Here are the latest developments in global markets:

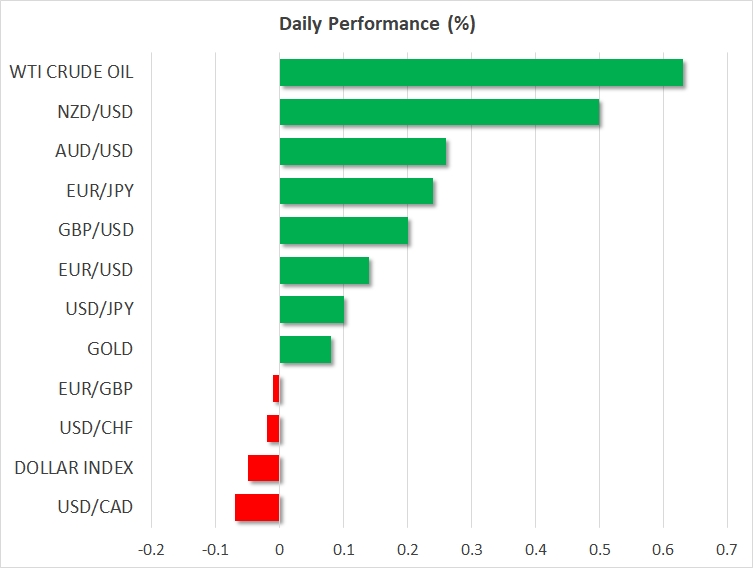

- FOREX: The dollar was slightly down against a basket of currencies after posting gains on Friday following the announcement that House and Senate Republicans have found common ground on the front of tax legislation. The antipodeans were again gaining ground versus the greenback.

- STOCKS: The Nikkei 225 added 1.55% and the Hang Seng was higher by 1.0% on a day when Asian equities were mostly on the rise on the back of positive sentiment following US tax reform momentum. Euro Stoxx 50 futures were up by 0.7% at 0725 GMT, while Dow, S&P 500 and Nasdaq 100 contracts traded higher by 0.45%, 0.3% and 0.4% respectively.

- COMMODITIES: WTI and Brent crude were both up by 0.6%, at $57.66 and $63.63 per barrel respectively. Gold was slightly higher at $1,256.20 an ounce.

Major movers: Dollar not much changed as markets await tax vote; antipodeans on the rise

The dollar index was down, though not by much, trading at 93.87. Following the latest developments on tax reform, it looks increasingly likely that Congress will pass the relevant bill this week. The bill will subsequently be send to President Trump for it to be signed.

USD/JPY was 0.1% higher at 112.68, though the US currency was losing some ground relative to the euro and the pound. EUR/USD and GBP/USD traded up by 0.1% and 0.2%, at 1.1770 and 1.3345 respectively. Still, both pairs were at a distance to recently tracked highs. Long-term Treasury yields not edging higher, at least not to a significant extent, also didn’t allow the dollar to post stronger gains.

Towards the end of last week, Germany’s Social Democrats agreed to get into talks with Merkel’s Christian Democrats on forming a government. In the absence of anything concrete and given that talks are expected to begin with the start of the new year, eurozone’s common currency didn’t get much of a boost on the back of the news.

The antipodean currencies maintained last week’s positive momentum, a week during which the aussie added 1.9% and the kiwi 2.2% versus the greenback. AUD/USD and USD/NZD were up by 0.3% and 0.5% on the day, at 0.7024 and 0.7667 respectively. The aussie was trading around one-month high levels and the kiwi around two-month high levels.

In emerging markets, USD/ZAR retreated sharply on Friday – and was last trading close to Friday’s low at 13.1268 – on relief that South African Deputy President Cyril Ramaphosa was likely to be nominated as the next chief of the African National Congress, South Africa’s ruling party. Investors feared that Nkosazana Dlamini-Zuma, the ex-wife of South African President Jacob Zuma who was involved in numerous scandals, could be ANC’s next leader and likely the country’s next president after elections take place in 2019. Earlier in the day, dollar/rand fell below the 13 handle to record its lowest in three months.

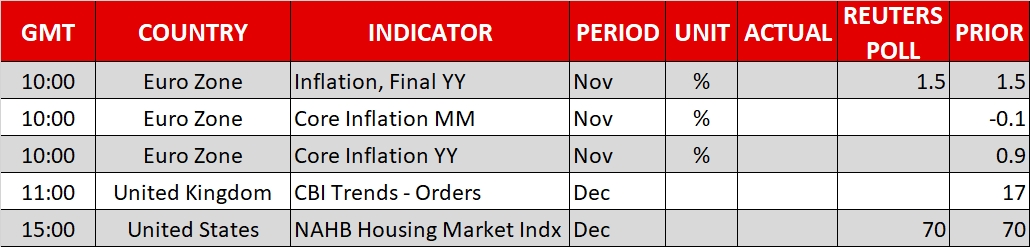

Day ahead: May to propose plans on transition period; EU final inflation numbers ahead

Eurozone’s final inflation figures for the month of November due at 1000 GMT will be gathering attention, with analysts expecting consumer prices to keep growing below the ECB’s target of 2.0%. Annually, headline CPI is anticipated to inch up by 0.1 percentage points to 1.5% y/y and remain flat on a monthly basis at 0.1% m/m.

