S&P 500 ends week higher

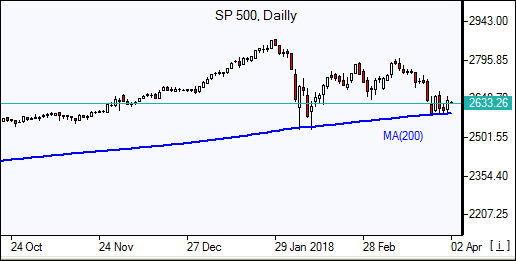

US stock indices closed sharply higher Thursday ending higher the holiday shortened week. S&P 500 gained 1.4% to 2642 led by technology stocks. SP 500 advanced 2.1% for the week, but closed down for the month. Dow Jones industrial average added 1.2% to 24143. The NASDAQ Composite rallied 1.6% to 7063. The dollar turned lower Friday: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.1% to 89.96. Stock indices futures point to lower openings today.

European markets closed

European stocks ended higher on Thursday ahead of Good Friday holiday. With stock exchanges closed Friday the euro turned higher against the dollar while British Pound’s was little changed. The Stoxx Europe 600 index ended March down 2.3%. European markets are closed today.

China institutes retaliatory penalties for US goods

Asian stocks are mostly lower today amid US-China trade war concerns after China instituted retaliatory penalties for about 130 US imports ranging from 15% on fruit and 25% on pork. Nikkei lost 0.1% to 21399.50 despite yen weakening against the dollar as confidence among Japan's large manufacturers weakened for the first time in two years in the January-March quarter, according to Tankan survey. Chinese stocks are lower as the Caixin private gauge showed weaker manufacturing activity for March: the Shanghai Composite Index is down 0.2%. Hong Kong’s and Australia’s markets are closed today.

Brent rising

Brent futures prices are extending gains today supported by lower US drilling activity and concerns US may re-impose Iran sanctions. The Baker Hughes reported US active rig count fell by 7 to 797, first drop in three weeks. Prices rose Thursday: Brent for May settlement gained 1.1% to close at $70.27 a barrel.