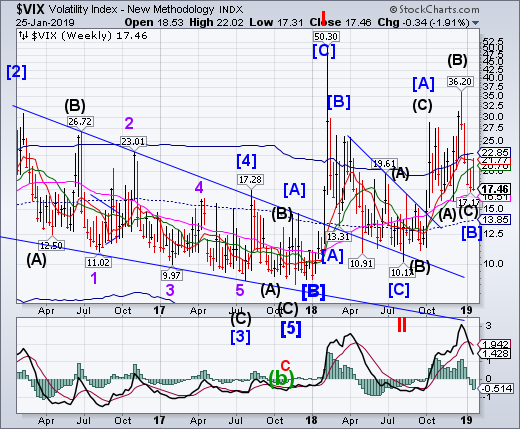

VIX challenged short-term resistance at 21.77 on Tuesday but eased back toward long-term support at 16.51 at the close on Friday. The Primary Cycle [C] that may have just started may be a multiple of the Primary Wave [C] of February 2018.

All Quiet on the Western Front is a 1929 novel which describes German soldiers’ extreme physical and mental stress during World War I, and subsequent detachment from civilian life felt by many soldiers upon returning home. This novel was eventually made into a major motion picture.

The phrase “all quiet on the Western Front” has become a colloquial expression meaning stagnation, or lack of meaningful change, in any context.

Many financial markets ended 2018 with considerable volatility. The stock market, as measured by the S&P 500 index, fell from its peak in early October to a December 26th low by over 21%. (RealInvestmentAdvice)

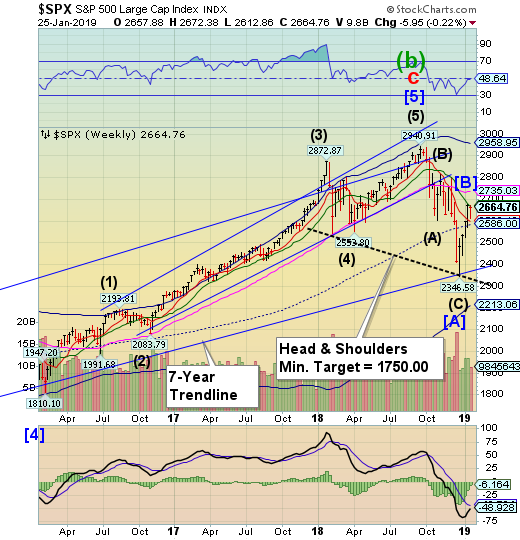

SPX Stalls At Intermediate-Term Resistance

SPX declined to Short-term support at 2599.18 on Tuesday, then bounced back to retest Intermediate-term resistance at 2665.37, leaving a flat week. Wave [B]s are rogue waves that often do the unexpected. In this case, it appears to most investors to have solidified the bullish case. The Cycles Model disagrees. There is a probable Head & Shoulders neckline that, if reached in the next few weeks, may indicate the target of this decline.

This week brought something new for stock investors whiplashed by December’s drubbing and subsequent January snap-back: a lull in the action.

The S&P 500 Index inched 0.2 percent lower this week as earnings season kicked into high gear, its smallest weekly move since October. That leaves the gauge up 6.3 percent in January after the 9.2 percent tumble in December.

But is this the pause that refreshes, or the eye of the hurricane?The equity rally “has lost some of its sparkle as the mood turns slightly more risk-off than a week ago,’’ Aliza Mason, an equity derivatives strategist at Grupo Santander (MC:SAN), wrote in a note. That’s left investors stuck “halfway between hope and despair. (Bloomberg)

