After my 2 week work break I've come back to a mixed message market. The question is which market is in charge?

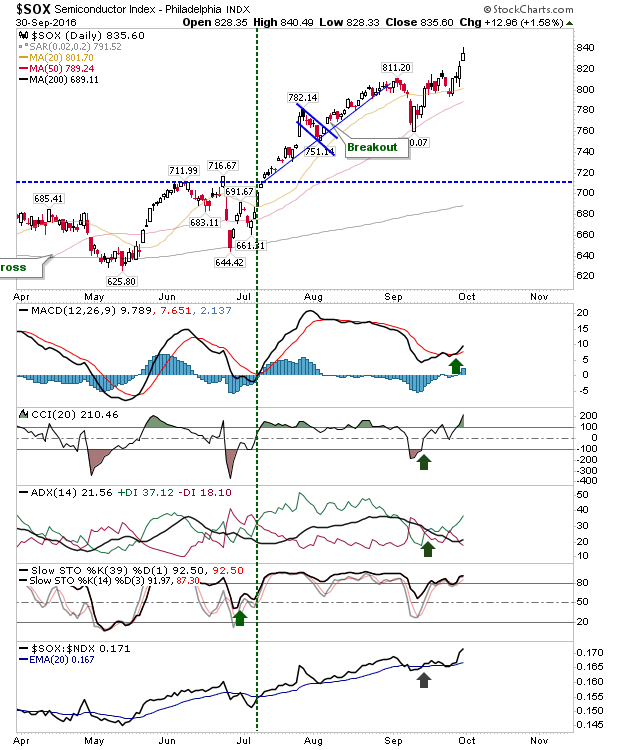

The clear leader over this period has been the Semiconductor Index. It pushed to new highs in a strong relative push. This restores the net bullish technical picture for this index dating back to July. The question is how much strength in this index can pass through to the NASDAQ and NASDAQ 100. The fresh MACD trigger 'buy' is a new pullback signal with a stop below the recent swing low.

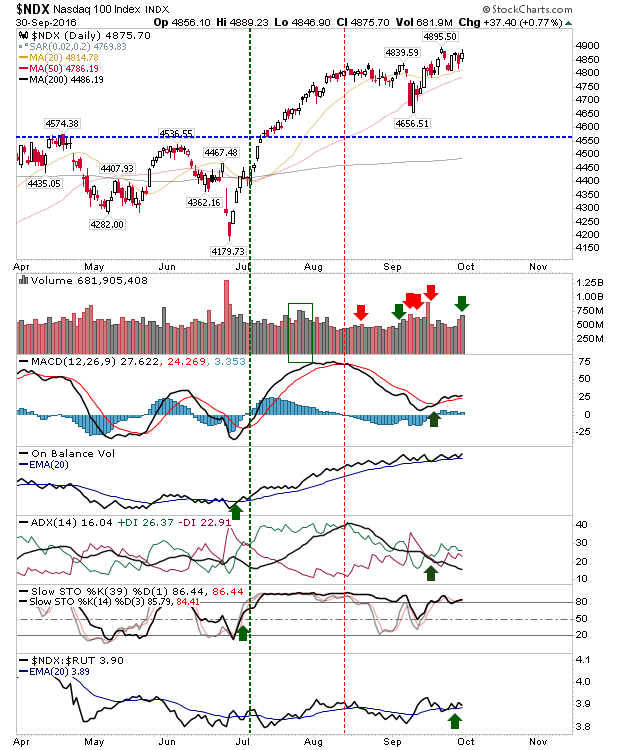

While the Semiconductor Index is at new highs, the NASDAQ 100 is pushing to clear the recent consolidation. A new high at 4,895 was posted, but it has struggled a little to add to this. However, technicals are in very good shape.