December’s industrial trends measured by the British CBI business organization will follow at 1100 GMT. Recall that in November, the index which tracks economic expectations of the manufacturing executives in the UK, surprisingly bounced by 19 points to +17, reaching its highest since 1988.

In other news out of the UK, the Prime Minister, Theresa May, who managed to break the deadlock in Brexit negotiations at the two-day EU summit in Brussels last week, will head to the British parliament on Monday to inform lawmakers about her latest talks with the EU and present her plans on the transition period which aim to limit a cliff-edge scenario for individuals and businesses after the country departs from the EU block.

In the US, eyes will be on the tax legislation as markets remain confident that the proposed-by- Republicans tax cuts will pass the Congress as soon as this Tuesday after the Senate and the House lawmakers added the final touches on tax overhaul on Friday. Furthermore, Republicans hope for the bill to be signed by the US President, Donald Trump, by the end of this week.

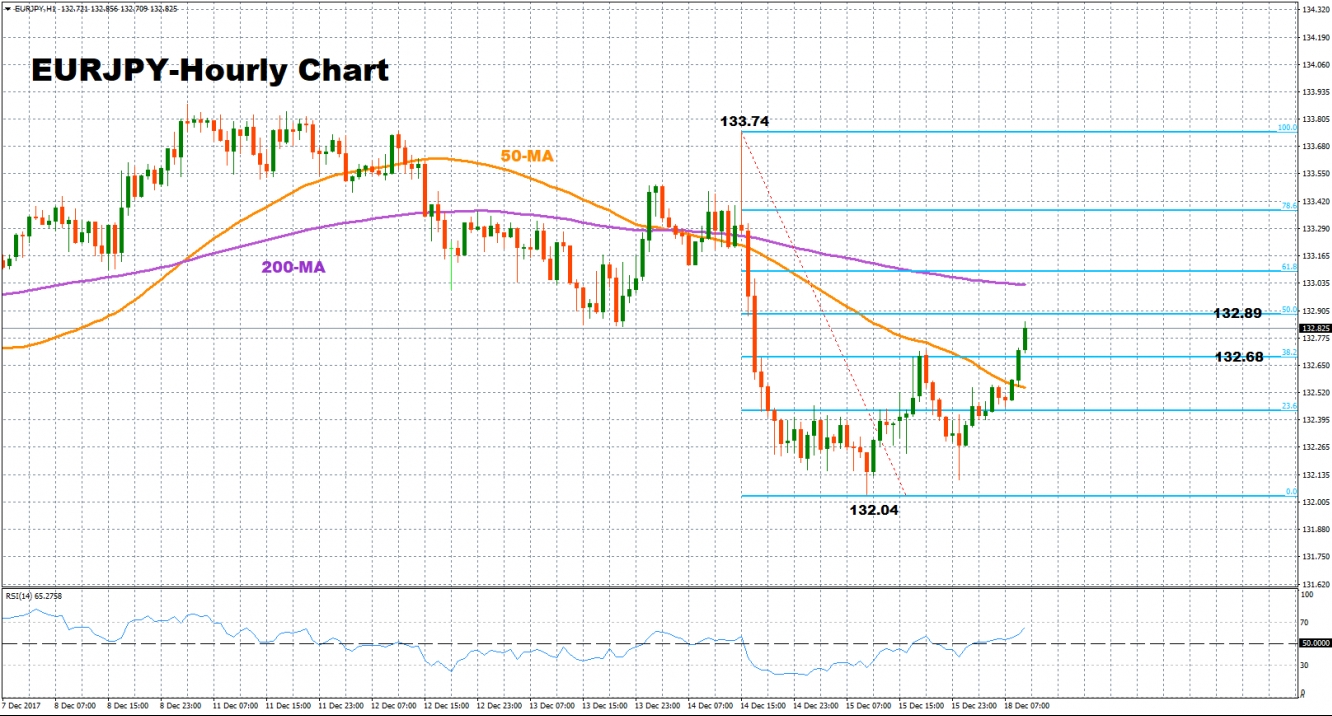

Technical Analysis: EUR/JPY bullish in the very short-term

EUR/JPY stretched to the upside on Monday, deviating from Friday’s low of 132.10 and consequently painting a bullish picture in the very short-term. The RSI supports this view as the indicator is heading higher.

Better than expected inflation figures out of the eurozone could push prices towards 132.89 which is the 50% Fibonacci of the aforementioned downleg. From here steeper increases could also find strong resistance at the 133 key-level where the 200-day moving average and the 61.8% Fibonacci also lay.

On the downside, immediate support could emerge at the 38.2% Fibonacci at 132.68 before the current level of the 50-day MA at 132.54 and the 132 key-point come into view.