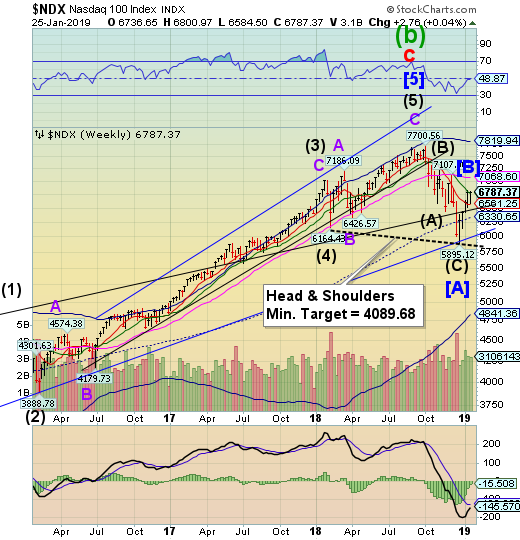

NDX Challenges Intermediate-Term Resistance

NDX declined to Short-term support at 6561.25, then bounced to challenge Intermediate-term resistance at 6764.69, closing above it. The Cycles Model suggests that NDX is either at or very near the end of its rally. There is a potential Head & Shoulders formation that, if triggered, may erase up to 3 years of gains. Stay tuned!

In the span of a day, China has gone from threatening to crash US markets if President Trump doesn't agree to a trade deal to helping the US rebut reports that trade talks weren't going as smoothly as President Trump and the Wall Street Journal had let on. During a press conference on Thursday, Ministry of Commerce Spokesman Gao Feng denied reports that a meeting involving high-level trade officials in Washington had been cancelled (the FT had cited US frustrations with China's reluctance to cave on demands relating to curbing IP theft and certain structural reforms) - backing up Larry Kudlow, who sparked a brief rally just before the close on Wednesday when he appeared on CNBC to deny these reports.

Kudlow said yesterday that the most important meeting, between a Chinese delegation led by Vice Premier Liu He, the country's top economic official, was still slated to take place in Washington next week. (ZeroHedge)

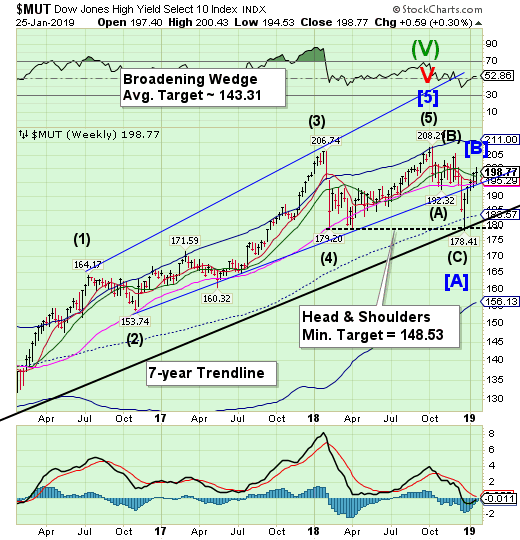

High Yield Bond Index Closes Again Above Intermediate-Term Resistance

The High Yield Bond Index declined to its trendline near 195.00, then rallied again above the Intermediate-term resistance at 197.17 and making a new retracement high.The 2 ½ year trendline is due for a retest that, if broken, may clear the way to a potential Head & Shoulders formation that may wipe out up to two years of gains.

Investment-grade corporate bonds are rallying to start 2019, but concerns remain about a potential raft of downgrades for BBB-rated bonds.

Those bonds, which represent a major chunk of the U.S. corporate bond market, are rated one to three notches above junk territory and almost half of those bonds cling to a rating that is just one level above high-yield status.

