After all three major indexes made new record highs last week, Monday’s trade started out the week on a shaky note. After several analysts cut their price targets on GE, the stock had its biggest one-day percentage decline since 2011, down 6.3%.

The ES did what it was supposed to do, it gapped higher and then sold off. What it didn’t do was bounce. The main clue to the ES weakness was how the it did not rally when the NQ did early in the day. The other clue to the day was how the ES could not rally and hold above the vwap. Once the ES started selling off, it just just could not regain its momentum.

The ES rallied up to 2577.00 on Globex at 7:36am Monday morning, traded 2576.25 on the 8:30 open, and then rallied 3 ticks up to the Globex high at 2577.00 before selling off down to 2573.00 at 8:47 am. There was one attempt at trading above the vwap, up to 2575.75, and then made several new lows, all the way down to 2567.25 around 1:30 CT, completing a MrToPStep 10 handle rule. After a small uptick the ES traded down to 2564.00 at 2:30.

It was one sell program after another. The next sell program pushed the ES down to 2562.00 as the MiM went to over $600 million for sale. At 2:45 the NYSE imbalance came out sell $700 million, and initially the ES rallied up to 2565.50, then sold off and retested the 2562.00 low going into the close.

VIX 11.08

It was a rough day for the futures markets and the VIX didn’t help. We were right about selling the gap up, but after weeks and weeks of buying the ‘dip’, the ES just kept going down. Unless you got out fast, buying weakness just didn’t work.

Amid Weak Inflation Central Bankers Show No Signs Of Cutting Off QE

The world’s largest central bankers meet for conference in Washington on Sunday for the 32nd Annual Group of 30 International Banking Seminar. The line up of government bankers was quite impressive, and included ECB Vice President Vítor Constâncio, People’s Bank of China Gov. Zhou Xiaochuan, Singapore Deputy Prime Minister, Group of 30 Chairman Tharman Shanmugaratnam, JPMorgan Chase (NYSE:JPM) International Chairman Jacob Frenkel, Bank of Japan Gov. Haruhiko Kuroda and Federal Reserve Chairwoman Janet Yellen.

The message they came out with was that weak inflation in advanced economies could help continue the post-crisis era of easy money policies, quantitative easing. What they said to a group of 30 bankers was despite improvements in global economies consumer prices and wages continue to be low they are wary of removing their stimulus measures too quickly. The news is in direct contrast to the upbeat tone during last weeks meetings of the International Monetary Fund and World Bank, and suggest there is still more work to do to get the global economy on track after the 2007 credit crisis.

While some countries are further along than others, some are scaling back, some are not in a hurry to scale back their efforts to boost growth. While the US Fed under Janet Yellen has already started to push short term rates higher, Japan is nowhere near being able to do that, and the European Central banks are at a point where they are still printing money, and all three central banks said weak inflation readings could keep them from moving too rapidly. Even Fed chairwoman Yellen said that she expects the US to continue to push rates higher, she cautioned about ‘how weak inflation might affect that path’.

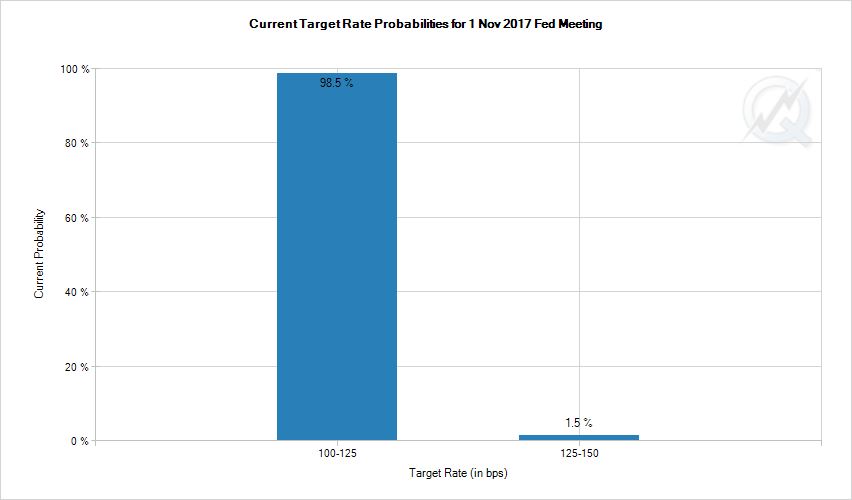

Without saying when, Yellen said gradual increases in the Fed’s benchmark federal-funds rate “are likely to be appropriate over the next few years to sustain the economic expansion”. According to the CME Groups fed’s futures contract there (http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html) is 98.5% probability of a rate hike during the November meeting and a 96.7% probability of a December rate hike.

