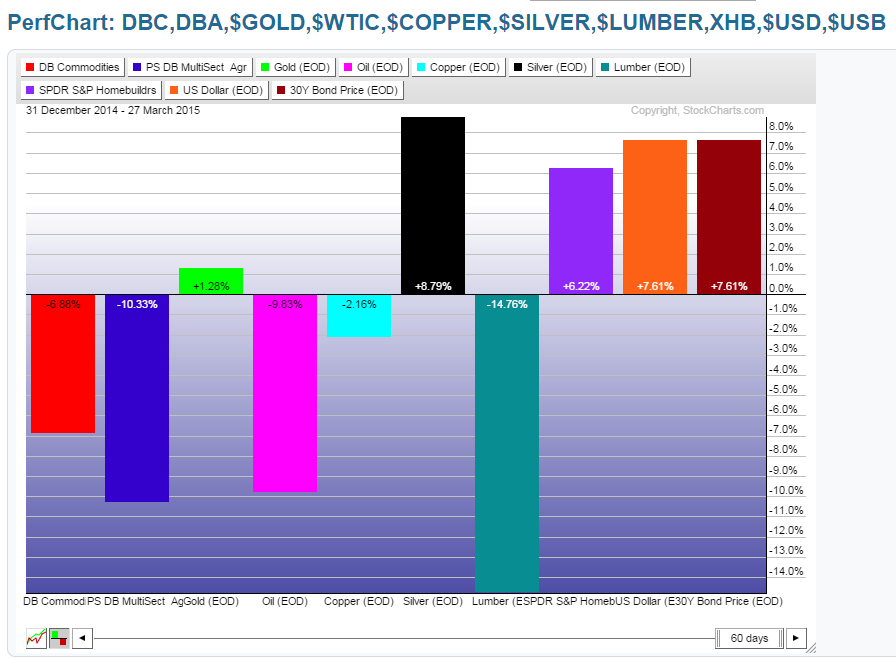

COMMODITIES + LUMBER + HOMEBUILDERS + USD + US BONDS

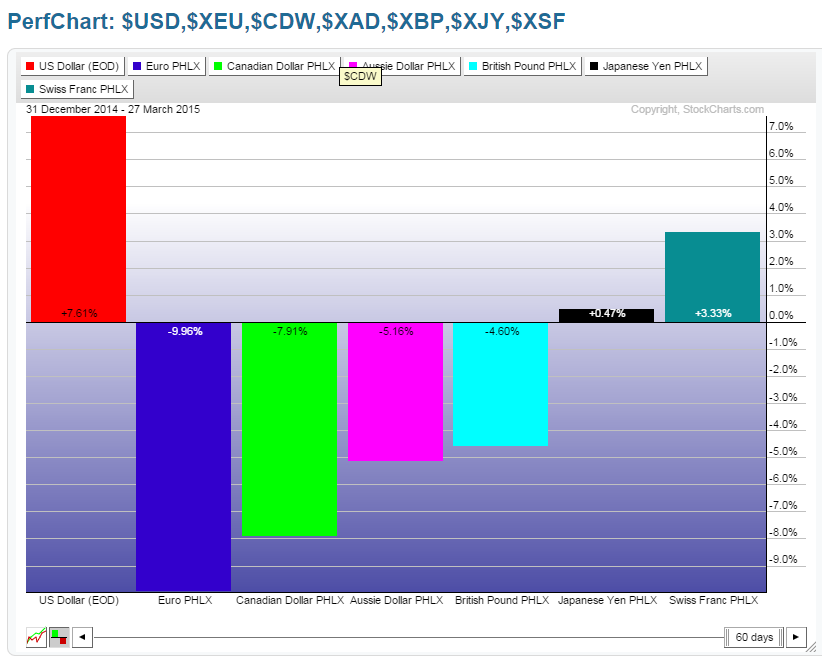

MAJOR CURRENCIES

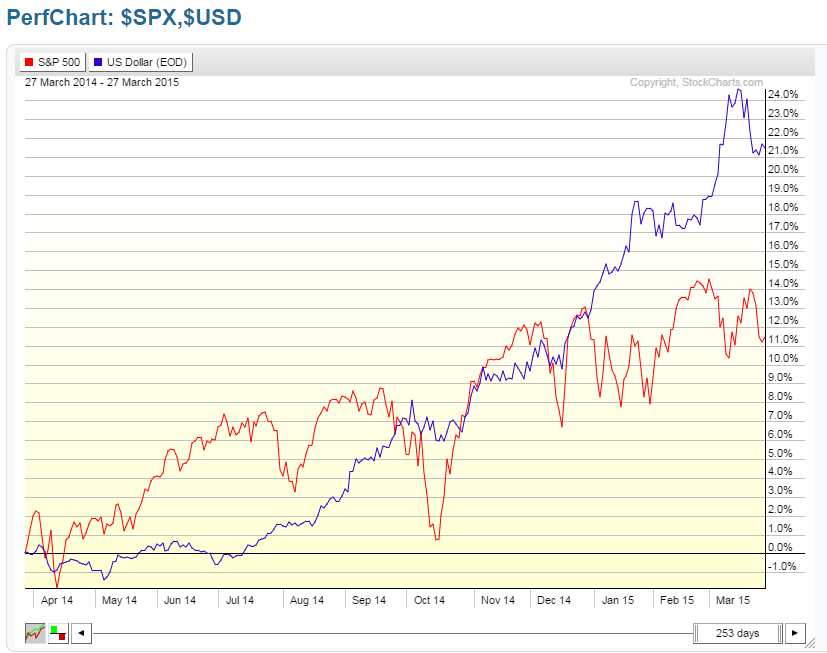

The following 1-Year percentage gained/lost chart shows the trend of the S&P 500 Index compared to the U.S. Dollar. They were, generally, in an uptrend until January of this year, whereupon the USD continued its gains, while the SPX consolidated in a large sideways range. From the beginning of March, the spread between them accelerated to the greatest extent seen over this one-year period, and they have been making some large volatile moves since then.

Whether this points to a capitulation and shift of money flow from the USD and into SPX (or whether we see a major correction in the SPX, with money