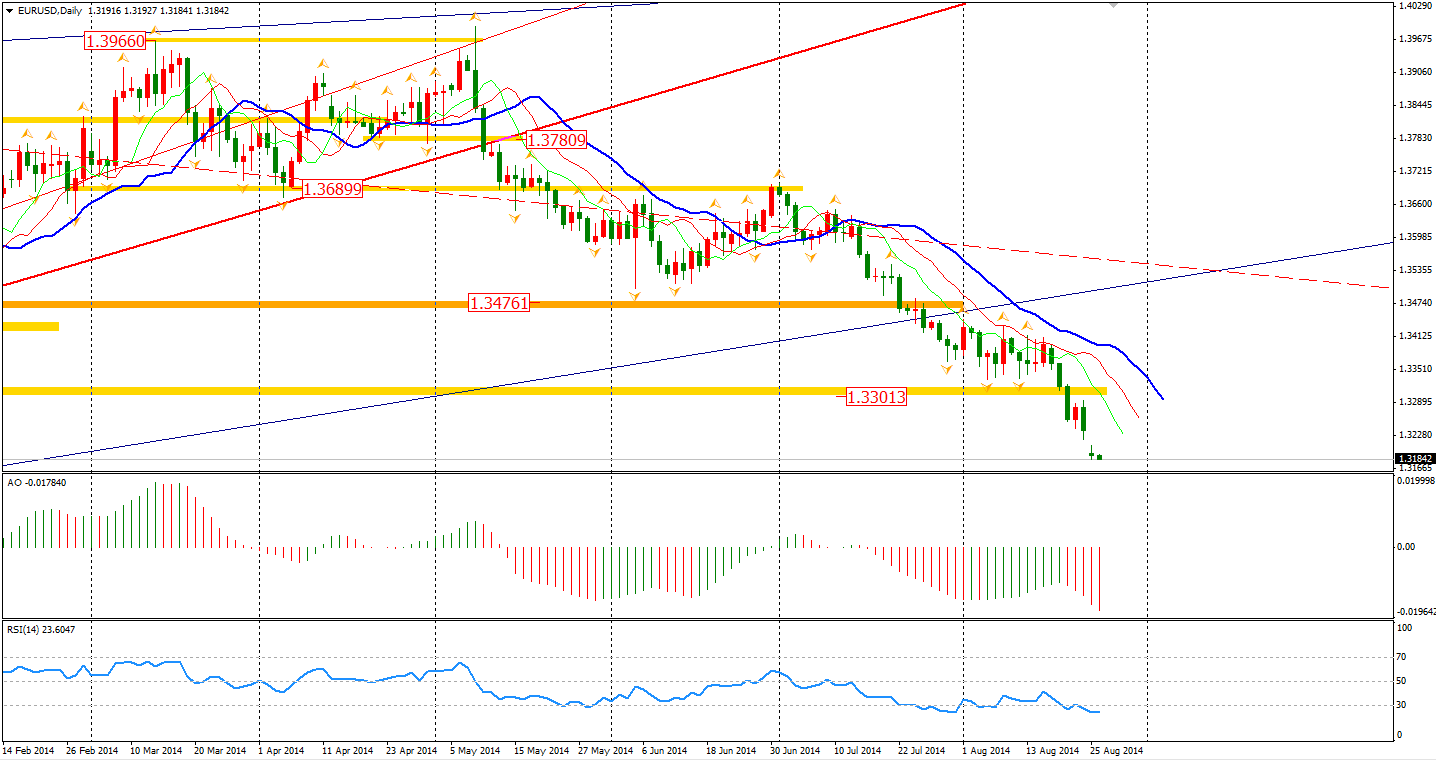

Most majors opened with a similar gap lower against the Dollar after the Jackson Hole symposium yet were able to recover the loss in the rest of the Monday session – all except the euro, which was still struggling around 1.32.

Both Fed and BOE mentioned that the current job market conditions did not provide enough evidence to raise interest rate, but it may happen within the year if the job market shows further sign of recovery. Contrastingly, Mr. Draghi restated that the ECB may have to introduce further stimulus if the employment and economy maintain its current weakness. Mr. Kuroda from the Bank of Japan made a similar speech as well.

The downbeat German IFO Business Climate revealed that the German economy may be losing its growth momentum, probably being dragged down by Ukraine crisis. This also affirms reasons as to why Germany is so eager to find a resolution.

