Dow, S&P 500 slide while Nasdaq edges higher

US stocks ended lower on Friday on corporate tax cuts delay concerns. The dollar weakened further as consumer sentiment deteriorated in November: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slid 0.1% to 94.373. S&P 500 slipped 0.1% to 2582.28 led by healthcare shares down 0.7%. The US broad market index lost 0.2% for the week. Dow Jones Industrial Average pulled back 0.2% to 23422.21. The NASDAQ Composite meanwhile edged up less than 0.1% to 6750.94.

European stock indices retreat

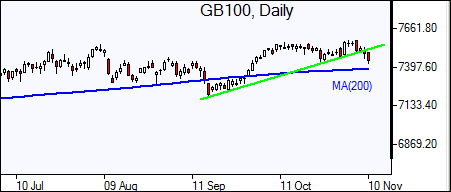

European stocks extended losses on Friday led by car maker shares. Both the euro and British Pound added to the previous session gains against the dollar.The Stoxx Europe 600 index ended the session down 0.4%. The DAX 30 slipped 0.4% to 13127.47. France’s CAC 40 lost 0.5% and UK’s FTSE 100 fell 0.7% to 7432.99. Indices opened higher today.

Asian indices mixed

Asian stock indices are mixed today. Nikkei ended 1.3% lower at 22380.99 as yen pared previous session losses against the dollar. Chinese stocks are higher: the Shanghai Composite Index is up 0.5% and Hong Kong’s Hang Seng Index is 0.4% higher. Australia’s ASX All Ordinaries is down 0.1% despite the continued decline in the Australian dollar against the greenback.

Oil lower

Oil futures prices are lower today as a rebalancing of global market supported by OPEC output cut agreement continues. Prices fell Friday on Baker Hughes report US oil rig count rose last week: January Brent fell 0.6% to $63.52 a barrel on Friday.