I do not pretend to be a central banker but what I do know is quantitative easing, or historically low interest rates, have been a main driver of the global stock markets, and I do not think the era of ‘easy money’ is over or even close to it, nor do I think the stock market rally is over. Pause? Pull back? Sure. Big drop? No!

While You Were Sleeping

Overnight, equity markets in Asia traded mostly higher, with the Nikkei leading the way, closing up +0.50%. Meanwhile, in Europe, stocks are trading mostly lower this morning, with the OMXS30 currently down -0.62%.

In the U.S., the S&P 500 futures opened last night’s globex session at 2562.50, and printed the low at 2562.25 in the first few minutes of trading. From there, it was a slow grind higher for the rest of the night. As of 7:10am CT, the last print in the ES is 2568.00, up +4.50 handles, with 146k contracts traded.

In Asia, 8 out of 11 markets closed higher (Shanghai +0.22%), and in Europe 8 out of 12 markets are trading lower this morning (FTSE +0.07%).

Today’s economic calendar includes Redbook (8:55 a.m. ET), PMI Composite Flash (9:45 a.m. ET), Richmond Fed Manufacturing Index (10:00 a.m. ET); Earnings — Stanley Black & Decker (NYSE:SWK) (6:00 a.m. ET), Centene (6:00 a.m. ET), Polaris Industries (6:00 a.m. ET), Infosys (6:15 a.m. ET), Eli Lilly (6:25 a.m. ET), Fifth Third Bancorp (NASDAQ:FITB) (6:30 a.m. ET), PulteGroup (NYSE:PHM) (6:30 a.m. ET), Biogen (NASDAQ:BIIB) (6:30 a.m. ET), United Technologies (NYSE:UTX) (6:55 a.m. ET), Sherwin-Williams (7:00 a.m. ET), Corning (7:00 a.m. ET), Hubbell (7:00 a.m. ET), Lockheed Martin Corporation (NYSE:LMT) (7:25-7:30 a.m. ET), TD Ameritrade (7:30 a.m. ET), General Motors (NYSE:GM) (7:30 a.m. ET), Caterpillar (NYSE:CAT) (7:30 a.m. ET), 3M Co. (7:30 a.m. ET), JetBlue (7:30 a.m. ET), McDonald’s (7:58 a.m. ET), Texas Instruments (NASDAQ:TXN) (4:01 p.m. ET), Akamai (4:01 p.m. ET), Canadian National Railway (4:01 a.m.), AT&T (NYSE:T) (4:01 p.m.), Capital One (4:05 p.m. ET), Illumina (NASDAQ:ILMN) (4:05 p.m.), Chipotle Mexican Grill (NYSE:CMG) (4:10 p.m. ET), Express Scripts (4:10 p.m. ET), Edwards Lifesciences (NYSE:EW) (4:15 p.m. ET), Ameriprise Financial (NYSE:AMP) (4:15 p.m. ET), Advanced Micro Devices (NASDAQ:AMD) (4:15 p.m. ET).

Our View

The S&P sold off yesterday as heavy weight General Electric (NYSE:GE) got crushed. The S&P has been up for 6 straight weeks, and with so many companies in the S&P reporting this week there could be some two-way flow. Yesterday everyone, including me, was trying to buy the dip, but the sellers took over. The question is, was it a one day decline like all the others recently, or is there more selling to come? My guess is the S&P bounces, but will it hold? I don’t know, but I do know everyone got shook out buying yesterday, and the best guess is they will get shaken out selling today. Our view remains unchanged, you can sell the early rallies and buy the pullbacks, or just wait and buy the pullbacks.