The Week That Was

Last week, the Dow Jones gained 0.3%, to finish at 21006.94. The index was unable to overcome its previous weekly high, which in turn was unable to overcome the high of March 3rd. While the S&P 500 did better, gaining 0.63% to 2399.29 and closing a hair over last week’s high of 2398.16, it too is still beneath its high of March 3rd.

Such incremental upward shifts, unable to make new highs, are particularly disappointing considering some of the major events that occurred last week. The FOMC policy meeting, Trump's new healthcare bill, to replace the Affordable Care Act, which passed in the US House of Representatives and on Friday, to finish the week on a high note, strong nonfarm payroll employment numbers: 211,000 new jobs in April, beating expectations of 185,000., a tic down in the unemployment rate, though wage growth and inflation remained flat.

US earnings also brought enough good news to have moved the markets more aggressively: Facebook (NASDAQ:FB) beat on earnings for the eighth straight quarter, and Tesla (NASDAQ:TSLA)—though it surprised to the downside on EPS losses—more than doubled revenue from last year on better than expected deliveries. Apple (NASDAQ:AAPL), however, disappointed, missing on revenue and signalling that until the release of the iPhone 8, expected in September or October, there could be more softness ahead for the mobile communications and media device manufacturer.

All in all, policy disappointments compounded by rising geopolitical risk of a potential Frexit, depending on the results of today's round two of the French election and a standoff with North Korea, kept investors from a leap of faith in the market.

The Week Ahead

Brexit – Trump – Frexit: Déjà vu All Over Again?

Will France elect to stay in the EU and embrace globalization by voting for centrist-Macron, or will it go with Le Pen and take up rising anti-global sentiment and close borders as it opts to leave the EU and its single currency?

Based on the opinions of pundits and polls, it seems certain that Macron will win (Current Bloomberg Composite of French Election Polls provides Macron a hefty 62.50% edge over Le Pen at 37.50). That gives Macron a whopping 25% lead. Betting odds at Oddschecker – where people put their money where their mouths are – gives Macron an overwhelming 92% chance of victory, while giving Le Pen an embarrassing 13% of the overall vote.

On Friday, euro traders drove the single currency to a close of 1.0998, its highest close since November 8, the date of the US election and the start of the Trump Trade.

However, let’s remember that the pattern was the same before both the Brexit and Trump votes. Right before the Brexit vote the pound broke 1.5000, the highest price since December 2015, only to follow up with a 6% single-day plunge, a new worst record, since the 4% drop of Black Wednesday on September 16, 1992, when George Soros shorted the pound and broke both the Bank of England and the Her Majesty’s Treasury.

The Dollar Index too was rising ahead of the US election in November, in anticipation of a decisive Clinton win. Fact is that when it was announced that Trump had won, the dollar sold off 2.00 to below 96.00 on the Dollar Index. Only when the narrative underwent an extreme makeover, and switched from Trump being the worst thing to happen to the market since the oil crisis of the 1970s, to Trump being the force that will bring back market animal spirits, did the Trump Trade take flight.

In both instances—Brexit and Trump—polls, betting firms, pundits and even bond traders were sure that the inconceivable—an actual Brexit and a Trump victory—would never happen. The US 10-year Treasury yield went up 40%, after bottoming out during July at 1.3180, climbing to 1.8547 before the US election, suggesting investors felt safe enough to go after risk assets because they believed Trump wouldn't win.

During the week leading up to the UK referendum, UK 10-year yields surged 30%, only to fall the same distance when it turned out investors were wrong and the majority of the UK electorate did in fact vote for the UK to leave the EU.

With both those examples in mind, let’s take a look at what France's bond investors think about today’s elections.

While the France 10-year bond yield has been rising from a low of 0.765 on May 3, up to 0.797 this past Friday—suggesting lower demand for bonds and greater faith in the French economy—in the bigger picture, the yield has fallen since March 10, down 0.34% from 1.068, the highest since July 14, 2015, completing a double top. This is a very bearish pattern. If Macron has the presidency in the bag, what are French bond investors so afraid of?

US retail sales numbers will be released this coming Friday. It's expected they will have advanced in April, the most this year, suggesting consumer spending may be turning up after a very weak first quarter.

