By Yasin Ebrahim

Investing.com – Wall Street closed modestly higher Thursday as gains in big tech offset losses in energy and financials amid weaker-than-expected data that exacerbated concerns about the strength of the economic recovery.

The Dow Jones Industrial Average rose 0.17%, or 46 points. The S&P 500 rose 0.32%, while the Nasdaq Composite added 1.06% to close at a record high.

U.S. weekly jobless claims unexpectedly increased to 1.106 million last week, from 923,000 the prior week, and above forecasts for 925,000. The rise in claims comes after $600-a-week government stimulus checks lapsed as lawmakers failed to agree on another wave of fiscal stimulus.

"It seemed that the expiration of the $600 enhanced benefit provided by the CARES Act had coincided with a fundamental improvement in the labor market and economy, especially in the states that had suffered from a surge in COVID cases earlier in the summer," Jefferies (NYSE:JEF) said.

Other areas of the economy also showed signs of slowing as the Philadelphia Fed reported that its manufacturing index fell to a reading of 17.2 this month from 24.1 the prior month.

The duo of sluggish reports added to the worries about the economy just a day after the Federal Reserve's minutes showed policymakers were uncertain about the strength of the recovery amid the ongoing impact from the coronavirus pandemic.

Against the backdrop of wobbles in the recovery, value stocks – those that tend to outperform during periods of economic strength – faltered, with energy and financials leading to the downside.

Energy fell more than 1%, paced by a decline in oil prices as oversupply concerns persist a day after OPEC and its allies suggested that the pace of recovery in oil demand had been slower than expected.

But big tech continued to rack up gains to keep losses in the broader market in check.

Amazon (NASDAQ:AMZN) rose 1%, Alphabet (NASDAQ:GOOGL), Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), and Microsoft (NASDAQ:MSFT), all of which collectively make up about 20% of the S&P 500, rose more than 2%.

Nvidia (NASDAQ:NVDA), meanwhile, cut its losses to close flat after reporting better-than-expected quarterly earnings and guidance.

"The company (NVDA) provided a solid FQ3 outlook with revenue expectations of $4.4B, well above our prior $4.14B outlook," Wedbush said as it upgraded its price target to $525 from $500.

Elsewhere, Estee Lauder (NYSE:EL) fell nearly 7% after swinging to a loss in the fiscal fourth quarter as sales slumped by nearly a third, pressured by lower demand for makeup during the lockdown.

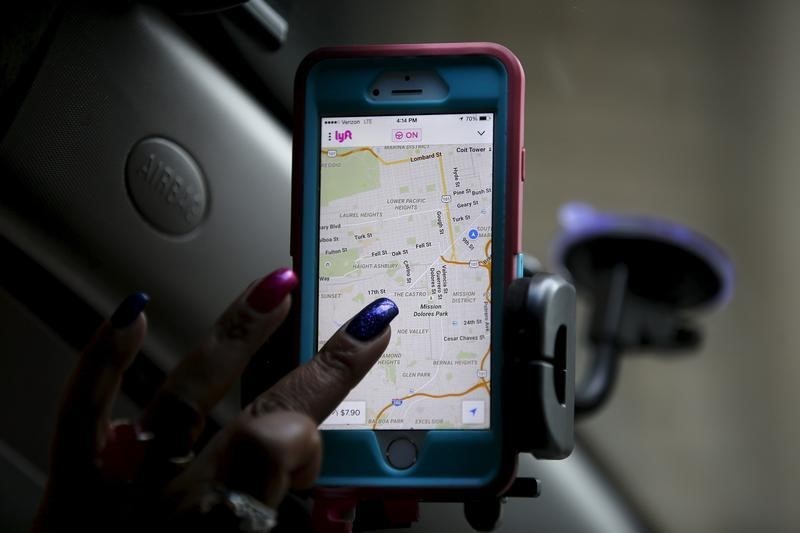

In other news, LYFT (NASDAQ:LYFT) and Uber Technologies (NYSE:UBER) pared losses to trade sharply higher after saying they would not stop operations in California after getting a judicial reprieve.