Friday May 4: Five things the markets are talking about

Global markets attention now turns to the health of the US. economy, with wages growth and jobs data due in a few hours (08:30 am EDT).

On Wednesday, the Federal Reserve kept rates on hold as expected, admitting inflation is near target without suggesting any need to accelerate its gradual hiking path.

So, what will US non-farm payroll (NFP) tell us?

February and March brought some volatility to the payrolls growth trend, but the average of the two suggested no real change.

With other data appearing to ‘normalize’ following the transitory effect of last year’s storms and hurricanes, the consensus expects a return to a steadier trend, with payrolls up +200k this month.

For the other headline numbers, the market is looking for the unemployment rate to finally slip to +4.0% (something the consensus had looked for the prior two months), and average hourly earnings to be up +0.2%. The workweek would be +34.5 hours for the fifth consecutive month.

Note: The Fed is generally pleased to see inflation getting back to its target, but earnings growth remains well below pre-recession rates. They are apparently willing to let it accelerate extremely gradually.

Elsewhere, for now, Sino-US trade talks continue, even after both sides appeared to dial back their expectations.

Note: US and China said to have reached consensus on some issues in trade talks but have areas of major disagreements in others that still exist

1. Stocks mixed results

Stocks in Europe have found some traction despite a decline in Asia as investors assess the implications of ongoing trade talks between the US and China.

Note: Japanese markets were closed Friday for a public holiday.

Down-under, Aussie credit-market concerns sent yield-sensitive utilities stocks down -1.3%, pushing the S&P/ASX 200 index -0.5% lower. The benchmark index has ended its five-day winning streak. In South Korea, the KOSPI fell -0.7% because of weakness in financial stocks and a near-2% drop by index heavyweight Samsung (KS:005930).

In Hong Kong, stock indexes continued to lag behind on Friday on worries about US/China trade tensions and on speculation about Chinese money being rerouted to invest in IPO. The Hang Seng Index, which has fallen in six of the past nine trading days, was -1.2% and achieved its sixth weekly drop in the past seven-weeks.

In China, stocks ended lower overnight, capping a listless week, as investors anxiously await the outcome of the Sino-US trade talks being held in Beijing. The blue-chip CSI 300 ended down -0.5%, while the Shanghai Composite Index closed -0.3%.

In Europe, regional bourses trade mixed ahead of US jobs data. The French CAC underperforms weighed down by banking names missing estimates.

US stocks are set to open in the ‘red’ (-0.1%).

Indices: STOXX 600 +0.2% at 385.5, FTSE 100 +0.5% at 7537, DAX +0.2% at 12713, CAC 40 -0.3% at 5487, IBEX-35 +0.2% at 10058, FTSE MIB +0.4% at 24157, SMI +0.4% at 8878, S&P 500 Futures -0.1%

2. Oil steady as US decision on Iran looms, gold lower

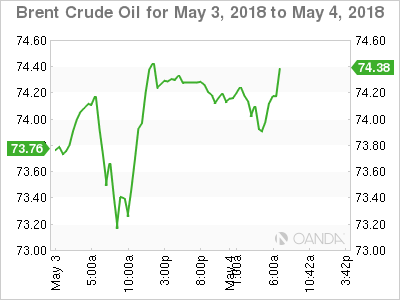

Oil prices have steadied overnight, consolidating after recent gains, as global supplies remained tight and the market waits for news on possible new US. sanctions against Iran.

Brent crude oil is down -30c at +$73.32 a barrel. The benchmark contract hit a four-year closing high of +$75.17 on Monday. US light crude (WTI) is -20c down at +$68.23.

Oil traders are concerned that US sanctions against Iran could cut oil supplies. President Donald Trump has until May 12 to decide whether to restore the sanctions on Iran that was lifted after an agreement over its disputed nuclear program.

Also pressuring prices this week was Wednesday’s EIA report showing US crude inventories increasing by +6.2m barrels to +435.96m in the week to April 27, the highest level in 2018.

And more US oil will likely flow as US drillers’ added +5 oil rigs looking for new production in the week to April 27, according to Baker Hughes.