flowing back into the USD) remains to be seen...it may be worth tracking the spread between these two to gauge such a shift in sentiment.

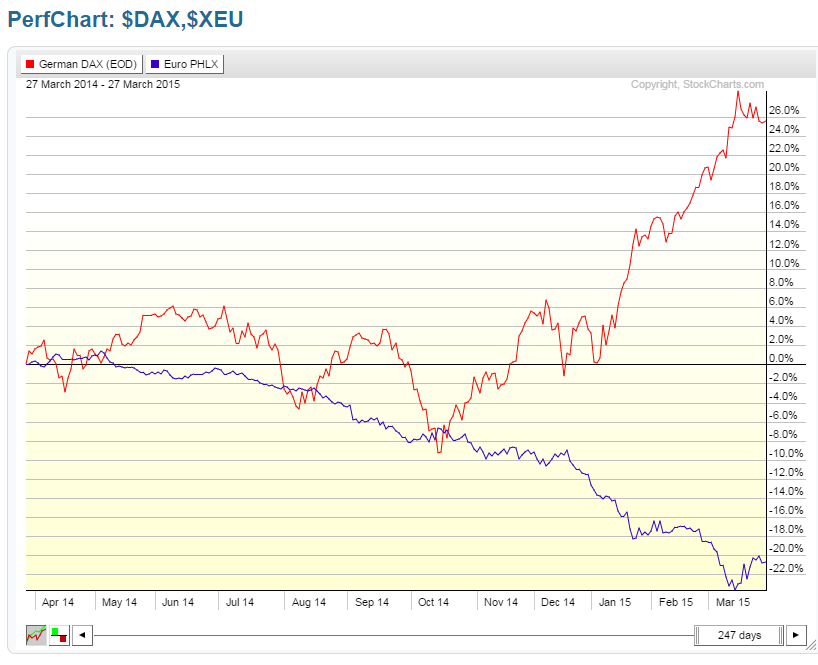

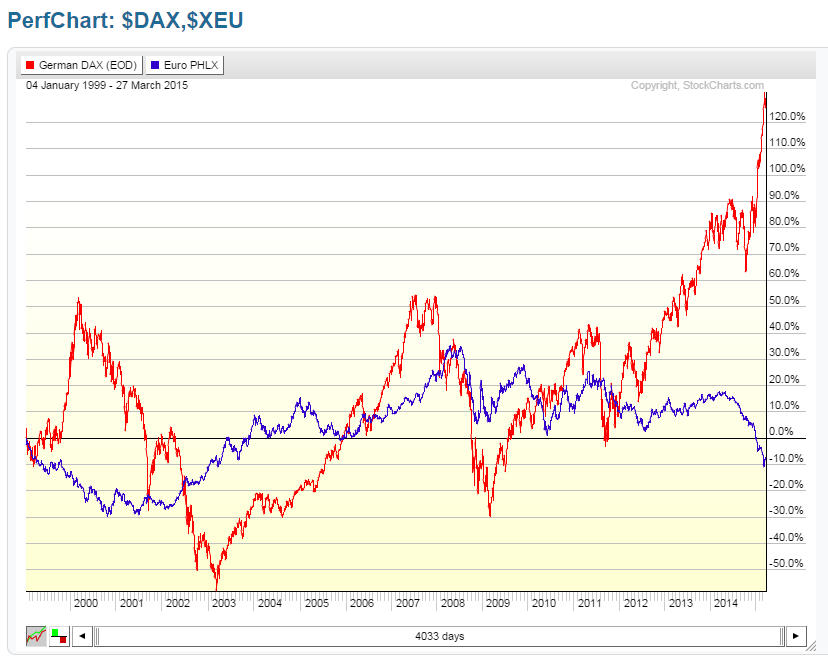

Furthermore, inasmuch as Europe has made such extensive gains so far this year (compared with U.S. markets), we'll see whether this pace continues, or whether some money is taken off the table soon. You can see on the following 1-Year percentage gained/lost chart that the spread between the German DAX and the Euro has reached an extreme level...in fact, the next chart, which begins in January 1999, shows this anomaly to be highly exaggerated and unprecedented.

The German DAX may, in fact, be well overdue for a major correction...another spread to watch closely over the near term.