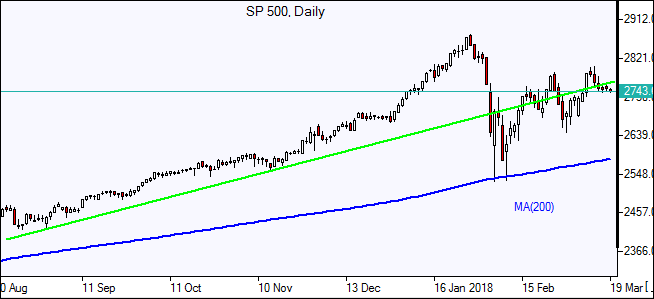

S&P 500 breaks a four-day losing streak

US stock indices ended higher on Friday supported by the report industrial production rose 1.1% in February, its fastest pace in four months. S&P 500 rose 0.2% to 2752.01. It lost 1.2% for the week. Dow Jones industrial average climbed 0.3% to 24946.51. The NASDAQ Composite advanced 0.2% to 7481.99. The dollar strengthening persisted: the live dollar index data show the ICE, a measure of the dollar’s strength against a basket of six rival currencies, edged up 0.1% to 90.162. Stock indices futures indicate mixed openings today.

European stocks advance

European stocks extended gains on Friday as investor optimism was lifted by positive US data. The euro's slide against the dollar continued after report eurozone inflation fell to 1.1% in February from an initial estimate of 1.2%. British pound edged higher against the dollar. The Stoxx Europe 600 index rose 0.2%, ending down 0.1% for the week. The DAX 30 gained 0.4% to 12389.58. France’s CAC 40 rose 0.3% and UK’s FTSE 100 added 0.3% to 7164.14. Indices opened flat to 0.4% lower today.

Asian indices mostly higher

Asian stock indices are mostly higher today after erasing early losses. Nikkei lost 1% to 21451.50 weighed by continued yen strengthening against the dollar. Chinese stocks are rising after news Yi Gang, US-trained economist, was appointed to lead China's central bank: the Shanghai Composite Index is up 0.3% and Hong Kong’s Hang Seng Index is 0.1% higher. Australia’s ASX All Ordinaries is up 0.2% as the Aussie continued weakening against the greenback.

Brent up

Brent futures prices are higher today with concerns US output is set to rise as the count of active US oil rigs increased by 4 last week limiting the gains. Prices rose Friday on expectations for growth in global crude demand. In May, Brent rose 1.7% to $66.21 a barrel on Friday. It gained 1.1% in the week.