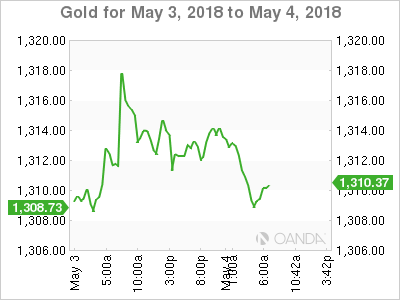

Ahead of the US open, gold prices have turned negative on a firmer dollar, while the market focuses on this morning’s US jobs data for a fresh catalyst. Spot gold is down -0.1% at +$1,309.93 per ounce and is heading for its third consecutive weekly decline.

3. Sovereign yields decline on risk aversion

After US 10-year Treasury yields briefly crossed the psychological +3% handle last week, equity investors have been worrying that a faster pace of monetary tightening could make stocks less attractive compared with bonds. However, since then, heightened geo-political risk aversion has supported Treasury prices and flattened the US curve again.

Note: The Fed this week signalled that they might allow a slight “overshoot in inflation,” which is now close to officials’ +2% target.

In the UK, despite the below-forecast PMI index for April on the UK’s important services sector, the BoE could still “possibly” hike interest rates next week (May 10), but the consensus is betting against it. Too many, it would be “out of character” for the normally cautious BoE to add policy uncertainty with a surprise policy move.

Note: Futures prices are pricing in the next UK hike for November on clearer evidence of a sustained rebound in GDP growth. However, if Q2 GDP and wage growth surprise to the upside, fixed income could reprice for a August hike.

The yield on US 10-year Treasuries have declined -1 bps to +2.94%, the lowest in more than two weeks. In Germany, the 10-year Bund yield has decreased less than -1 bps to +0.53%, the lowest in a fortnight, while in the UK, the 10-year Gilt yield increased less than -1 bps to +1.39%.

4. Dollar steady ahead of jobs report

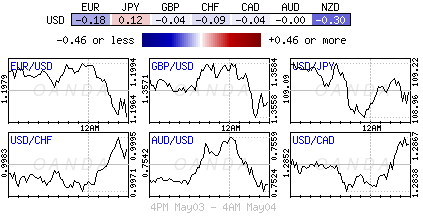

The USD is holding onto its slight gains atop of this year highs against a plethora of G7 and Emerging Market currencies. Monetary policy divergence had remained the overall theme in recent months – divergence amongst the ECB, BoJ and FOMC is the biggest support.

EUR/USD (€1.1960) remains below the psychological €1.20 level as major Euro services PMI data and retail sales disappointed earlier this morning. The single unit is also being penalized by the recent ECB cautiousness on ‘normalization.’

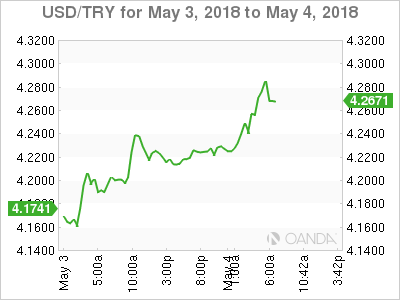

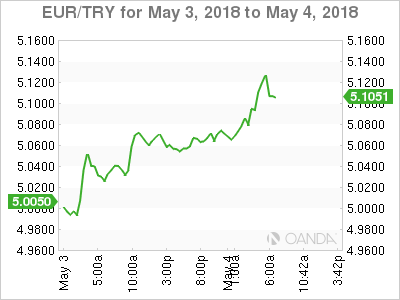

Elsewhere, Emerging Market (EM) currencies continue to experience turmoil. In Argentina, the central bank hiked rates by another +300 bps for the second time in a week to stem capital outflows while the Turkish Lira (TRY) continues to probe record lows against the USD. Fixed income dealers believe that Turkish monetary policy remains too loose to deal with an overheating economy.

5. Euro retail sales and PMI’s disappoint

Data this morning showed that March’s +0.1% rise in eurozone retail sales was weaker than the consensus forecast of a +0.5% increase.

Note: Market expectations were lowered after disappointing German retail sales data published earlier this week.

Other data showed that April’s final euro-zone PMI’s suggest that the slowdown in GDP growth in Q1 is not the start of marked downturn. The final Composite PMI was revised down slightly from the flash estimate of 55.2 to 55.1, weaker than the Q1 average of 57.0. But on past form, the PMI is still consistent with quarterly GDP growth of about +0.5%.

March’s euro-zone retail sales data suggest that consumer spending had a weak Q1 and April’s composite PMI implies that the pace of GDP growth is unlikely to fully rebound after a slow Q1.