Preparing for the meeting of the central bank of Norway

The next meeting of the central bank of Norway (Norges bank) will be held on March 21, 2019. Is there a possibility for the Norwegian krone to strengthen?

On the USD/NOK chart, it looks like a downward movement. Market participants expect a rate hike by the Norwegian central bank amid high inflation of 3% in February of the current year. Since June 2018, it has exceeded the target level of 2.5%. Let us note that Norges Bank, for the first time in the last 7 years, announced a possible rate hike in March 2019 from 0.75% to 1% at its October meeting last year. By the end of 2019, the rate can be once again raised to 1.25%. This is a positive factor for the Norwegian krone exchange rate.

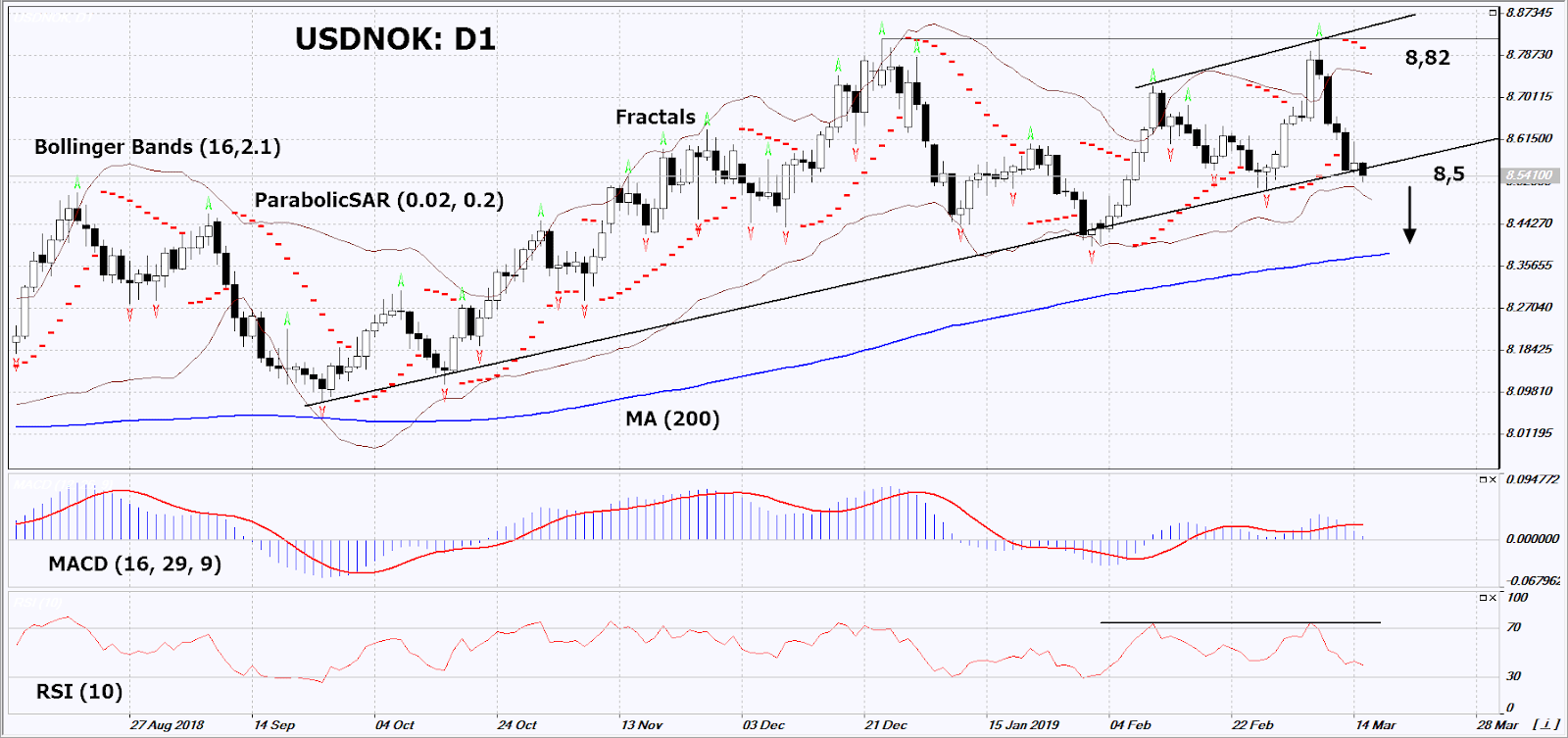

On the daily timeframe, USD/NOK: D1 approached the support trend of the rising trend. Before opening a sell position, it should be breached down. Most technical analysis indicators formed sell signals. A downward movement may be formed in case of a rate hike by the Norwegian Central Bank and negative data in the US.

-

The Parabolic Indicator gives a bearish signal.

-

The Bollinger® bands have narrowed, which indicates low volatility. Both Bollinger bands are titled down.

-

The RSI indicator is below 50. It has formed a weak, negative divergence.

-

The MACD indicator gives a bearish signal.

The bearish momentum may develop in case USD/NOK falls below is last fractal low and the lower Bollinger band at 8.5. This level may serve as an entry point. The initial stop loss may be placed above the last fractal high, the Parabolic signal and the upper Bollinger band at 8.82. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level (8.82) without reaching the order (8.5), we recommend to close the position: the market sustains internal changes that were not taken into account.

Technical Summary

- Position Sell

- Sell stop Below 8.5

- Stop loss Above 8.82

Market Overview

US stocks resumed gaining.

Dollar weakens after weaker than expected industrial data.

US stock market resumed advancing on Friday. S&P 500 rose 0.5% to 2822.48, closing 2.9% higher for the week. Dow Jones Industrial Average gained 0.5% to 25848.87. The Nasdaq added 0.8% to 7688.53. The dollar strengthening reversed on a weaker than expected reading of just 0.1% rise in US industrial production in February. The live dollar index data show the ICE (NYSE:ICE) US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.2% to 96.521 and is lower currently. Futures on US stock indexes point to higher openings today.

CAC 40 Outperforms Other European Indices

European stocks extended gains on Friday. Both the GBP/USD and EUR/USD resumed gaining with both pairs higher currently. The Stoxx Europe 600 Index gained 0.7%. The DAX 30 rose 0.9% to 11685.69. France’s CAC 40 advanced 1% and UK’s FTSE 100 added 0.2% to 7244.05.

Shanghai Composite Leads Asian Gains

Asian stock indices are higher today despite weekend reports the summit between President Donald Trump and China’s President Xi Jinping to sign an agreement ending the trade war may be pushed back to June. Nikkei rose 0.6% to 21584.5 with yen resuming its slide against the dollar. Chinese markets are gaining: the Shanghai Composite Index is up 2.5% and Hong Kong’s Hang Seng Index is 1.4% higher. Australia’s All Ordinaries Index added 0.3% as the Australian dollar accelerated its climb against the greenback.

Brent Higher

Brent futures prices are higher today supported by OPEC cuts. Prices ended lower on Friday despite Baker Hughes report that the number of active US rigs drilling for oil fell for a fourth straight week: Brent for May settlement fell 0.1% to close at $67.16 a barrel Friday, gaining 2.2% for the week.