Market Brief

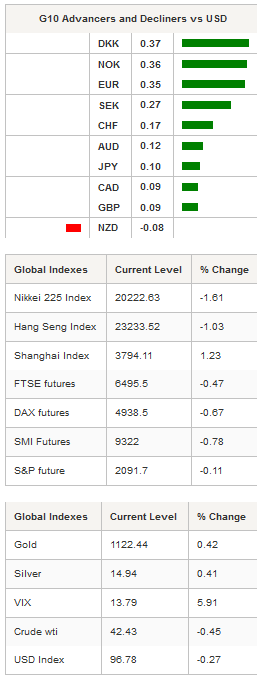

Japanese shares are heavily sold off in Tokyo as July trade balance fell short of expectations. The Nikkei lost 1.61% while the broader Topix index fell 1.42%. Japan recorded its biggest trade deficit since February (-¥428.5bn) with a reading of -¥268.1bn. This major drop is due to slowing exports, which grew 7.6%y/y from 9.5% a month earlier (5.2% consensus), while imports contracted less than forecasted, down -3.2%y/y versus -8.2% expected. However, the yen holds ground against the dollar and remains stable around 124.40. A strong support still lies at 123.78 (Fib 61.8% on June-July debasement), while on the upside, a resistance can be found at 125.86 (high from June 5). On the medium/long-term, we remain bearish on the yen versus the dollar given the diverging monetary policies between Japan and the US. We therefore expect USD/JPY around 130 by the end of the year.

Elsewhere, Chinese shares recover early losses. The Shanghai Composite and the Shenzhen Composite are up 1.23% and 2.19% respectively. In Hong Kong, the Hang Seng lost 1.03%, while in South Korea, the Kospi index is down 0.86%. Further south, Australian shares added 1.45% as Westpac leading index matched expectations, printing flat. AUD/USD recovers losses in early Asian session and is back around 0.7350, as traders continue to evaluate the implications of a weaker yuan on commodity currencies. In New Zealand, the equity market is up 0.71%, while the kiwi holds steady versus the US dollar. NZD/USD is still stuck under the 0.66 resistance and will need a serious boost to break that level to the upside.

Yesterday in UK, inflation was a massive surprise as core CPI jumped 1.2%y/y in July while analysts were looking for a reading closer to 0.9%. The headline printed at 0.1%y/y versus 0% median forecast. The release strongly increases the odds of a rate hike by the BoE in the first quarter of 2016, but more importantly, the bank may increase rates at a faster pace straight after. GBP/USD jumped 1% to 1.5717 before stabilising around 1.5660. The cable converted the previous resistance standing at 1.5640 (Fib 38.2% on June rally) into a support. On the upside, it is wide open up to 1.5790 (previous high), then 1.5930. Since the market expects the Fed to hike rate this year, we favour EUR/GBP to play the BoE rate hike. It’s all about monetary policy divergence, again.

The minutes from the July FOMC meeting will be released later today and it is definitely the hot topic of the day together with July inflation report. Headline CPI is expected at 0.2%y/y, up from 0.1% a month earlier while on a month-over-month basis markets expect a reading of 0.2% versus 0.3% in June. According to median forecast, core inflation should remain stable at 1.8%y/y or 0.2%m/m. Should we expect the USD to explode on inflation report, like the GBP did? In our opinion, the Fed emphasised several times that it is monitoring closely the labour to adjust the timing of the first rate hike together with inflation level. We therefore expect limited reactions.

Today's Calendar Estimates Previous Country / GMT SZ Bloomberg Aug. Switzerland Economic Survey - - CHF / 07:15 EC Jun ECB Current Account SA - 18.0B EUR / 08:00 EC Jun Current Account NSA - 3.4B EUR / 08:00 SA Jul CPI Core MoM 0.50% 0.30% ZAR / 08:00 SA Jul CPI Core YoY 5.50% 5.50% ZAR / 08:00 SA Jul CPI YoY 5.00% 4.70% ZAR / 08:00 SA Jul CPI MoM 1.10% 0.40% ZAR / 08:00 IT Jun Current Account Balance - 2600M EUR / 08:30 EC Jun Construction Output MoM - 0.30% EUR / 09:00 EC Jun Construction Output YoY - 0.30% EUR / 09:00 US Aug 14 MBA Mortgage Applications - 0.10% USD / 11:00 SA Jun Retail Sales Constant YoY 3.30% 2.40% ZAR / 11:00 SA Jun Retail Sales MoM 0.20% 0.10% ZAR / 11:00 BZ Jun Economic Activity MoM -0.50% 0.03% BRL / 11:30 BZ Jun Economic Activity YoY -1.30% -4.75% BRL / 11:30 US Jul CPI MoM 0.20% 0.30% USD / 12:30 US Jul CPI Ex Food and Energy MoM 0.20% 0.20% USD / 12:30 US Jul CPI YoY 0.20% 0.10% USD / 12:30 US Jul CPI Ex Food and Energy YoY 1.80% 1.80% USD / 12:30 US Jul CPI Index NSA 238.752 238.638 USD / 12:30 US Jul CPI Core Index SA 242.552 242.193 USD / 12:30 US Jul Real Avg Weekly Earnings YoY - 1.80% USD / 12:30 BZ Currency Flows Weekly - - BRL / 15:30 US U.S. Fed Releases Minutes from July 28-29 FOMC Meeting - - USD / 18:00 BZ Jul Formal Job Creation Total -115800 -111199 BRL / 22:00 Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.1068

S 1: 1.0809

S 2: 1.0660

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5682

S 1: 1.5330

S 2: 1.5171

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 124.23

S 1: 120.41

S 2: 118.89

USD/CHF

R 2: 1.0129

R 1: 0.9984

CURRENT: 0.9751

S 1: 0.9571

S 2: 0.9151