Tuesday May 1: Five things the markets are talking about

Global equities again nudge a tad higher during a holiday shortened trading week in which many markets across both Europe and Asia are shut in observance of Labor Day.

The ‘mighty’ dollar is again supported, while sovereign bond prices edge lower, and most commodities slip. One exception is crude oil, which found support, stimulated by Israel’s accusation that Iran has a secret plan to continue building nuclear weapons.

Note: Markets are closed in Germany, France, Italy, Spain, China, Hong Kong, Singapore, India, and a host of other countries.

As the month of May gets underway, focus turns to central bank policy and economic data. The Federal Open Market Committee begins its two-day meeting today with a rate decision tomorrow (2:00 pm EDT).

Investors and dealers will closely watch for whether the Fed will make more explicit its threat to hike interest rates another three times this year.

On Tap: Canada will release its latest GDP numbers later this morning (08:30 am EDT).

1. Stocks find limited support in quiet trading

Market participation in Asia remained limited given holidays in China, Hong Kong, S. Korea, Singapore and Taiwan.

In Japan, the Nikkei eked out modest gains in holiday-thinned trade overnight, supported by buying in index-heavy stocks. The Nikkei ended +0.2% higher, while the broader Topix dropped -0.2%.

Down-under, Aussie shares firmed to a seven-week high as financials rally. The S&P/ASX 200 index rose +0.5% at the close of trade. The benchmark added +0.7% on Friday.

Note: The Reserve Bank of Australia (RBA) sees 2018 and 2019 GDP growth to average a bit above +3% vs. +2.4% in 2017 and also affirmed that CPI will be a bit above +2% for this year. There was little reaction to the central banks statement (see below) as dealers are looking ahead to the bank’s Friday’s upcoming quarterly statement on monetary policy (May 4).

In Europe, regional bourses are mostly shut today in observance of May Day Bank Holiday with the exception of the UK, Ireland and Denmark. The FTSE trades slightly higher following positive results from BP, which reported profits slightly ahead of consensus.

US stocks are set to open in the ‘red’ (-0.1%).

Indices: FTSE 100 +0.2% at 7524, S&P 500 Futures -0.1%

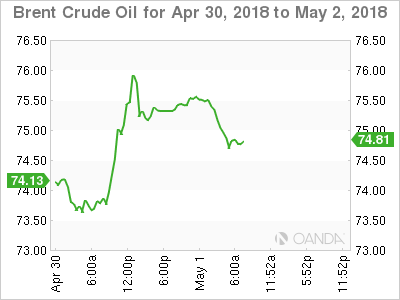

2. Oil pares gains, market supported by Iran worries, gold lower

Oil prices held steady overnight as the dollar remained near a four-month high, with crude supported by worries that President Trump may pull out of the Iran nuclear deal.

Brent crude oil for new July delivery is up +1c at +$74.70, while US West Texas Intermediate crude (WTI) for June delivery is up +2c at +$68.59 a barrel, after settling up +47c yesterday.

Note: Brent June contract expired on Monday, settling up +53c at +$75.17.

Oil prices have been better bid this week after Israeli Prime Minister Netanyahu stepped up pressure on the US to pull out of the 2015 nuclear deal with Iran – he presented so called evidence of a secret Iranian nuclear weapons program.

Temporarily capping prices is the rise in US production. According to Baker Hughes data on Friday, US drillers added five oil rigs in the week to April 27, bringing the total count to +825, the highest level since March 2015.

Note: US President Trump has until May 12 to decide whether to restore the sanctions on Iran that were lifted after an agreement over its disputed nuclear program.

Gold prices have inched lower ahead of the US open, trading atop of its six-week low touched yesterday, as the US dollar holds firm atop of its four month highs. Spot gold has fallen -0.1% to +$1,314.00 per ounce. US gold futures for June delivery eased 0.3 percent to $1,315.10 per ounce.

Note: Prices slipped to +$1,310.11 on Monday, their lowest since March 21.

3. RBA on hold, credit crunch fears grow

Earlier this morning, the RBA left its cash rate target at +1.5% as expected, and continued to point to a solid pace of GDP growth this year and next.

Nevertheless, a number of analysts are warning of a mini housing crash – significant house price falls over coming years – which would put a dent in confidence, spending and growth. This in turn, would force many banks to adopt conservative lending practices, just like in Canada and Ireland.

In Europe, a softening in regional economic data, and signs that inflationary pressures remain subdued, has been encouraging the European Central Bank (ECB) to hold off from raising interest rates until well into next year, and therefor supported the bond markets in recent weeks.

The yield on 10-Year Treasuries have increased +1 bps to +2.96%, while in the UK the 10-Year Gilt yield backed up +1 bps to +1.418%, the biggest advance in more than a week.

4. Dollar in demand

The ‘mighty’ US dollar continues its firm tone against G10 currency pairs. The driver behind the greenback’s strength has been the divergence between economic data in the US and the rest of the world. This has led to higher rate expectations in the US in the medium term.

The EUR/USD (£1.2032) continues to probe its four-month lows ahead of the psychological €1.2000 handle.

GBP/USD (£1.3693) is trading below £1.3700 handle and about 100 pips from its key support level of £1.3600, which was the breakout level from January. UK data (see below) continues to disappoint (Apr PMI and Mar Mortgage Lending data miss expectations) as any BoE rate hike for this year seems to be priced out.

USD/JPY (¥109.62) is firmer by +0.35% just ahead of the NY open.

5. UK consumer borrowing falls to a five-year low

Data this morning showed that UK citizens cut back sharply on new borrowing in March, a fresh sign of economic weakness that makes it less likely that the BoE will hike later this month.

Total new lending to households fell to +£4.3B from +£5.5B in February.

Digging deeper, mortgage lending was slightly up from January at +£4.0B, but borrowing through credit cards and other forms of unsecured loans fell to +£254m from +£1B. It was the lowest level in six years.

Note: In February, the BoE signalled it was considering a rise in its key interest rate as early as a policy announcement scheduled for May 10. However, very weak growth at the start of the year has persuaded fixed income to reprice their curves to show a rate hike in late 2018.