by Pinchas Cohen

The Week That Was

- Comey’s testimony leaves investors unresolved

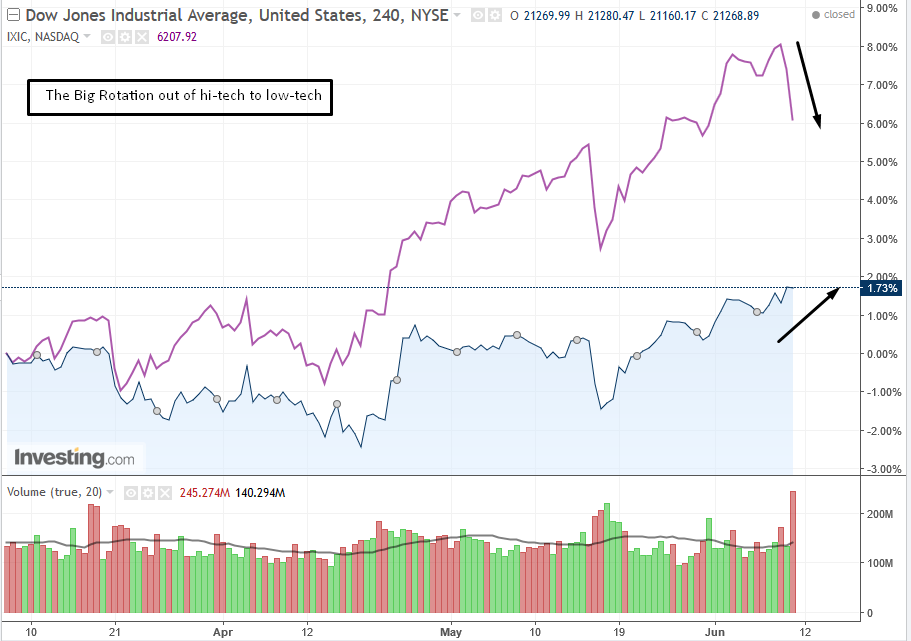

- The Dow closed at a record, while the NASDAQ fell 2.5%, the most since May 17 on a major rotation out of tech

- UK hung parliament increases Brexit uncertainty

- ECB rules out lower rates, as Eurozone reasserts global economic leadership

- Oil inventories surprise rise far outweighed fear of supply interruptions or OPEC’s compliance integrity.

Once again equity investors demonstrated their lack of fear in the face of political risk. It's a theme reflected repeatedly in markets since the UK Brexit referendum vote on June 24 2016.

This past week, fired FBI Director James Comey put a bullseye on US President Donald Trump’s head and un-elected UK Prime Minister Theresa May lost her bid to gain a greater majority for herself and the Tory party in Parliament, instead losing whatever majority she may have had and increasing political and Brexit uncertainty. Still, the Dow Jones and the FTSE 100 indices each went up.

In the US, investors don’t seem concerned that it's looking increasingly unlikely that Trump will be able to help the market, even as it's looking more and more likely he can't even seem to help himself. Political battles between the Democrats and Republicans appear guaranteed to escalate rather than miraculously disappear under Trump's chaotic leadership style, yet the DJIA made a record close.

In the UK, the reasons government won't be able to get anything done are different—a hung parliament, a weaker position in the Brexit negotiations—yet the FTSE 100 has gone up the most since April 24. While the VIX rose, it’s still at historic lows, signaling complacency, thus the psychological environment is ripe for a market top.

To be fair, insofar as US markets go, it’s actually more complicated than that. While the Dow broke a new record on Friday, the NASDAQ fell 2.85% on an intraday basis on a major sell-off of mega-cap tech stocks including Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), Facebook (NASDAQ:FB) and Alphabet (NASDAQ:GOOGL), and closed 1.85% lower; Goldman Sachs) released a report stating that the last time this combination happened was before the dotcom crash.

The S&P 500 saw wild swings that day, but closed slightly lower than where it opened, demonstrating that investors are turning here and there but are ultimately without sector leadership.