The Russian and Ukrainian Presidential meeting will be held tomorrow, which may provide the Euro a chance to recover the gap. However, bears may see the bounce as a good opportunity to short.

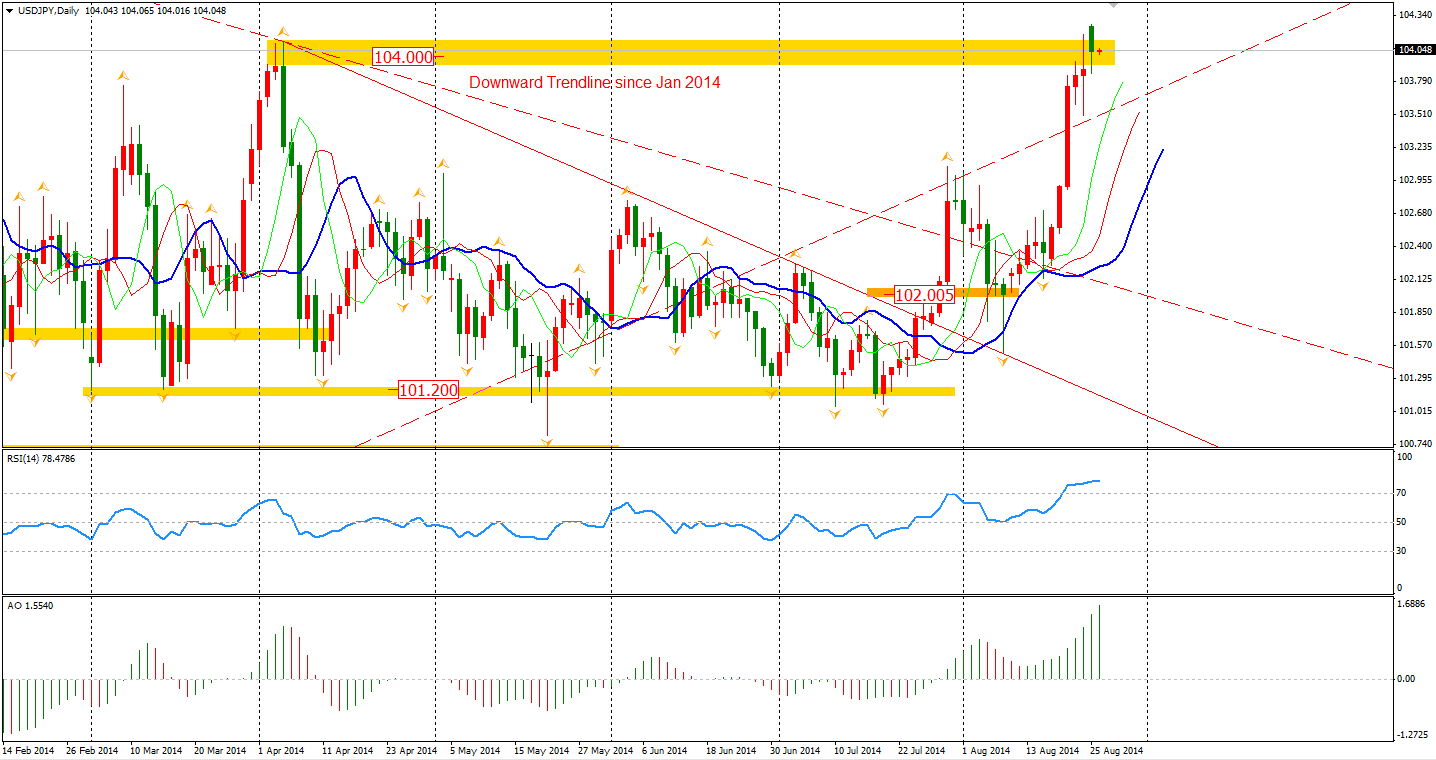

The JPY restarted its depreciation after a half-year consolidation. In the mid-term, it may be the second weakest major after the Euro. But, traders need to be cautious of pursuit waves of safe-haven assets.

Asian stocks opened mostly higher on Ms. Yellen’s neutral statement on rate hiked but closed mixed. The Shanghai Composite edged 0.51% lower to 2229. The Nikkei Stock Average gained 0.48%. The Australian ASX 200 200 lost 0.19% to 5635. In European stock markets, the German DAX rocketed 1.83% and the French CAC Index surged 2.1%.

