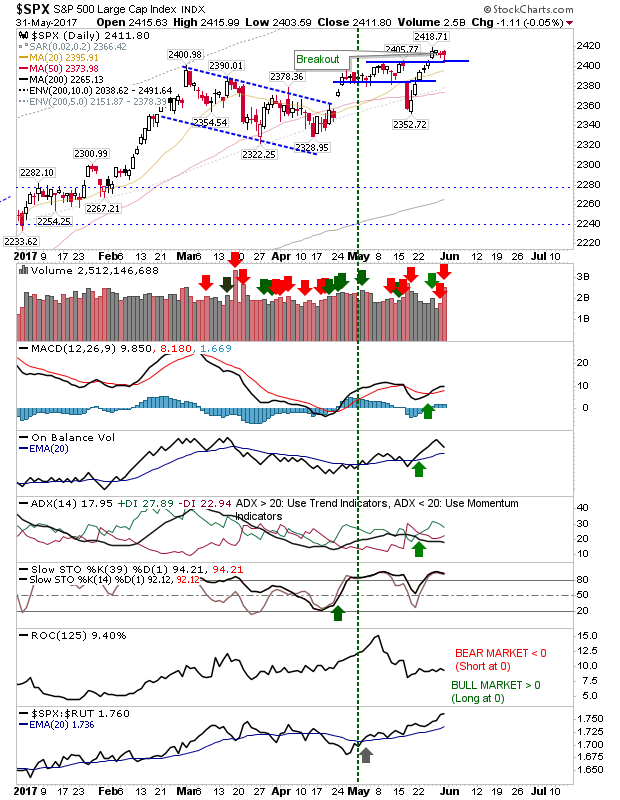

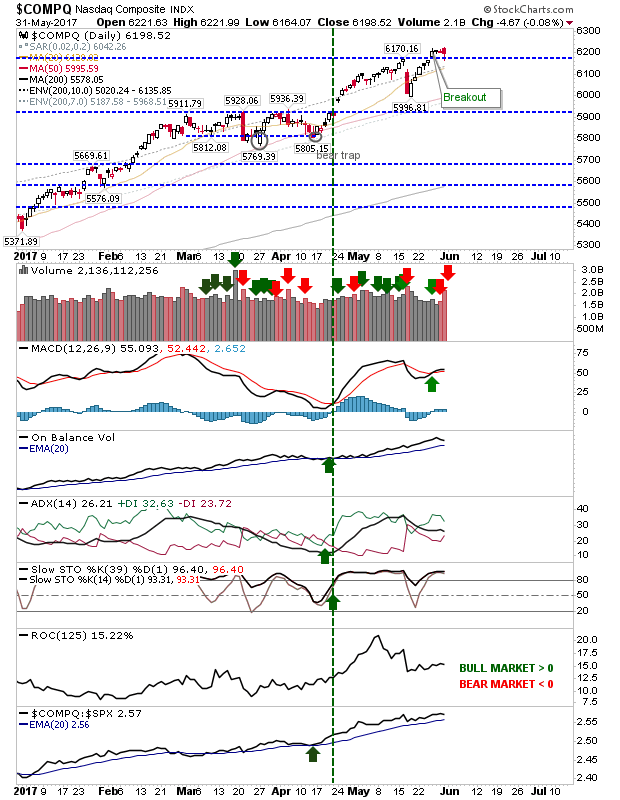

After a couple of weeks of light trading volume picked up yesterday as sellers returned to markets. However, sellers were unable to reverse market breakouts.

The S&P tagged 2,403 at yesterday's low, but recovered to leave it halfway between recent highs and 2,400. Technicals are net bullish with the MACD slowly building on its recent 'buy' trigger.

It was a similar story for the NASDAQ, as it too retained its breakout on solid technical strength.