Concerns about the vulnerabilities of BBB-rated corporates were among the factors behind a 2018 decline of 3.8 percent for the MarkitiBoxx USD Liquid Investment Grade Index, one of the most widely followed gauges of high-quality corporate debt. That benchmark allocates over half its weight to BBB-rated debt. (Benzinga)

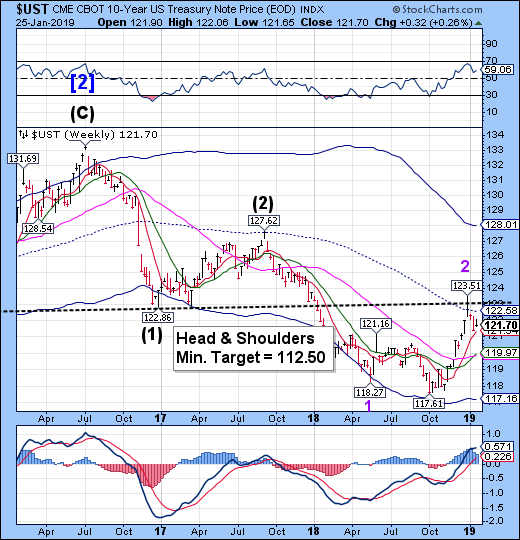

Treasury Bonds Have An Inside Week

The 10-year Treasury Note Index fell somewhat but stayed within the parameters of the prior week’s high and low. The breakout either above mid-Cycle resistance at 122.58 or beneath Short-term support at 121.31 may give us the direction of the move in the next two weeks.

U.S. government debt yields rose on Friday after President Donald Trump announced that he had reached a deal with congressional lawmakers to reopen the federal government for three weeks.

The yield on the benchmark 10-year Treasury note was up at 2.755 percent at 1:11 p.m. ET, while the yield on the 30-year Treasury bond rose, trading at 3.06 percent. Bond yields move inversely to prices.

The short-term resolution would leave open the possibility that lawmakers fail to come to terms and end up at another impasse in mid-February. (CNBC)

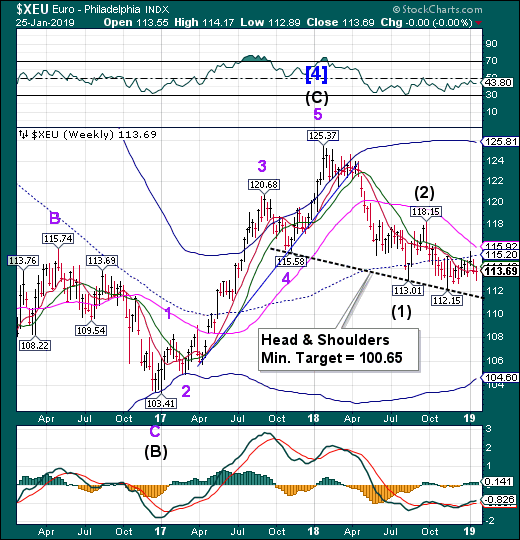

The Euro Hanging By A Thread

The euro fell this week but managed to levitate back to its weekly opening price. The decline may resume next week. There is a potential Head & Shoulders formation beneath 112.00 that suggests a downside target that may be attained in the next month.

The euro was headed for a second weekly decline today after the head of the European Central Bank said economic growth was likely to be weaker than previously expected.

ECB President Mario Draghi blamed factors ranging from China's slowdown to Brexit for the slowdown.

The central bank left the bloc's interest rates unchanged as expected yesterday.

The euro, which has traded in a range of $1.12 to $1.16 for the past three months, weakened as investors questioned whether the ECB would be able to raise interest rates this year, as its current guidance indicates. (RTE)

EuroStoxx Approaches A Trendline

The EuroStoxx rally challenged Cycle Bottom support at 3101.07 before rallying back above Intermediate-term resistance at 3139.24. The Cyclical strength extended until this weekend, with the weakness to follow through the middle of February.

European stocks traded higher on Friday, amid a rally among technology shares and as investors continued to monitor U.S.-China trade developments.

The pan-European Stoxx 600 index rose 0.6 percent during trade, with tech stocks and trade-sensitive sectors like autos and basic resources among the top gainers.

The FTSE 100 was the only major bourse to close lower, dragged by Vodafone’s disappointing earnings and a rise in the value of sterling against the dollar.

