Market Brief

The first batch of economic data from the US was roughly in line with market expectations. Traders will therefore have to wait for Friday’s NFPs to have a little more clarity on the timing of the first rate hike by the Federal Reserve. Personal income (s.a.) edged down to 0.3%m/m in August, lower than median estimates of 0.4% and the revised increase of 0.5% in July. Personal spending rose 0.4%m/m, beating an anticipated 0.3%. On the inflation front, core personal consumption expenditure improved slightly in August, easing some of the Fed’s worries. The gauge moved back to 1.3%y/y from 1.2% a month earlier. However, this is not good enough in our opinion as the gauge is still far below the 2% threshold. Finally, pending home sales contracted -1.4%m/m in August versus 0.4% median forecast and 0.5% in July, while the Dallas Fed manufacturing outlook stayed in negative territory, printing at -9.5 in August, from -15.8 the previous month.

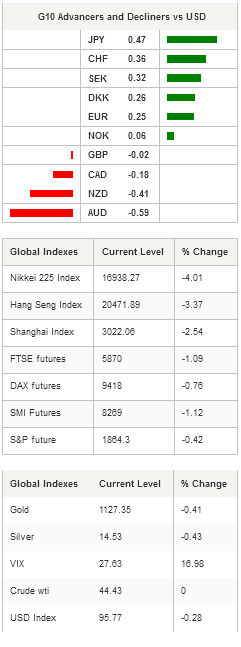

All in all, the data failed to provide support to the greenback as Fed’s Dudley recalled that the US central bank’s policy remains data dependent. The dollar index has lost 0.70% since yesterday and continues to move lower as I write. EUR/USD is heading back towards the next resistance standing at 1.1296 (high from September 24th) as dollar bulls remain on the sideline. On the downside, the low from September 3rd at 1.1087 will continue to act as a strong support.

In Asia, the equity sell-off continues as concerns about global growth persist. The Shanghai Composite fell -2.54% while the Shenzhen Composite retreated -2.29%. Japanese shares erased all their gains for the year: the Nikkei 225 is down -4.01%, while the broader TOPIX index fell -4.39%. In Hong Kong the Hang Seng is down 3.37%, while in Australia the local gauge is down 3.82%. European futures are no exception this morning. The DAX is down -0.76%, the CAC 40 -1.06%, the Euro Stoxx 50 -1.09% and the SMI -1.12%.

As expected, the respite for the Brazilian real has proven to be short-lived. The BRL fell 3.26% against the greenback in Sao Paulo yesterday with the USD/BRL back above the BRL4.00 threshold as investors await concrete steps from Brazilian lawmakers to shore up the fiscal deficit.

Yesterday in Switzerland, the SNB’s weekly report indicated that sight deposits continues to increase at a steady pace. Total sight deposits increased at an average pace of Sfr432mn per week during the month of September, reaching a total of Sfr465.6bn in the week ending September 25th, up from Sfr464.9bn in the previous week. Foreign and other deposits on sight continued to fall substantially in September at a weekly pace of Sfr1.8bn, reaching Sfr60.5bn, the lowest level since February as foreign institutions withdraw funds. EUR/CHF now holds ground slightly below the 1.10 threshold while USD/CHF moves lower due to dollar weakness.

Currency Tech

EUR/USD

R 2: 1.1561

R 1: 1.1330

CURRENT: 1.1268

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5659

R 1: 1.5383

CURRENT: 1.5173

S 1: 1.5136

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.40

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9705

S 1: 0.9513

S 2: 0.9259