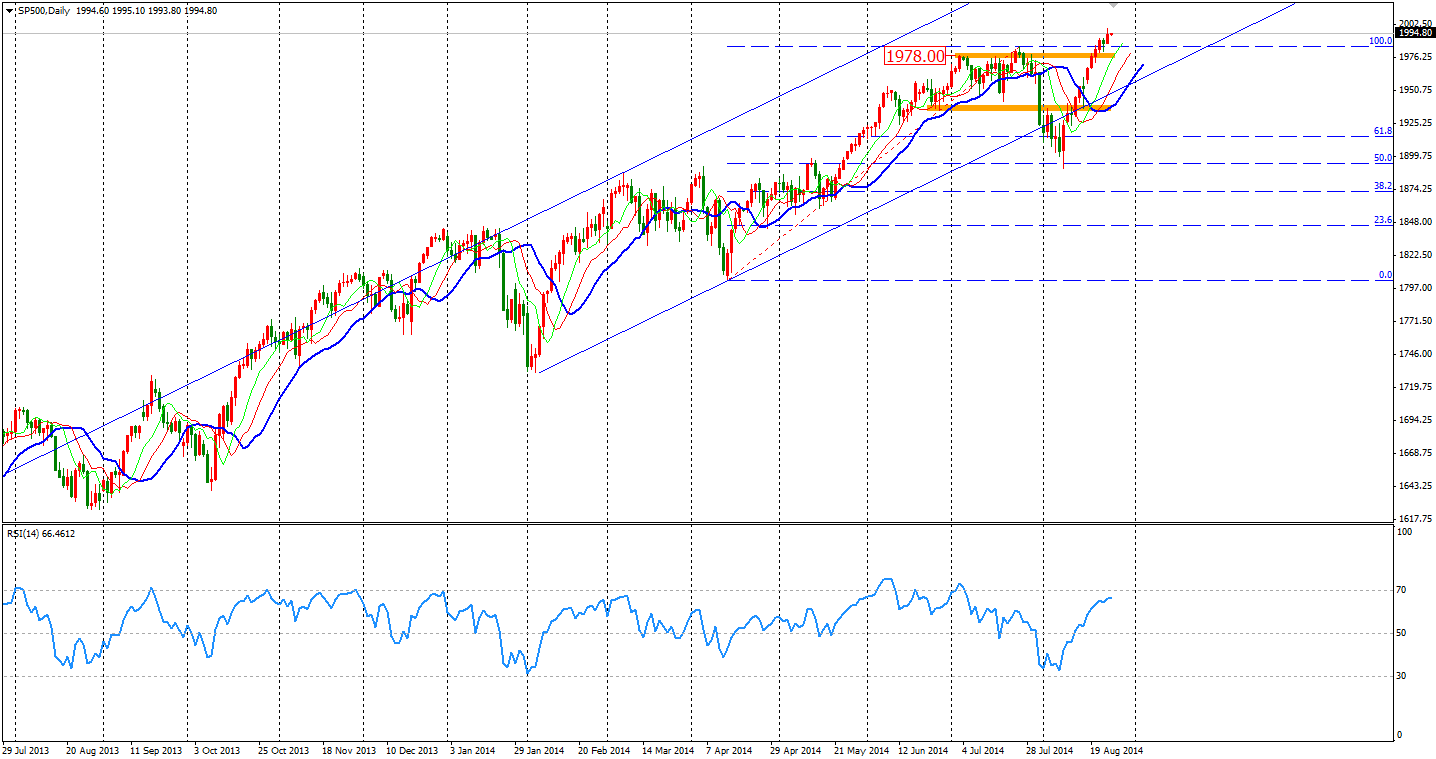

U.S. stocks rose across the board on Monday. Under the background of rate hike and the bustle of bears, the S&P 500 reached a record high at 2000.24, which is also the first time in history that the index has stood upon 2000. The S&P 500 finally closed at 1998, rising 0.48%. The Dows gained 0.44% to 17077, while the NASDAQ Composite Index was up 0.41% to 4557.

No important data releases today during the Asian trading hours. The market will mainly focus on U.S. data. Durable Goods Orders at 22:30 AEST; the Housing Price Index will be half an hour later and Consumer Confidence will be at midnight.

Have a great trading day!

Anthony

This report was originally published on the MXT Global News Centre

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Dollar, Stocks Ignore Downbeat Data

Published 08/25/2014, 08:31 PM

Updated 07/09/2023, 06:31 AM

US Dollar, Stocks Ignore Downbeat Data

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.