US jobless rate hits 17-year low

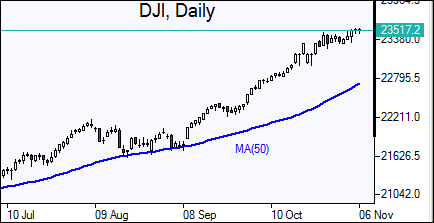

US stocks ended higher on Friday on the strong jobs report. The dollar strengthened as jobless rate declined from 4.2% to 4.1% in October: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, added 0.2% to 94.914. S&P 500 gained 0.3% to 2587.84 led by technology shares with Apple shares (NASDAQ:AAPL) gaining 2.6% on strong earnings results. The US broad market index added 0.26% for the week. Dow Jones industrial average added 0.1% to 23539.19. The NASDAQ Composite jumped 0.7% to 6764.44.

European stocks advance

European stock indices closed higher on Friday with market sentiment supported by positive reports. The euro fell against the dollar while British Pound pared some of Thursday’s 1.5% loss. The Stoxx Europe 600 index ended the session up 0.3%. The DAX 30 rose 0.3% to 13478.86. France’s CAC 40 gained 0.1% and UK’s FTSE 100 added 0.1% to 7560.35. Indices opened 0.1%-0.2% lower today.

Asian indices higher

Asian stock indices are mostly higher today. Nikkei ended flat at 22548.35 as yen accelerated the slide against the dollar after Bank of Japan governor Kuroda said the central bank will be patient with the stimulus program. Chinese stocks are higher in choppy trade following China central bank governor’s warning about rising risks to China’s financial system: the Shanghai Composite Index is up 0.5% and Hong Kong’s Hang Seng Index is 0.1% higher. Australia’s ASX All Ordinaries is down 0.1% with a steady Australian dollar against the greenback.

Oil rally intact

Oil futures prices are higher today on signs of global market rebalancing. Prices rose Friday on Baker Hughes report US oil rig count fell last week as US crude inventories declined: December Brent jumped 2.4% to $62.07 a barrel on Friday.