Europe’s tech sector saw big gains even after U.S. chipmaker Intel (NASDAQ:INTC) posted earnings and guidance that missed analysts’ expectations. Semiconductor firm Siltronic was up more than 5 percent, while competitors STMicro and Infineon were more than 4 and 2 percent higher respectively by the close. (CNBC)

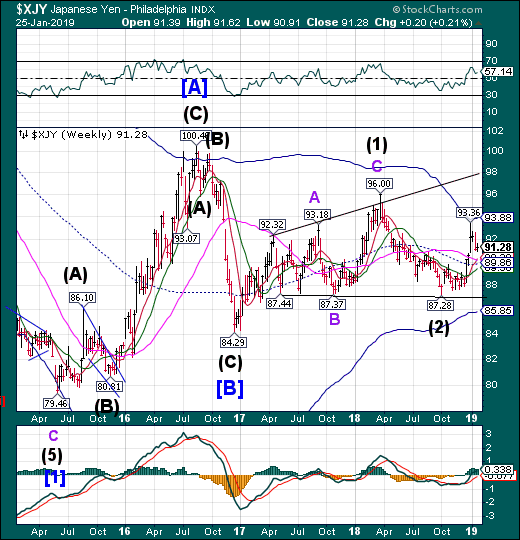

The Yen Consolidates At The Lows

The yen traded in place for most of the week as it gathers strength for the next upswing. The Cycles Model suggests a continued probe to the upper trendline over the next two weeks

Don’t underestimate the Japanese yen’s status as a haven — and its ability to buoy the currency despite lackluster economic fundamentals.

Granted, with consumer price inflation at stubbornly low levels and economic growth dented, the yen doesn’t necessarily sound like the best bet among major currencies. But ample liquidity could allow the yen to defend its haven status and attract investments irrespective of economic data, analysts said.

In times of geopolitical or financial turmoil, the yen USD/JPY, -0.08% tends to gain versus its peers, according to conventional wisdom. Seeking protection from Brexit in a sterling-yen GBP/JPY, +0.93% trade has been a favorite suggestion from pound bears, for example.

The secret to Japan’s ability to live up to its haven status despite sluggish data centers on liquidity. (Market Watch)

Nikkei Meets Resistance

The Nikkei challenged Short-term resistance at 20771.87, closing just above it. The Cycles Model appears to be inverting in the next week or so. The bounce may be running out of time.

Japan's Nikkei ended almost flat on Thursday weighed down by a fall in index heavyweight Fast Retailing, but strong earnings from Texas Instruments (NASDAQ:TXN) boosted chip-related shares, supporting the broader market. The Nikkei share average dipped 0.09 percent to 20,574.63, hit by a 3.1 percent fall in Fast Retailing, which accounts for more than 9 percent of the Nikkei. But it managed to stay above its 25-day moving average at 20,451. The broader Topix was up 0.36 percent at 1,552.60, with chip-related shares and financials leading the gains.

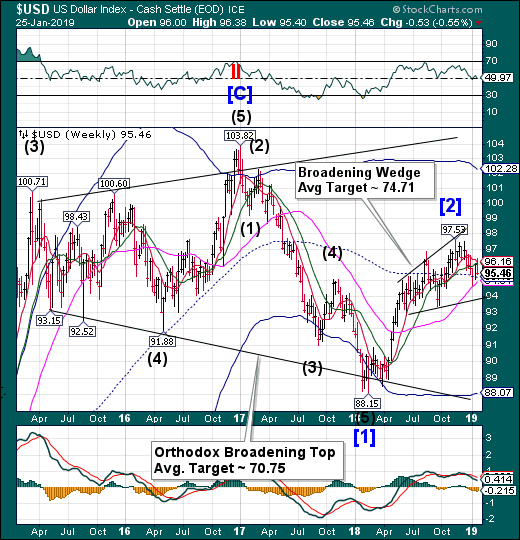

U.S. Dollar Decline Toward Mid-Cycle Support

The USD rally failed at Intermediate-term resistance, declining toward mid-Cycle support at 95.18. The USD remains on a sell signal. The Cycles Model suggests weakness for the next 2-3 weeks.

