By Marcus E. Howard

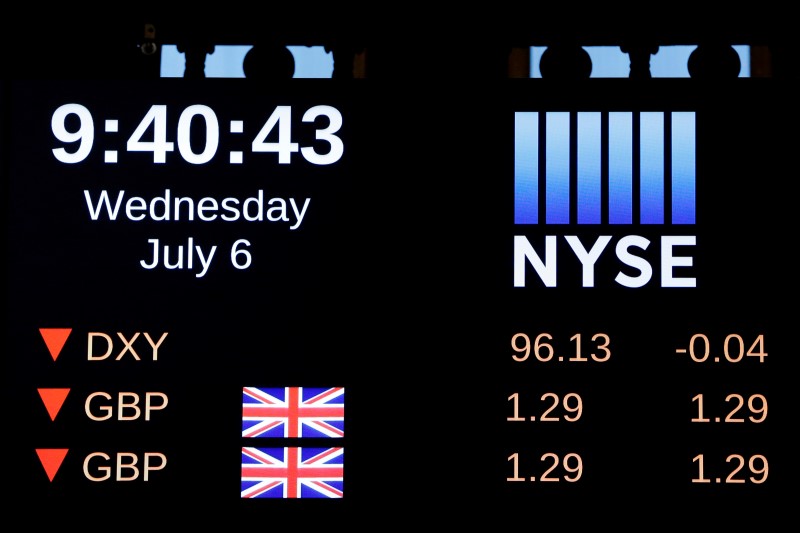

(Reuters) - Wall Street stocks rose Wednesday afternoon as officials sought to reassure investors of limited impact from Britain's decision to leave the European Union and as healthcare shares gained.

German Chancellor Angela Merkel said Britain's June 23 vote would have limited impact on the country's economy, while Federal Reserve Governor Daniel Tarullo said world financial markets are well prepared for it.

Minutes from the U.S. central bank's June policy meeting showed policymakers decided in June that interest rate hikes should stay on hold until they have a handle on the consequences of the "Brexit" vote.

A recovery in oil prices and strong U.S. services data also helped alleviate some concerns about a potential global economic slowdown. The S&P energy index (SPNY) was up 0.1 percent.

U.S. services industry activity hit a seven-month high in June as new orders surged and companies hired more workers, suggesting the economy regained speed in the second quarter.

"In the morning sector there was certainly a lot of stress due to Europe and you saw that flight to safety very apparent in record low yields," said Ryan Larson, head of U.S. equity trading at RBC Global Asset Management in Chicago.

"So Europe closes out the lows and we've been able to build off that here in the U.S., simply off of short-covering and some rebounds in the commodities, WTI specifically."

Stocks have been volatile following the June 23 Brexit decision, while investors have driven up safe-haven assets such as gold

Most of the major S&P indexes were higher, led by a 0.9 percent rise in healthcare (SPXHC). Celgene's (O:CELG) 4 percent rise to $104.33 was its biggest boost.

At 2:26 p.m. (1826 GMT), the Dow Jones industrial average (DJI) was up 31.67 points, or 0.18 percent, to 17,872.29, the S&P 500 (SPX) had gained 4.89 points, or 0.23 percent, to 2,093.44 and the Nasdaq Composite (IXIC) had added 21.66 points, or 0.45 percent, to 4,844.56.

Larson said he expected the U.S. central bank to take a gradual approach, noting the uncertainties related to Brexit. The Fed's next two-day policy meeting is July 26-27.

"It's very more likely the Fed will cut rates before they raise rates according to how futures are pricing this," said Larson.

Facebook (O:FB) rose 1.6 percent to $115.83 and provided the biggest boost to the Nasdaq and the S&P 500.

Among the day's decliners, Walgreens Boots Alliance (O:WBA) fell 2.5 percent following results and comments from its CEO that it is bracing for a long period of volatility following the Brexit vote.

Advancing issues outnumbered declining ones on the NYSE by 1,761 to 1,219, for a 1.44-to-1 ratio on the upside; on the Nasdaq, 1,633 issues rose and 1,166 fell for a 1.40-to-1 ratio favoring advancers.

The S&P 500 posted 54 new 52-week highs and three new lows; the Nasdaq recorded 58 new highs and 47 new lows.