Market Brief

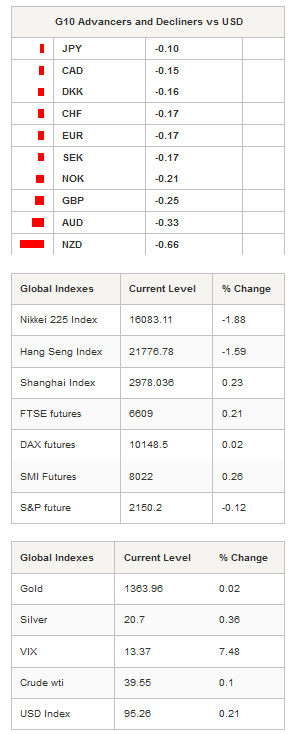

Asian stock markets were about to close in negative territory for a second straight day as investors wondered whether the rally is running out of steam. In Japan, the Nikkei was off 1.88%, while the broader Topix index slid 2.17% as the yen consolidated gains.

After rallying strongly over the last two weeks, the Japanese yen consolidated gains against the greenback as USD/JPY traded sideways around 101 in overnight trading. The currency pair will likely stabilize around the 100 level. On the upside, the closest resistance lies at 107.49 (high from July 21st).

The US dollar was the best performing currency on Wednesday as it reversed yesterday's sharp losses. The single currency fell 0.18% against the greenback after testing the 1.1231 resistance level (Fibonacci 61.8% on June debasement), the pair eased to 1.12 in Tokyo and will likely continue to trade with a negative bias. The closest support can be found at 1.1170 (Fibonacci 50%).

GBP/USD has moved towards the top of its monthly range. Buying interest will remain modest ahead of the BoE meeting on Thursday. The risk is on the upside for GBP/USD as the market is expecting the BoE to ease further its monetary policy.

Even though the market has fully priced in a rate cut, we still believe the central bank will stick with its cautious approach with regards to a potential increase in monetary stimulus as the available data did not suggest a substantial deterioration of the UK economy since the July meeting. Therefore, they will likely try to buy time by being very dovish, but a rate cut is not a done deal in our opinion.

The Kiwi had a rough session in overnight trading as energy prices fell further. AUD/USD slid 0.30% in Sydney, down to 0.7585, while the Kiwi fell 0.70% against the US dollar down to 0.7190.

Crude oil prices struggled to keep their head above the water, with the West Texas Intermediate up 0.10% after falling more than 2% to $39.55 a barrel on Tuesday, while the international gauge, Brent crude, edged down 0.05% to $41.78. Both of them are currently testing their 200dma and will likely break to the downside as supply glut looms.

In the equity market, European futures did not follow the negative lead from Asia. The FTSE 100 is up 0.21%, the DAX +0.02%, the SMI +0.26%, while the CAC rose 0.15%. In the US, futures on the S&P 500 are down 0.12%, while the ones on the Nasdaq edged down 0.06%.

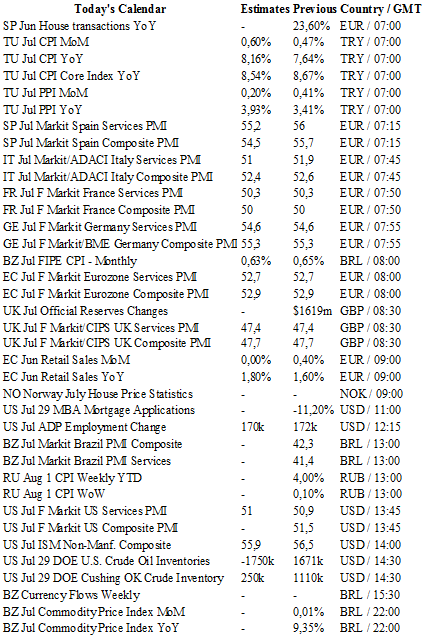

Today traders will be watching ADP employment change, MBA mortgage application and crude oil inventories from the US; Markit PMIs from Brazil, the UK, the euro zone, France, Germany, Spain, Italy and the US.

Currency Technicals

EUR/USD

R 2: 1.1428

R 1: 1.1234

CURRENT: 1.1206

S 1: 1.0913

S 2: 1.0822

GBP/USD

R 2: 1.3981

R 1: 1.3534

CURRENT: 1.3303

S 1: 1.2851

S 2: 1.2798

USD/JPY

R 2: 109.14

R 1: 107.90

CURRENT: 101.18

S 1: 100.00

S 2: 99.02

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9664

S 1: 0.9522

S 2: 0.9444