Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Here are the latest developments in global markets:

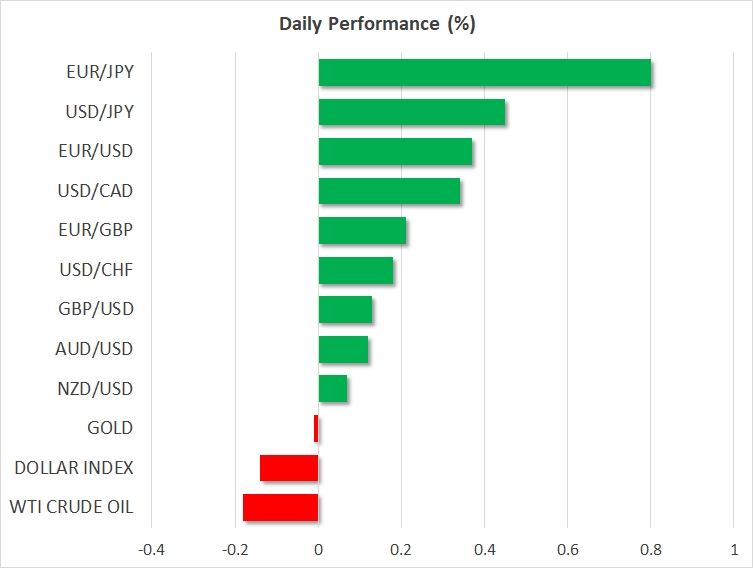

- FOREX: The US dollar index – which measures the greenback’s performance against a basket of six major currencies – is lower on Monday, though by less than 0.2%. The euro is higher across the board, as some encouraging remarks from Italy’s new finance minister helped to calm markets. Meanwhile, the yen is on the back foot amid subsiding European political risks, and as investors position for the several events this week will bring.

- STOCKS: US markets closed higher on Friday, with the S&P 500 and Dow Jones climbing by 0.31% and 0.30% respectively, while the tech-heavy Nasdaq Composite lagged, rising by 0.14%. Meanwhile, it appears the worrisome signals on global trade from the G7 summit over the weekend were not enough to worry equity investors, as futures tracking the S&P, Dow, and Nasdaq 100 are all currently in positive territory, albeit marginally so. In Asia, most markets were in the green on Monday. Japan’s Nikkei 225 and Topix gained 0.48% and 0.30% correspondingly, as a softer yen brightened the outlook for exporting firms. In Hong Kong, the Hang Seng rose 0.37%. Meanwhile in Europe, futures tracking the major benchmarks were pointing to a much higher open for all these indices, possibly due to some encouraging signals from Italy over the weekend.

- COMMODITIES: In energy markets, oil prices are lower on Monday, extending losses from Friday. Crude Oil WTI and Brent crude are down by 0.2% and 0.3% respectively, with the losses being attributed to signs that US and Russian productions continue to surge. Active US oil rigs ticked up again during the past week, while Russian news agency Interfax said the nation’s production touched 11.1 million barrels per day in early June, above its OPEC-deal target of under 11.0 million. In precious metals, gold prices are practically flat on Monday, after experiencing a similarly lackluster session on Friday. The metal continues to trade in a very narrow range, and this week’s risk events could finally be the trigger for a break in either direction (US-North Korea summit, Fed and ECB meetings, US tariff announcement on Chinese goods).

Major movers: Euro looks to extend recovery; yen on the defensive ahead of key events

The US President backed out of signing a joint statement with the G7 over the weekend, presumably due to some remarks by Canadian Prime Minister Trudeau, who said that Canada would impose retaliatory tariffs on the US commencing July 1. Leaving the meeting, Trump reiterated on Twitter that the US is looking at introducing tariffs on imported vehicles, something that would single out major car-manufacturing nations and classic US allies, such as Germany and Japan.