Currency traders have an exciting week coming up as Central Banks in England and New Zealand, among others have upcoming interest rate decisions pending. Neither the BoE nor the RBNZ are expected to make any changes.

Other key market drivers in the coming week include:

Monday

Canada reports housing starts for April. Will last month’s fastest gain since 2007 prove to be a trend or merely an anomaly?

Big potential moves in pharmaceuticals could be on the horizon, as US Vice President Mike Pence, Ivanka Trump and Jared Kushner will attend a biotech summit at the White House. This occurs after the administration proposed cutting $1.23 billion from the National Institute of Health research budget this fiscal year and $5.8 billion next year, an 18% reduction. President Trump also said that the pharmaceutical industry is “getting away with murder” per the prices they charge. Any repeat of this rhetoric is almost certainly going to hit pharma shares, while any softening of rhetoric may boost them.

North Korea and Iran will be the focus of a meeting of nuclear envoys from 120 countries, as a second week of meetings take place at the UN in Vienna, through May 12.

Tuesday

South Korea holds elections to replace former President Park Geun-hye, who was ousted on corruption charges that impacted some of the country’s most powerful companies. Polls favor former opposition leader Moon Jae-in, who advocates closer relations with North Korea.

Earnings: Walt Disney Co. (NYSE:DIS) will report 2Q 17 earnings, after-market. Despite substantial fundamental growth, capped by “Beauty and the Beast, the top grossing movie worldwide this year, Disney's growth is going to be cut down on soaring cable costs, perhaps as much as 16%. Also, holiday timing may have cost Disney up to $50 million in profit from its parks.

After a bottom of $90 last October, the stock has soared 20.2% to over $115 in April. However, shares plunged about 6% since, in just five days, in one of the worst declines in many months, on news the company would be laying off around 100 ESPN staffers, increasing the bearishness on its ESPN network.

The stock’s plunge cut through the 50dma like a hot knife through butter and fell on an intra-day basis through the 100dma, suggesting to some that Disney's uptrend is dying out. However, the fact that it created a bullish hammer, with a close above the 100dma and even climbed the next day, suggests it’s too early to let the curtain down on this stock.

Of 35 surveyed analysts by Bloomberg, 21 provide a buy recommendation, 11 provide a hold recommendation and only 3 provide a sell recommendation – with a media target price of $119.44.

Economy: Job openings and wholesale inventories for March (final); German industrial production for March, Australia retail sales for March, Japan wages for March.

Energy: API weekly oil inventory report.

Wednesday

Earnings: Toyota Motor Corp (NYSE:TM). In our current market environment, perhaps one of the key factors to pay attention with regard to global products is forex. A company may do very well, but an unfavorable currency move could erase any profits. On the other hand, a mediocre period could be offset by favorable currency swings.

The Japanese yen appreciated 9% this year, which creates a potential headwind for this Japanese car manufacturer.

Additional points:

- U.S. Passenger Vehicle Sales Growth Slows in 3Q

- Yen Appreciated Against the Dollar After Weakening in 4Q Last Year, Potential Headwind

- China Passenger Vehicles Sales May Slow with Lower Tax Incentive

- Toyota, Lexus May Raise Incentives to Drive Sales in U.S.

US auto sales plunged 4.7% in April. Might this give us a clue about Toyota, whose market share in the US is about 14%?

