Market Brief

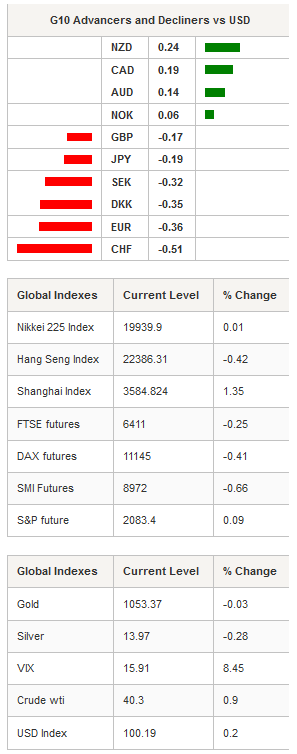

After a very quiet start of the week, we finally got some volatility in the FX market yesterday as traders reacted to Janet Yellen comments. It seems now that a rate hike in December is inevitable according to the latest comments from Fed members. In the US yesterday, Atlanta Fed Chief Lockhart said that “the case for liftoff [in December] is compelling”, adding that “the economy doesn’t require emergency treatment anymore”. For her part, Janet Yellen prepared the ground for “normalization”, arguing: “the economy has come a long way toward the FOMC’s objectives of maximum employment and price stability”. However, it appeared that the market was expecting more hawkish comments from the Federal Reserve Chairwoman as the US dollar lost ground against of G10 currencies. The volatility is still very low ahead of this afternoon ECB decision and EUR/USD is back below the 1.06 threshold after climbing to 1.0627 in Wall Street. As discussed many times, Mario Draghi is expected to increase his support to the economy as the euro zone is on the edge of deflation. From our standpoint, information from both sides of the Atlantic, have already been priced in, meaning that the dollar rally is mostly complete. However, if central bankers do not deliver what the market expects, we will see some massive adjustments. The dollar index has been unable to break the 100.50 level to the upside and is currently trading around 100.

GBP/USD printed new lows in the European session yesterday amid mounting evidence of UK’s economic slowdown. Construction PMI came in well below expectations, printing at 55.3 versus 58.5 expected and 58.8 in October. Even the euro is gaining ground against the pound sterling as EUR/GBP climbed above the 0.71 threshold.

On the equity side, traders started to pocket profits in the US session. The S&P 500, the Nasdaq and the Dow Jones 30 were all in negative territory, down 1.10%, 0.64% and 0.89% respectively. In the Asian session, equity indices are blinking red across the screen with the exception of Chinese markets, which managed to add gains. The Shanghai and Shenzhen Composite were both up 1.35% and 2.50% respectively. In Japan, the Nikkei 225 and TOPIX were treading water, edging up 0.01% and 0.04% respectively amid mixed PMI figures. In South Korea, the KOSPI index fell 0.76% in spite of an upwardly revised GDP (1.3%y/y vs. 1.2% previous). The Aussie continues to build positive momentum. The Australian dollar was up 0.52% against the euro, 0.30% against the pound and 0.15% against the US dollar.

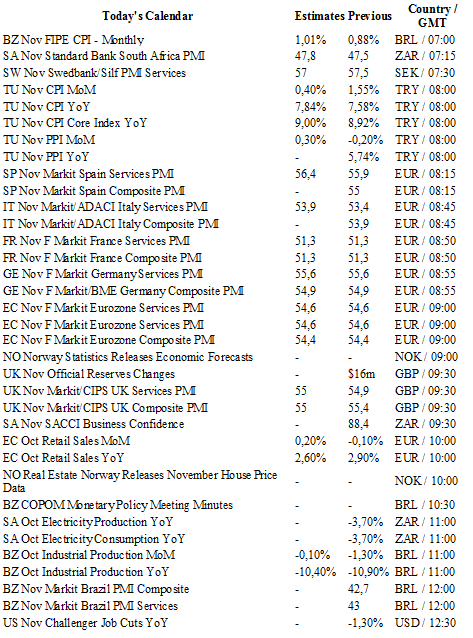

Today traders will be watching composite and services PMI from Spain, Italy, France, Germany, the euro zone, the US and Brazil; ECB rate decision and retail sales from the euro zone; industrial production and COPOM minutes from Brazil; ISM non-manufacturing, factory orders and durable goods orders from the US. Separately, Fed Fischer, Mester and Yellen will speak today.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0577

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.4938

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 123.49

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.1138

R 1: 1.0676

CURRENT: 1.0240

S 1: 0.9739

S 2: 0.9476