March jobs growth sharply lower

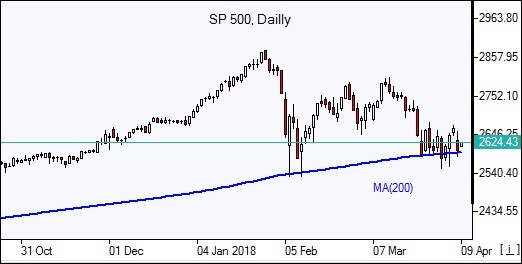

US stock indices closed sharply lower Friday as China responded saying it would counter US protectionism “to the end, and at any cost” after President Trump said late Thursday he was considering imposing tariffs on an additional $100 billion in imports from China. S&P 500 fell 2.2% to 2604 led by industrial and financial stocks, with March jobs growth sharply lower. SP 500 retreated 1.4% for the week. Dow Jones industrial average dropped 2.3% to 23932.76. The NASDAQ Composite lost 2.3% to 6915.11. The dollar turned lower Friday: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.4% to 90.07. Stock indices futures point to mixed openings today.

European stocks fall

European stocks reversed gains on Friday as US and China trade war rhetoric escalated. The Stoxx Europe 600 Index slid 0.4%, gaining 1.1% for the week. Both the euro and British Pound turned higher against the dollar. The DAX 30 dropped 0.5% to 12241.27. France’s CAC 40 lost 0.4% and UK’s FTSE 100 slipped 0.1% to 7190.57. Indices opened 0.2% - 0.6% higher today.Asian indices mostly higher

Asian stock indices are mostly higher today in cautious trade amid US-China trade war concerns. Nikkei rose 0.6% to 21686.50 helped by yen weakening against the dollar. Chinese stocks are a gaining: the Shanghai Composite Index is up 0.3% and Hong Kong’s Hang Seng Index is 1.3% higher. Australia’s All Ordinaries Index is up 0.4% as Australian dollar is retreating against the greenback.

Brent advances

Brent futures prices are rising today. Prices fell Friday as the Baker Hughes reported US active rig count rose by 11 to 808, the highest number since March 2015. Brent for June settlement fell 1.8% to close at $67.11 a barrel Friday.