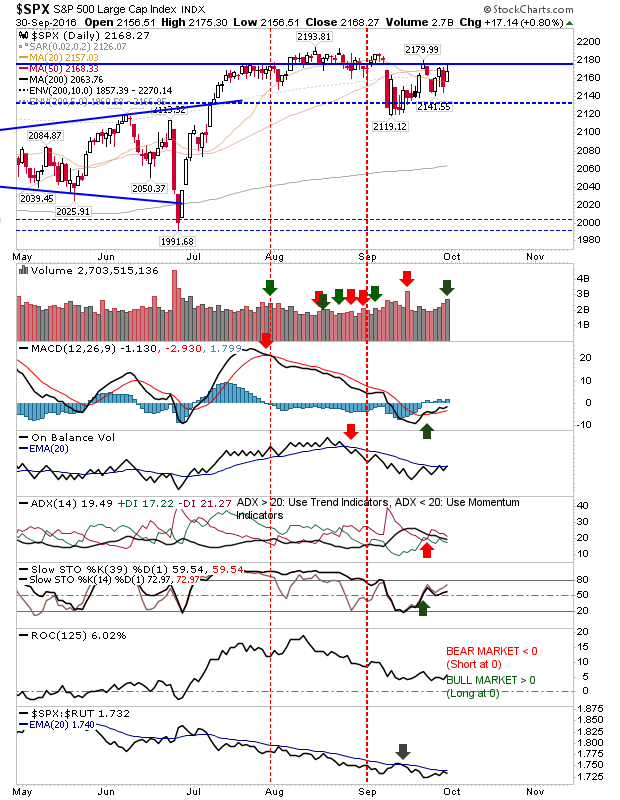

Struggles can be found in Large Caps. It has been a roller coaster, but the S&P remains pegged by resistance despite Friday's accumulation. While the show-piece index struggles, it will sow doubts for buyers of stronger indices. The S&P needs to break 2,180 to get itself out of the consolidation and match the strength of other indices.

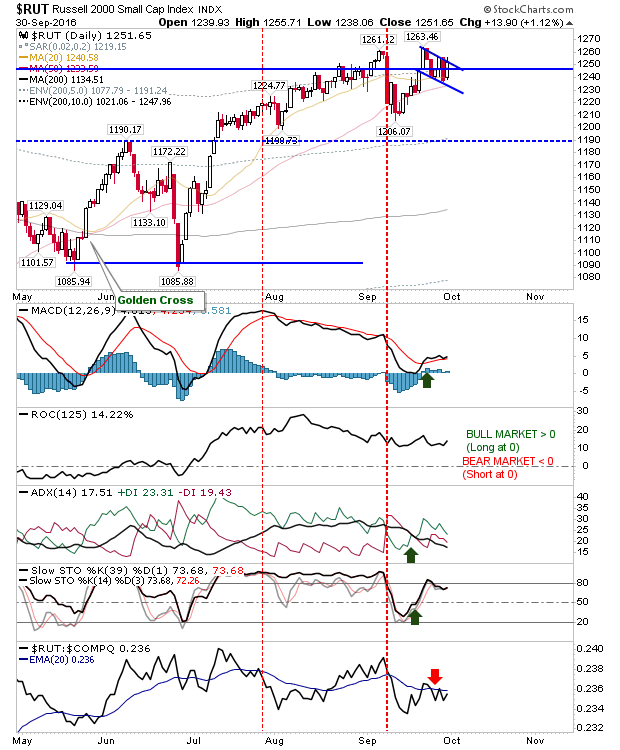

The Russell 2000 is setting itself up for a 'bull flag'. This could offer a strong kicker for the start of the new quarter. The presence of the 20-day and 50-day MA will help.

Bulls may get the most joy out of this index - watch pre-market for leads. If it can hold Friday's highs into the open then it could have a good opening half hour.

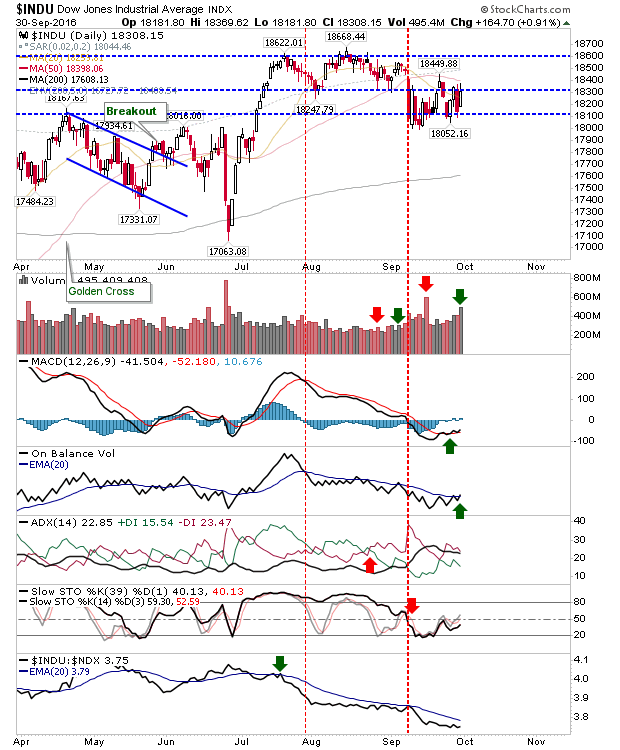

My personal interest is a short in the Dow. Unfortunately for me, technicals are rolling towards bulls on an intermediate-term time frame. As a holding short, a weak start to the quarter is needed given stars look to be aligning in the bulls' favour.

Bulls can look to the Russell 2000 to push on in what looks like a good setup. Aggressive shorts may want to look at the S&P, but stops need to be tight as the position could quickly get away.