The U.S. dollar pushed higher against a basket of its rivals on Thursday but gains were held in check by concerns over global growth, the U.S. government shutdown and the ongoing U.S.-China trade war. "Trade tensions are the most dominant factor for investor sentiment right now and will drive market flows," said Nick Twidale, chief operating officer at Rakuten Securities. Twidale added that investor risk appetite will only improve once concerns over the partial U.S. government shutdown and trade tensions fade. Trade tensions were evident again Thursday as access to Microsoft (NASDAQ:MSFT) (NASDAQ:MSFT)'s Bing search engine was blocked in China. (Investing.com)-

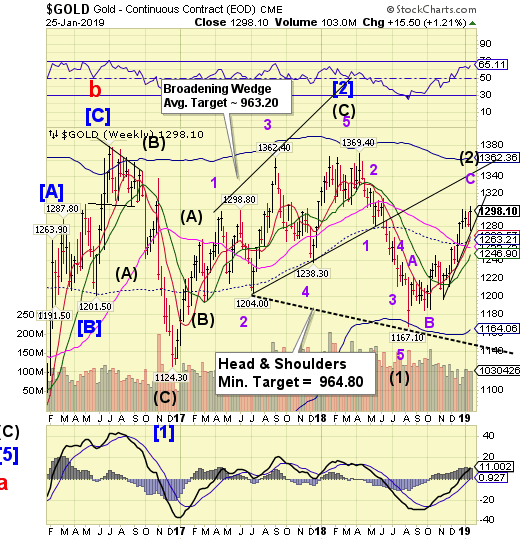

Gold Makes A Weekly Key Reversal

After two “inside” weeks, Gold made a weekly key reversal that may allow it to rally to 1320.00 or higher. A the key reversal now suggests a Cycle inversion instead of a decline, as originally anticipated. The Head & Shoulders formation is still valid, however, unless a new high is made.

Gold jumped over 1 percent to a more than seven-month high on Friday, briefly surpassing the $1,300 mark, as the dollar slid ahead of a U.S. Federal Reserve meeting next week where the central bank is widely expected to leave interest rates unchanged.

Spot gold rose 1.29 percent to $1,297.13 per ounce as of 1:58 p.m. ET, having earlier touched a peak of $1,300.30, its highest since June 15, 2018. The metal was on course for its best week in four.

U.S gold futures settled $18.30 higher at $1,298.10 per ounce.

“The major catalyst supporting gold is a big drop in the dollar, amid expectations the Fed will reiterate a pause to its hiking cycle next week,” said FawadRazaqzada, an analyst with Forex.com. (CNBC)

Crude May Rally Another Week

Crude oil appears to have completed its corrective bounce to the top of the December high. However, it appears that the current Cycle is inverting and maybe extending for another week.

Attempted coups and alternative governments in petrostates like Venezuela are typically the stuff of oil price rallies. Thus far, the political crisis in Caracas — really just the latest escalation of the long-standing crisis engulfing the country — has prompted a twitch in crude oil prices rather than a full-on spasm of fear.In part, that reflects a market that priced in Venezuela’s slumping oil output ages ago. But it also reflects apparent weakness in one of oil’s most important markets: gasoline. And further turmoil in Venezuela may actually exacerbate this.The latest oil inventory numbers from the Energy Information Administration, released Thursday, showed weakening U.S. gasoline demand and stocks of the fuel hitting record levels. Little wonder gasoline cracks — a simple proxy for the profit on refining crude oil into the fuel — have hit their lowest level since late 2010 (Bloomberg)

Shanghai Index Challenges Intermediate-Term Resistance.