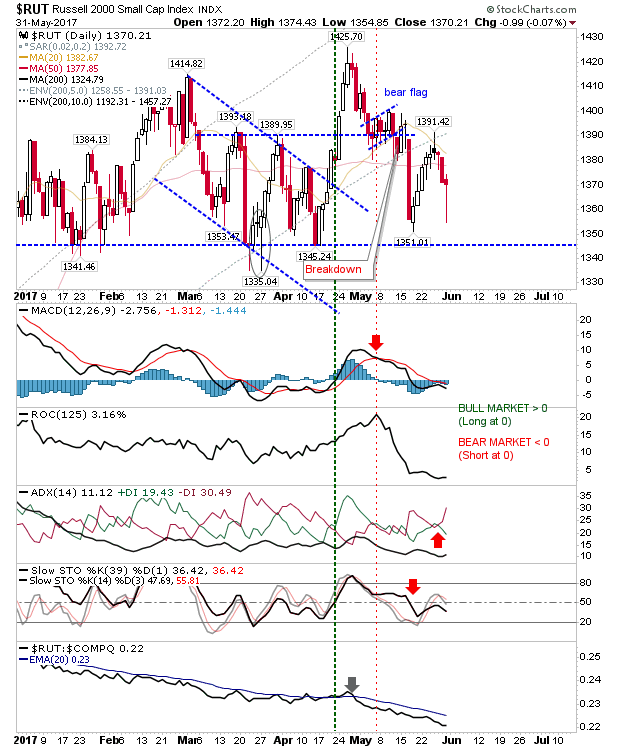

It was looking like it was going to be another tough day yesterday for the Russell 2000. However, buyers came in late in the day to bid this back up to near yesterday's highs. Not sure there is enough for a swing low as the broader trading range is the dominant action here. Aggressive players may look too long positions with a stop on a loss of yesterday's low.

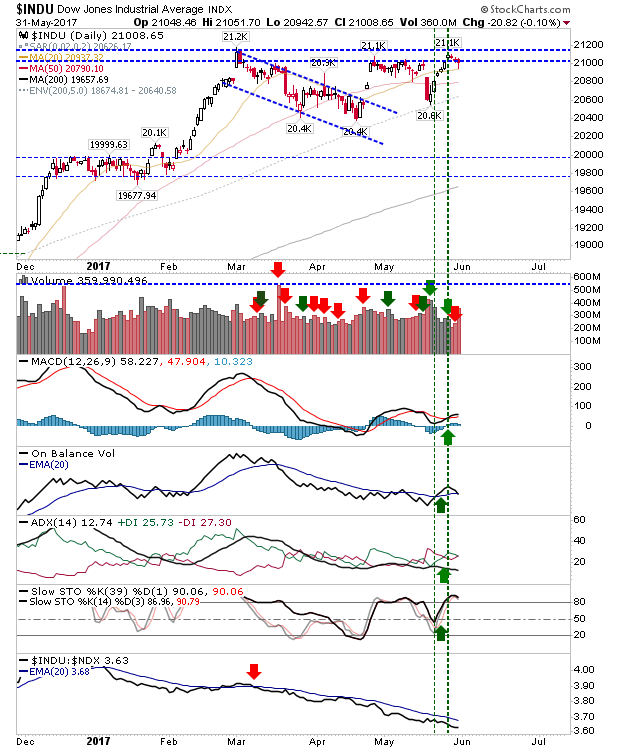

The Dow Jones was not so dramatic, but it too looks well placed for a breakout. Technicals are wavering a little with On-Balance-Volume on the verge of a 'sell' trigger, but others remain strong.

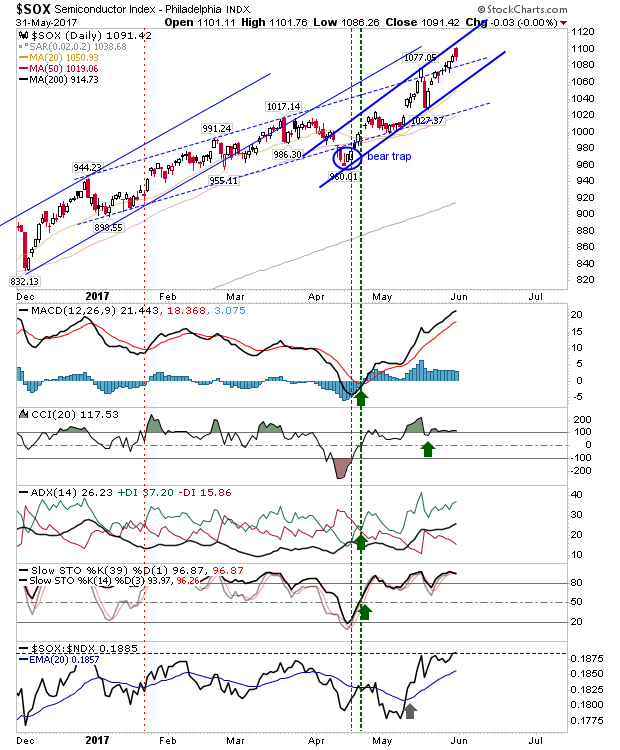

Shorts may want to take a look at the Semiconductor Index. Yesterday's action ranked as 'bearish cloud cover', but given the proximity to channel resistance it may be in a position to fall back some more. Supporting technicals are good, although I'm surprised relative performance to the NASDAQ 100 has remained pinned by marked horizontal resistance.

For today, Thursday, bulls may be the ones to gain most satisfaction as breakouts in the S&P and NASDAQ evolve. The Dow Jones may represent the value play while day traders could look to benefit from morning upside in the Russell 2000. Shorts should watch the Semiconductor Index for leads; stops on a break above yesterday's high.