As opposed to equity investors, currency investors are very sensitive to political risk. On Thursday, June 8 at 17:00 EDT, the pound sterling dropped 1.30% versus the dollar, from 1.2958 – 1.2790, inside a single minute. Cable held until Friday, June 9 , 2:52 EDT, when it reached a low of 1.2636, a total loss of 2.47% or 320 pips down on an intraday basis. The price bounced back 109 pips to a close of 1.2746, making the daily loss 208 pips or 1.60%. The fall of the pound, as well as that of the euro occurred on lower inflation projections. This gave the dollar index a 0.35% boost, on a rising gap.

The ECB's lower rate bias has ended, but its QE bias remains intact. While the region has generally seen really strong economic and earnings growth so far in 2017, inflation has still not kicked in. For ECB President Mario Draghi and the central bank itself, that’s the mandate and target. They want to get inflation back up to 2%.

Until that happens it's very likely the current QE policy will continue. Europe is currently in the prime stages of an expansion, generating good growth, both from an economic and corporate perspective, while monetary policy remains very accommodative.

While a Fed rate hike is widely expected and also priced in, markets await guidance in two areas: (1) The Fed’s perspective on the recent weaker US economic data, both growth and inflationary and (2) The Fed’s over $4 trillion balance sheet. While there has been talk of rolling that back, will there be more details released?

Week Ahead

Rate Decisions, US Retail Sales

- Fed, BOE, BOJ, SNB, Russia

- H&R Block, Kroger) report earnings

A rate hike by the FOMC—a quarter of a percentage point, the second increase this year—is considered a forgone conclusion by investors. This would indicate that the Fed sees employment remaining healthy and inflation sticking close to the Fed’s goal. Should the increase be announced, it would mean the Fed is looking beyond these goals.

The Bank of England, the Bank of Japan and the Swiss National Bank also set monetary policy this week. The BOE and SNB release growth and inflation forecasts as well.

UK-based equipment rental firm Ashtead Group (LON:AHT) Plc, US tax preparation services provider H&R Block and supermarket retailer Kroger (NYSE:KR) Co. are among companies releasing earnings this coming week.

Monday

US Environmental Protection Agency Administrator Scott Pruitt will join a meeting of G7 environmental ministers in Bologna, Italy. The event comes less than two weeks after Trump pulled the US out of the Paris Climate Accords. Through June 12.

So many big name CEOs, including Tesla (NASDAQ:TSLA)'s Elon Musk, Facebook's Mark Zuckerberg, Apple's Tim Cook and General Electric's (NYSE:GE) Jeff Immelt were against the decision. How will this play against still-alive expectations for Trump's pro-market agenda?

- ECONOMY: The US Budget Statement, a monthly report of the deficit (or theoretically surplus) held by the US government is released. It was negative $52.5b; the monthly deficit is expected to deepen to a negative of $87b.

- ENERGY/COMMODITIES: ICE weekly Commitment of Traders report for Brent, gasoil; U.S. Agriculture Department’s weekly grain-export inspections; monthly EIA drilling productivity report.

Tuesday

Morgan Stanley) Chief Executive Officer James Gorman and Chief Digital Officer Naureen Hassan speak at the firm’s U.S. financial conference. In New York City, through June 14.

- CENTRAL BANKS: Federal Reserve begins two-day policy meeting.

- EARNINGS: U.S. tax preparation company H&R Block Inc. (NYSE:HRB) releases earnings after market. Consensus has it reporting earnings of $3.15 a share on $2.28 billion in review, according to Thomson Reuters. The company also announced it had approved an increase in its quarterly cash dividend to 22 cents per share.

- ECONOMY: US NFIB Small Business Optimism, an indicator of small business health in the US, which is half of the US private workforce, is expected to remain flat for the month of May.

- ENERGY/COMMODITIES: American Petroleum Institute's (API) weekly oil inventory report; OPEC's monthly market report.

Wednesday

The Federal Reserve Open Market Committee is expected by everyone, without exception – to raise their benchmark interest rate for the second time this year, after a two-day meeting. The announcement is due at 14:00 EDT and Fed Chair Janet Yellen will hold a news conference at 14:30.

US Consumer Prices are expected to decline a bit, except the core rate, which excludes food and energy, which is expected to rise from 0.1% to 0.2%. Report at 8:30 EDT

US Retail Sales probably cooled in May, down from a month earlier, as motor vehicle purchases eased. 8:30 EDT in Washington.