Yet, the market response was muted, with haven currencies like the Japanese yen trading 0.4% lower against the US dollar and 0.8% down against the euro on Monday. The lack of reaction may be owed to some market-friendly comments by the new Italian economy minister, and investors positioning for this week’s numerous risk events – for instance by reducing their exposure to the yen. Both the Fed and ECB are expected to take one more tiny step towards reducing monetary accommodation when they meet again this week, and since the BoJ is not expected to alter its ultra-loose policy anytime soon, that helps to reduce the yen’s appeal. Moreover, expectations around a positive outcome in the Trump-Kim Jong Un summit tomorrow may be reducing geopolitical risk premium and hence, diverting flows out of haven currencies like the yen and Swiss franc.

Over the weekend, Italy’s new finance minister Giovanni Tria said “there is no question of leaving the euro”, a move that is likely to put to rest any surviving speculation for an imminent ‘Italexit’, at least for now. He also emphasized the nation has to reduce its debt/GDP ratio and prioritize structural reforms over more deficit spending. The message was well-received, as Italian government bond yields are lower across the board today while the euro is higher against its major counterparts.

Day ahead: UK industrial and manufacturing output on the horizon; trade, Trump-Kim meeting, central bank decisions in investors’ minds

Barring some data releases out of the UK, Monday’s calendar is empty of other data points out of major economies. In the absence of releases, investors may focus on the global trade outlook, tomorrow’s Trump-Kim meeting, as well as on speculating on the actions of major central banks which will be completing their meetings on monetary policy as the week unfolds.

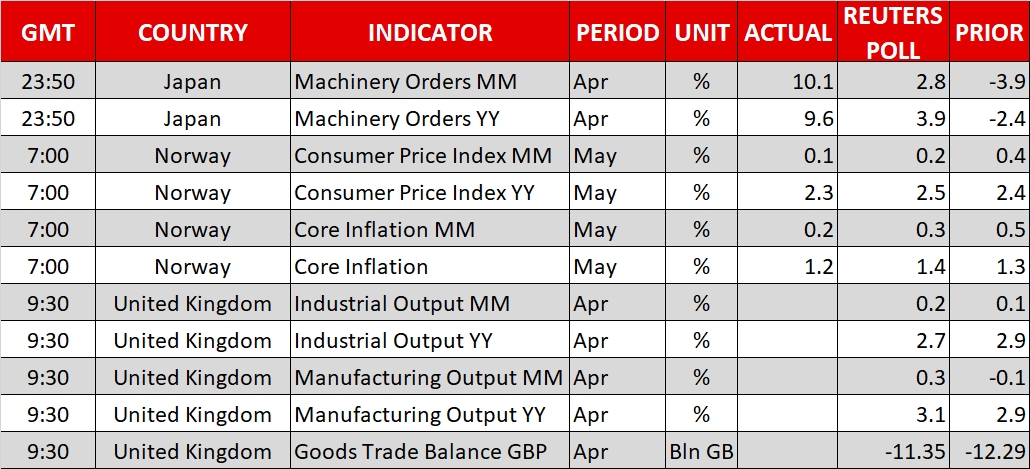

At 0830 GMT, the UK will be on the receiving end of industrial and manufacturing production data for April. Month-on-month, manufacturing output is anticipated to have risen by 0.3%, after contracting by 0.1% in March. The yearly pace of growth is expected at 3.1%, up from March’s 2.9%. Industrial output is also forecast to have expanded at a faster pace on a monthly and annual basis in April compared to the previously tracked month. Stronger-than-projected prints can stoke market expectations for a Bank of England rate hike sooner rather than later. For the record, market participants currently see a mere 11% chance for the delivery of a 25bps rate increase when the Bank meets next week according to UK overnight index swaps.

UK data on April’s goods trade balance will also be made public at 0830 GMT; the deficit is expected to narrow to 11.35 billion pounds from 12.29bn in March.

Ahead of tomorrow’s meeting with North Korea’s Kim Jong Un, Trump maintained a confrontational stance with traditional US allies, such as Canada (with NAFTA negotiations ongoing), after last week’s G7 meeting. In this respect, trade developments, as well as Tuesday’s US-North Korea summit in Singapore will be on investors’ minds. Meanwhile, the Fed (Wednesday), ECB (Thursday) and the Bank of Japan (Friday) will be completing their respective meetings on monetary policy later in the week; the euro continues to enjoy positive momentum after a slew of hawkish comments by ECB policymakers last week, with euro/dollar currently trading above the 1.18 handle.