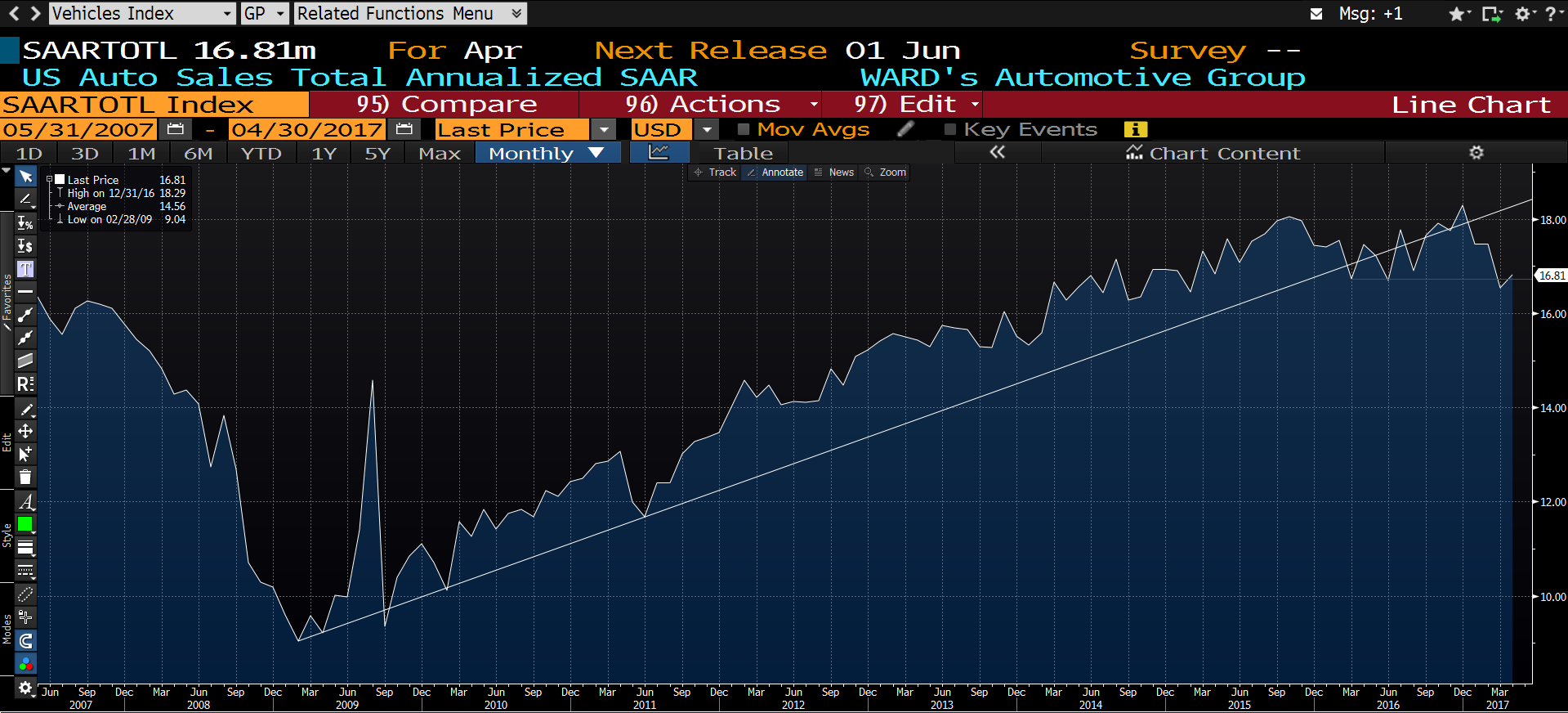

Take a look at US auto sales history in the following chart:

Since the financial crisis ended, the car sales climbed till mid-2015. Since then sales have failed to reach new highs. In fact, sales have been unable to stay above the uptrend line.

Now, take a look at Toyota’s chart:

Look familiar? It too is unable to make new highs. In fact a break below $100, which would coincide with crossing below the 100dma, may indicate a major H&S reversal.

Toyota shares have been rising since mid-April, within a correction back toward its downtrend line since December. Last week it formed a shooting star at previous support at the $110 price level and below the 50dma. Volume has diverged, diminishing as the price has been rising.

Economy: U.S. weekly MBA mortgage applications, April import-price index.

Energy: US EIA weekly crude oil inventory report.

Thursday

BoE inflation and growth forecasts; policy decision. The policy makers are split on inflation.

The European Commission publishes new economic forecasts after warning in February of risks to growth from Brexit and the U.S. election of Donald Trump. At the time, it predicted a 2017 expansion of 1.6 percent, slower than the 1.7 percent expansion in 2016.

Economy: US weekly jobless claims

Friday

Economy: Michigan consumer sentiment (May preliminary), March business inventories.

Energy: Weekly US Baker Hughes Rig Count