China releases data including Industrial Production and retail sales at 10:00 in Beijing (June 13 at 22:00 EDT). It will be interesting to see if the country's economy resumes the overall downtrend it's been displaying of late. And if not, will investors buy it, or remain suspicious of Chinese government data?

European Central Bank Governing Council member Klaas Knot speaks at the Dutch parliament in The Hague. 10:00 local time (04:00 EDT). While he is unlikely to drop a bomb, so soon after his boss had his say, these meetings often create at least short term movements for FX traders.

- ECONOMY: U.S. MBA weekly mortgage applications, prior release was 7.1%; April Business Inventories are expected to drop from 0.2$ to negative 0.1%.

- ENERGY/COMMODITIES: U.S. Energy Information Administration (EIA) weekly petroleum inventory report with real-time coverage on the TOPLive blog, China energy/metals production (May), International Energy Agency (IEA) oil market report (monthly).

Thursday

Bank of England rate decision. The BOE holds its first scheduled policy meeting since the U.K. general election, and is expected to keep its key interest rate unchanged at 0.25%, a record low. The Monetary Policy Committee’s accompanying statement will include its latest assessment of economic growth and inflation. 12:00 in London (07:00 EDT)

Swiss National Bank rate decision. The SNB releases its quarterly policy assessment along with growth and inflation forecasts. The central bank’s deposit rate is at a record low of minus 0.75 percent, where it’s expected to stay. 09:30 in Bern (03:30 EDT), followed by a briefing with President Thomas Jordan at 10:00.

Euro-area finance ministers meet in Luxembourg to discuss debt relief for Greece, which may lead to the completion of a bailout review and the disbursal of about 7 billion euros ($7.9 billion) in aid. Meeting begins at 15:00 (09:00 EDT).

- Earnings: U.S. grocery giant Kroger Company (NYSE:KR) releases earnings, and it’s adjusted EPS is expected to decline 17% as revenue advances 3%. Its biggest challenge is streamlining its prices, as the company expected deflation to start easing. Another problem: they've stayed behind competition on improving operations, while they focused on building loyalty and sales.

- ECONOMY: The US's Import Price Index (May) is expected to fall from 0.5% to 0%; weekly initial jobless claims are expected to drop from 245k to 241k, while continuing claims are expected to rise from 1917k to 1920k; Empire State manufacturing (June) is expected to rise from negative 1 to 5; Philadelphia Fed Business Outlook (June) is expected to decline from 38.8 to 25; industrial production for May is expected to fall from 1% to 0.2%; NAHB Housing Market Index for June is expected to remain flat at 70.

- ENERGY/COMMODITIES: EIA natural gas weekly storage report; U.S. Department of Agriculture net export sales (weekly), Singapore oil-product stockpile data (weekly).

Friday

The Bank of Japan concludes a two-day policy meeting. While economists don’t expect any significant changes to monetary policy, as with their European and US counterparts, they will look for guidance. In the Japanese case, economists will will parse the BOJ’s statement and Governor Haruhiko Kuroda’s comments for clues to the outlook for inflation. The decision is announced around midday in Tokyo. Kuroda gives a press conference at 15:30 local time (02:30 EDT).

Federal Reserve Bank of Dallas President Robert Kaplan speaks to the Park Cities Rotary Club in Dallas at 11:45 local time (12:45 EDT).

The second annual meeting of the board of governors of the Asian Infrastructure Investment Bank will be held on South Korea’s southern island of Jeju through June 17. Investors will look for any impact the Chinese summit may have on this year’s meeting and for clues regarding another reflation rally.

- CENTRAL BANKS: Bank of Russia rate decision and briefing. It's expected that rates will decline from 9.25% to 9.00%. Will that be enough to significantly boost the ruble?

- ECONOMY: US Housing Starts for May are expected to have climbed from 1172k, negative 2.6% relative to the previous month, to 121k; Labor Market conditions (May) are expect to fall from 3.5 to 2.8 and Michigan Consumer Sentiment (June) is expected to remain at a 97.1; Russia GDP (1Q) is expected to remain steady at 0.5%; euro-area CPI (May) will be reported. Results should provide another clue as to the world's current economic leader.

- ENERGY/COMMODITIES: Commodity Futures Trading Commission report on the Commitments of Traders (weekly), Baker Hughes U.S. Rig Count weekly; USDA world coffee production report (biannually).