Potentially of interest is a news conference that will follow after a meeting between German Chancellor Angela Merkel and the heads of the IMF, WTO, the World Bank, the ILO and the OECD in Berlin at 1500 GMT.

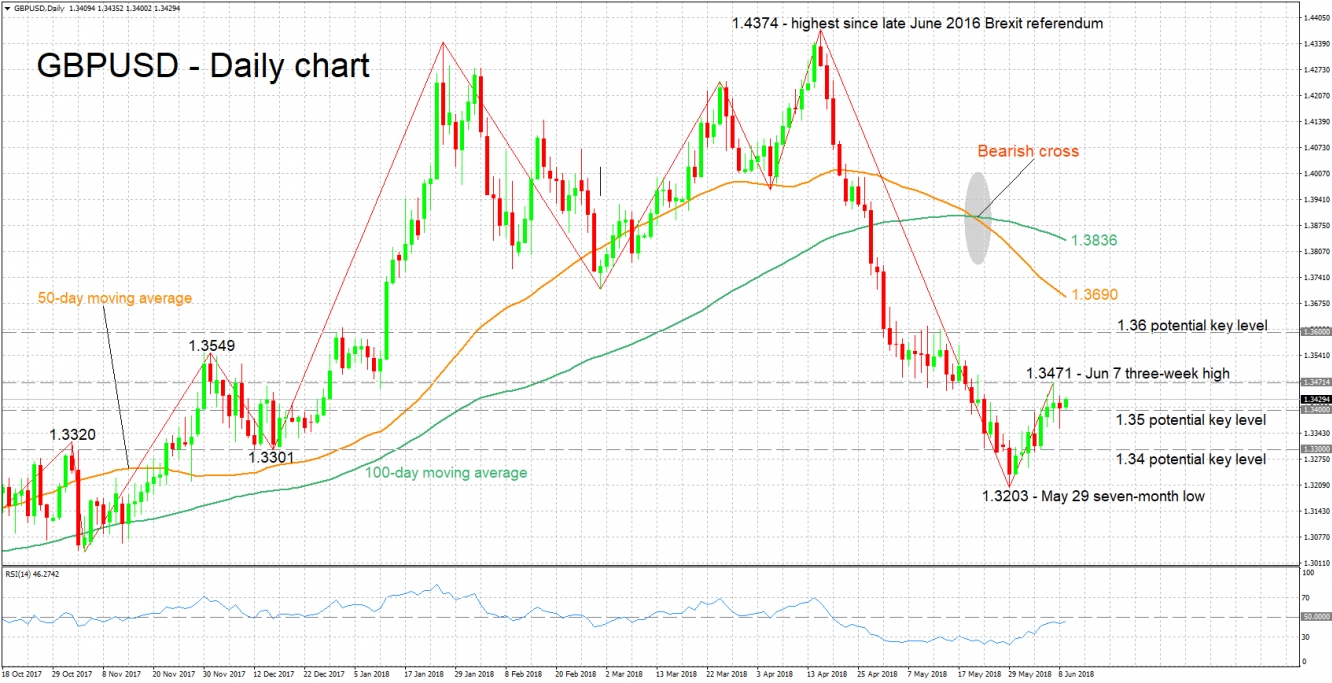

Technical Analysis: GBP/USD looking bullish in the short-term

GBP/USD has gained more than 200 pips after touching a seven-month low of 1.3203 on May 29. The RSI is rising in support of a positive picture in the short-term.

Upbeat UK data later in the day can support the pair. Resistance to advances may come around last week’s three-week high of 1.3471, including the 1.35 round figure. Further above, the attention would increasingly turn to the 1.36 handle.

Weaker-than-anticipated figures on the other hand, are likely to exert selling pressure in GBP/USD. Immediate support could be met around 1.35, and further below at the 1.34 handle.