Market Brief

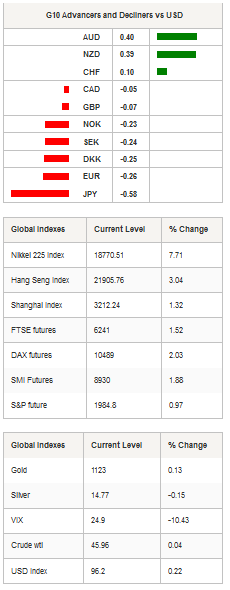

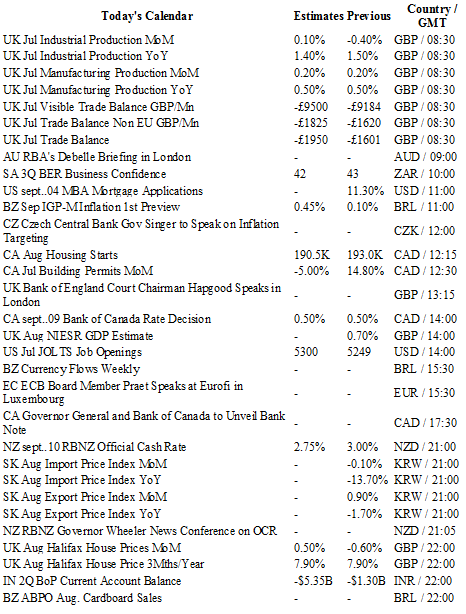

The US dollar erases previous losses against most G10 currencies, while commodity currencies bounce back as investors seek riskier assets. The Japanese Nikkei is the biggest winner in Asia this morning as the index is up 7.71% in Tokyo, while the broader Topix index gains 6.40%, erasing most of last week’s losses in just one trading session. In China, mainland shares are also buoyed with the Shanghai Composite gaining 1.32% and the Shenzhen Composite jumping 2.08% as investors bet on further policy stimulus from Asian central bankers. The Hang Seng index is not left out, as Hong Kong shares rise 3.72%, while in South Korea the Kospi index reaches a 1-week peak, up 2.96% to 1,934.20 points as August unemployment rates printed well below expectations at 3.6% versus 3.8% median forecast. Australian stocks are no exception. The S&P/ASX is up 2.07% in Sydney, while the Aussie is back above 0.70 against the greenback, despite Westpac consumer confidence falling 5.6% in September after a July increase. AUD/USD is up for a third day straight, rising 2.20% to $0.7050, as iron ore futures (for January 2016) soared, gaining almost 6% over the same period. On the upside, the next key resistance stands at 0.7206 (high from August 28th), while on the downside, the September 4th low of 0.6908 will act as support.The kiwi is the other big winner this morning with gains against all G10 currencies. The New Zealand dollar is up 1.11% against the JPY, 0.98% vs. the EUR, 0.97% vs. the DKK, 0.82% vs. the Swiss franc, 0.74% vs. the GBP and 0.60% against the greenback. In the equities market, New Zealand shares closed up 1.09% to 5,671.42. The RBNZ is expected to cut its official cash rate by 25bps to 2.75% at tonight’s meeting. In Europe, equity futures follow the Asian lead and are up 2% on average. The Euro Stoxx 50 is up 2.22%, the DAX 2.03%, CAC 40 2.11% and the SMI 1.88%. EUR/USD has proven unable to consolidate previous gains and is back below the 1.12 threshold. On the downside, the September 3rd low of 1.1087 will act as a second-class support, while a stronger one can be found at 1.0809 (low from July 20th). On the upside, the euro has some room to maneuver, as the strongest resistance lies at 1.1514 (fib 50% from December 2014 - March 2015 debasement). It will be a busy day for the cable as a fresh batch of economic data is due in the UK today. July’s industrial production is expected to rebound from a 0.4%m/m contraction in June to a 0.1%m/m expansion. Manufacturing production is expected to remain stable at 0.2%m/m. GBP/USD bounced back to 1.5379 from 1.5165 (last week low) and is now taking a breather, slightly below the resistance standing at 1.5415 (Fibo 38.2% on August September debasement). We remain bullish on the cable as we see an overcorrection of the GBP against the USD. We expect the cable to return to between 1.56 and 1.58 over the coming weeks. Besides UK data, traders will be watching MBA mortgage application and JOLTS job opening from the US; housing starts and building permits from Canada; RBNZ interest rate decision in New Zealand.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1332

CURRENT: 1.1174

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5626

R 1: 1.5443

CURRENT: 1.5383

S 1: 1.5089

S 2: 1.4960

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.60

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9779

S 1: 0.9513

S 2: 0.9259